Business Insider recently published an article suggesting that if you missed the recent short covering rally then you made a classic mistake in investing.

"Because of the way our brains work, most of us worried about the possibility that this correction was turning into an outright market crash. Our instinct was to dump stocks. Surely, many investors sold and told themselves they would "wait out the volatility" on the sidelines. A confident few likely even shorted the market.

However, history shows this is the most classic mistake investors make. So, kudos to those who held on to their long positions."

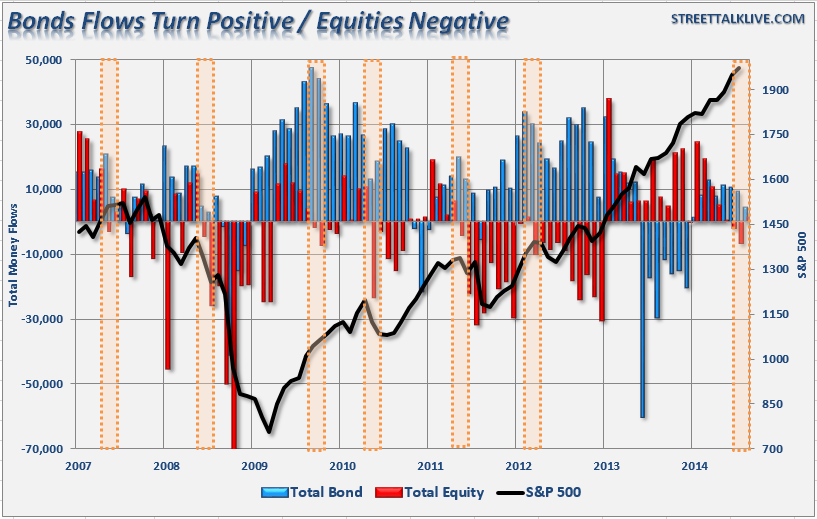

First of all, there is scant evidence that "surely, many investors sold..." As shown by the recent ICI flow of funds report investors only pulled $2.6 billion from equities in September and October looks pretty much the same with a week of reporting data still left to go. This is hardly a rush for the exits by any measure.

[Note: Interestingly, the recent inversion of equity/bond flows, as highlighted, has typically been seen near intermediate term market tops. Considering that the correction to data has been extremely mild, this may signal that the correction is not yet complete.)

Secondly, this is always the "mantra" written during ebullient periods in the stock market when "investment risk" is disregarded in the pursuit of gains. It is during these times where markets "only seem to go up" that statements such as "investing is about 'time-in' the market rather than 'timing' the market" are made. Such statements are generally regretted in the not-so-distant future.

There is a major point of clarification that needs to be made here. I completely agree that investors can not be "all in" or "all out" of the market on a consistently correct basis. However, it is at this point in the discussion that some analyst pulls out a chart showing how poor your investment returns would have been if you had missed the "10-best days in the market."

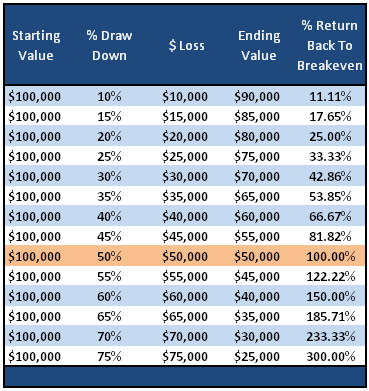

While that bit of information is true, what is never discussed is the what happens to investor returns when they capture market losses. The table below shows the damage done to an investor's portfolio during a market drawdown and the subsequent return required to get "back to even."

Even a modest 10% correction requires an 11.11% gain just to get back to even. This is why a strategy of "getting back to even" has never been a worthwhile investment discipline. [Note: The most important commodity lost during such a period is "time." Time is the one asset in all portfolios that can never be replaced or recovered. Once it is lost, it is gone forever. Read: "How Long Is Long Term"]

Conversely, being "all in the market all the time" is just as poor of a strategy as bullish prognosticators forget about the importance of capital destruction as it relates to portfolio returns over time. The article makes a very interesting statement in this regard:

"But, that's just part of investing in the stock market. If you aren't prepared to lose tremendous amounts of value, you shouldn't be in stocks."

Why should I need to be prepared to lose a tremendous amount of value in my portfolio? Why can't I apply some rather simplistic risk management tools, combined with a lower volatility portfolio allocation model, to create returns over time with a lower risk of major drawdowns? After all, is this not one of the most basic tenants of investing: "buy low/sell high?"

