This is a busy week. Today is “options expiry day”; COMEX August gold options expire. As options expiry day approaches, gold tends to trade in a sideways pattern near round numbers, and $1100 is the number in focus now.

Also, the FOMC meets today and tomorrow. They release a statement at 2PM tomorrow about the Fed’s interest-rate policy.

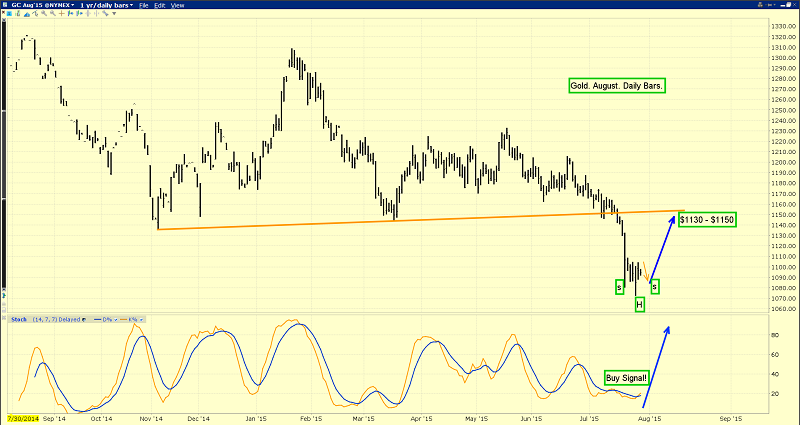

In the short term, Fed policy is the world’s most important driver of the gold price. That’s the daily gold chart. A rally seems imminent, and it probably begins after tomorrow’s FOMC statement.

Note the beautiful buy signal on my 14,7,7 Stochastics series oscillator, at the bottom of the chart.

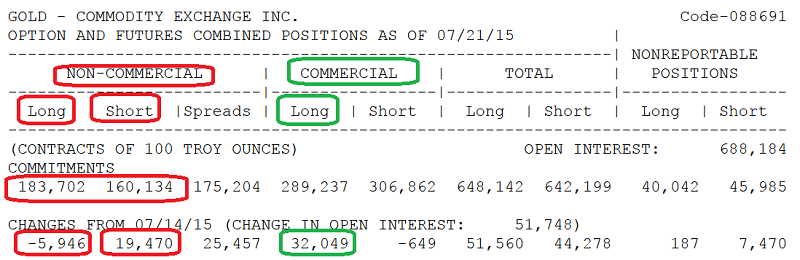

That’s a snapshot of the latest COT report. It only includes the trading through last Tuesday.

In my professional opinion, at Friday’s lows near $1072, the commercial traders (banks) were probably net long gold. On any further price weakness, I expect them to become even more net long!

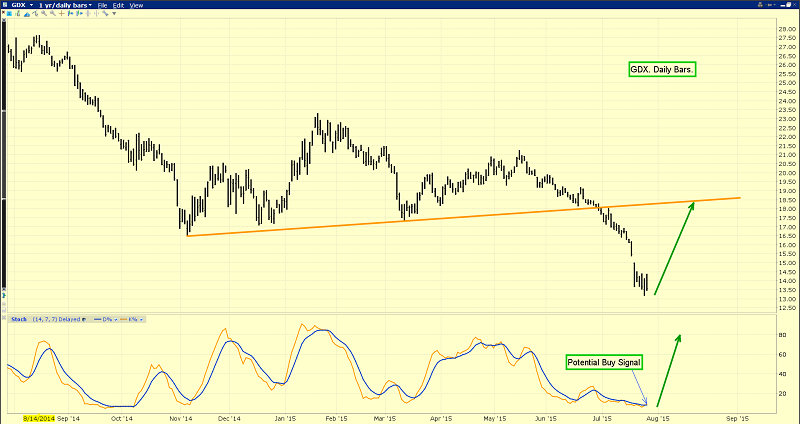

That’s the daily chart for (ARCA:GDX). Yesterday, my fund had all its GDX short positions force-liquidated by my broker. There’s no more stock to borrow. I put on those short positions at $55, $28, and $22, so getting them force-liquidated at $14 is AOK with me. I think GDX is poised for a major rally, and whether an investor is bullish or bearish, now is the time to be a significant buyer of GDX, (ARCA:GDXJ), and of numerous individual gold and silver stocks!