Managing The Risk

There are no great investors of our time that "buy and hold" investments. Even the great Warren Buffett occasionally sells investments. True investors buy when they see value and sell when value no longer exists.

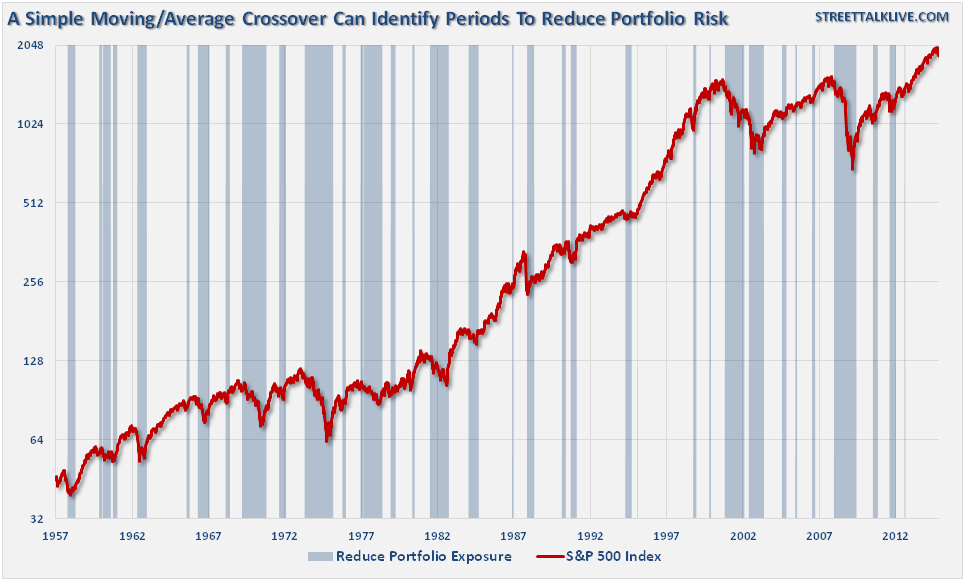

While there are many sophisticated methods of handling risk within a portfolio, even using a basic method of price analysis, such as a moving average crossover, can be a valuable tool over the long term holding periods. Will such a method ALWAYS be right? Absolutely not. However, will such a method keep you from losing large amounts of capital? Absolutely.

The chart below shows a simple moving average crossover study. The actual moving averages used are not important, but what is clear is that using a basic form of price movement analysis can provide a useful identification of periods when portfolio risk should be REDUCED. Importantly, I did not say risk should be eliminated; just reduced.

Again, I am not implying, suggesting or stating that such signals mean going 100% to cash. What I am suggesting is that when "sell signals" are given that is the time when individuals should perform some basic portfolio risk management such as:

- Trim back winning positions to original portfolio weights: Investment Rule: Let Winners Run

- Sell positions that simply are not working (if the position was not working in a rising market, it likely won't in a declining market.) Investment Rule: Cut Loser Short

- Hold the cash raised from these activities until the next buying opportunity occurs. Investment Rule: Buy Low

Missing The 10-Worst Days

The reason that portfolio risk management is so crucial is that it is not "missing the 10-best days" that is important, it is "missing the 10-worst days." The chart below shows the comparison of $100,000 invested in the S&P 500 Index (log scale base 2) and the return when adjusted for missing the 10-best and -worst days.

Clearly, avoiding major draw downs in the market is key to long-term investment success. If I am not spending the bulk of my time making up previous losses in my portfolio, I spend more time compounding my invested dollars toward my long-term goals.