Many Western gold community investors wonder about the relationship between interest rates and gold. Interestingly, gold can rise when rates fall, and it can also rise when rates rise. Most bank economists focus on US “real interest rates”. Real rates are defined as the difference between US interest rates and the inflation rate. If inflation is perceived to be rising faster than interest rates rise, that’s bullish for gold.

Bank economists also tend to be trend followers. That means their forecasts can be correct until there is a change in the trend. For example, at the 2011 gold price high, most bank economists were forecasting higher gold prices. At the $250 area lows, most were forecasting lower gold prices, as they are now.

Is the trend about to change? I think so, and the QE “money ball” that the banks are sitting on is the main catalyst for the change.

The bank economists acknowledge there are some inflationary pressures (like wages) in the pipeline, but they feel rate hikes from the Fed will overcome those pressures, and send real interest rates higher. That’s why they feel gold will move lower.

In contrast, I would argue that higher rates are inflationary in the current situation, because they incentivize the banks to begin loaning their QE money ball. Those loans would reverse the decline in money supply velocity, and exacerbate inflationary pressures. That’s bullish for gold.

Regardless, within three years, I predict that all price drivers in the Western world to become less relevant to the gold price… than a rotary phone is relevant now, to telephone communication.

Rajesh “Raj” Mehta of India will quickly replace Janet Yellen as the most influential person in the world of gold, in his rise to becoming the “king of gold”. That’s the weekly chart of his gold jewellery company, REL-NSE.

In time, most Western mining company stock charts will begin to look more like that spectacular chart of his gold jewellery company, Rajesh Exports. He imports hundreds of tons of gold each year. His company is by far the single largest source of gold demand in the world, and he’s beginning a game-changing expansion program.

I believe that his expansion program could send Western mining stocks to prices that the most dramatic fear trade-oriented investors have only dreamed about.

Raj just bought the world’s largest gold refinery, Valcambi. The world’s largest gold refinery is LBMA-approved, and is now in Indian hands!

Valcambi refines over 900 tons a year, but, incredibly, the “king of gold” has even bigger plans! He says, “We’ll make our Indian gold refinery a subsidiary of Valcambi and make it an LBMA (London Bullion Market Association)-approved refinery. Gold for the Indian market will be directly imported in unrefined-ore form for refining in our refinery in India.”– July 28, 2015.

When the West began exiting gold in the spring of 2013, Swiss refiners couldn’t refine the Western 400 ounce bars into kilo bars fast enough to meet Indian and Chinese citizen demand. So, the gold price declined on the COMEX, and the banks covered large amounts of short positions at a profit.

I then predicted that Indian gold jewelers would slowly unveil a plan to take over the world’s refining businesses, and then move to take control of most gold mines, ultimately creating enormous profits for Western gold community investors in those mines.

That prediction is steadily coming true, pretty much exactly in the manner that I suggested it would. So, what is the king of gold’s next chess board move? “Going forward, Rajesh Exports said the company, which has a controlling market share (50%) in supplying raw materials to 14 states, is also planning to expand the number of stores under its retail brand 'Shubh' to 450 from the existing 82 in the next three years.” - DNA India News, July 28, 2015. Over the next three years, the king of gold plans to quintuple the number of his gold jewellery retail stores!

Raj Mehta is focused on jewellery, refining, and now on mining too, as I predicted he would be. “Mr Mehta vowed earlier this year to spend up to $US700 million on Australian gold assets in a bid to secure supply of gold for his jewellery empire, and speaking to Fairfax Media on Monday, Mr Mehta said those plans would be resumed once the Valcambi transaction was completed.”– The Age Business Day News, July 28, 2015.

Raj Mehta, the king of gold, clearly wants it all. He wants to control the mining of gold, the refining of gold, and the production of gold jewellery. His factory is the largest gold jewellery factory in the world, and has the lowest cost of production.

What does the king of gold think about the next move for the gold price?” He says to The Age News, “I am of the opinion that from here it should turn back.” The king of gold is speaking. Is anyone in the Western gold community listening? I hope so, because this is a key buying area, for those who embrace gold as the greatest asset in the history of the world!

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?