You Can't Handle The Volatility

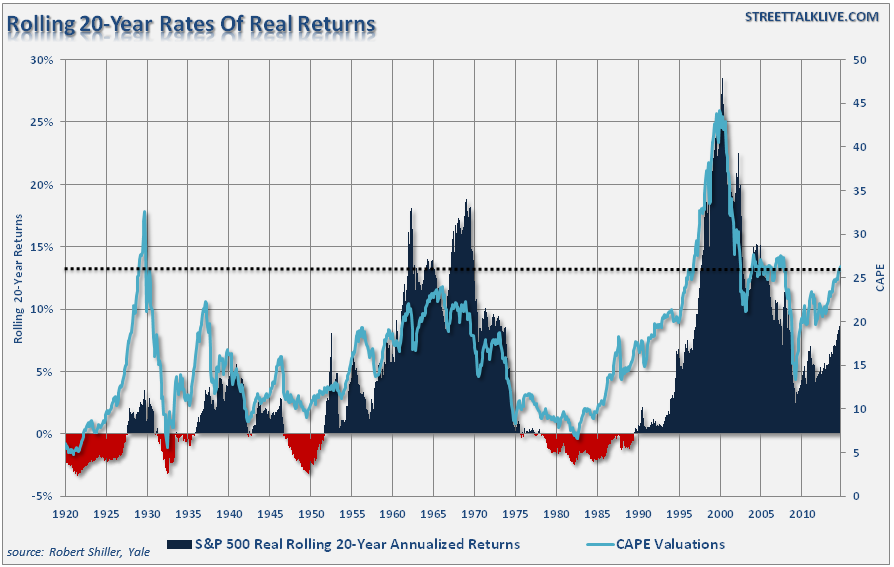

Despite the mainstream attempt at convincing you that it is "time in the market" that matters, the reality is that there have been many periods in history where you simply "ran out of time." As shown, when adjusted for inflation, there are several 20-year periods in history where market returns have resulted in either low or negative outcomes.

Of course, such dismal forward returns have only occurred when the starting 10-year cyclically adjusted P/E ratio was above 23x earnings. At nearly 26x earnings, this would suggest that "time in the market" may not be as beneficial over the next 20-years.

More importantly, it is the "human factor" that leads to the poorest of outcomes over time. When markets are strongly trending positively, the emotion of "greed" leads a diminishment as to the understanding of risk contained within portfolios. Even the worst possible investment mistakes are masked by a strongly rising prices. (It is near the peak of these periods when articles espousing "this time is different" and chastising those that "missed the rally..."

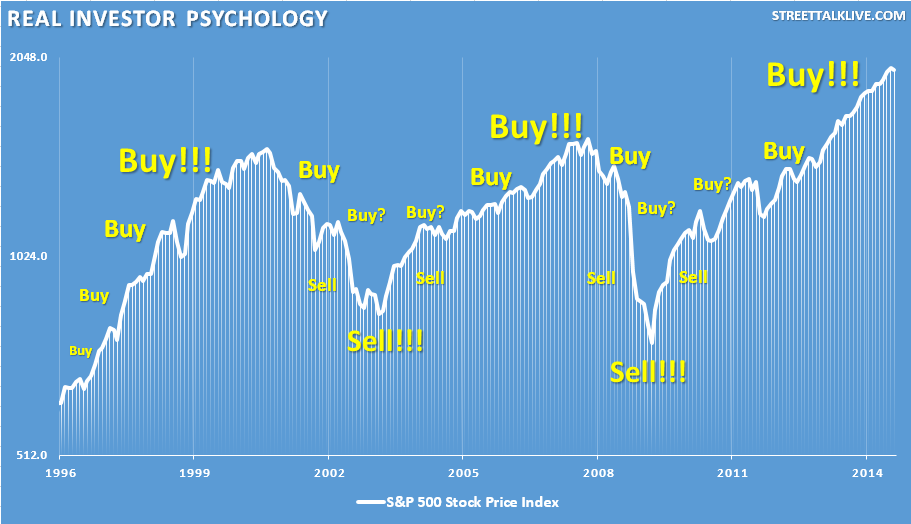

However, it is only after a significant decline in prices, and a large amount of capital destruction, that individuals "panic sell" to stop the "pain of loss" as the risk in portfolios is realized. This is where investors do the most damage to their long-term portfolio goals. I have published the following "investor psychology" chart many times in the past -- the message is all too clear.

Let me reiterate this point. A strict discipline of portfolio risk management will NOT eliminate all losses in portfolios. However, it will minimize the capital destruction to a level that can be dealt with logically rather than emotionally.

There is no reason to "benchmark" your portfolio to some random index. The index is a mythical creature, like the Unicorn, and chasing it takes your focus off of what is most important - your money and your specific goals. Investing is not a competition and, as history shows, there are horrid consequences for treating it as such. This is why incorporating some method of managing the inherent risk of investing over full-market cycle. I would question those who tell you not to do so as they are likely acting from a position of incompetence or self-interest. In the long run, you probably will not beat the index, but you are likely to achieve your financial goals which is why you invested in the first place.