The Utility Sector

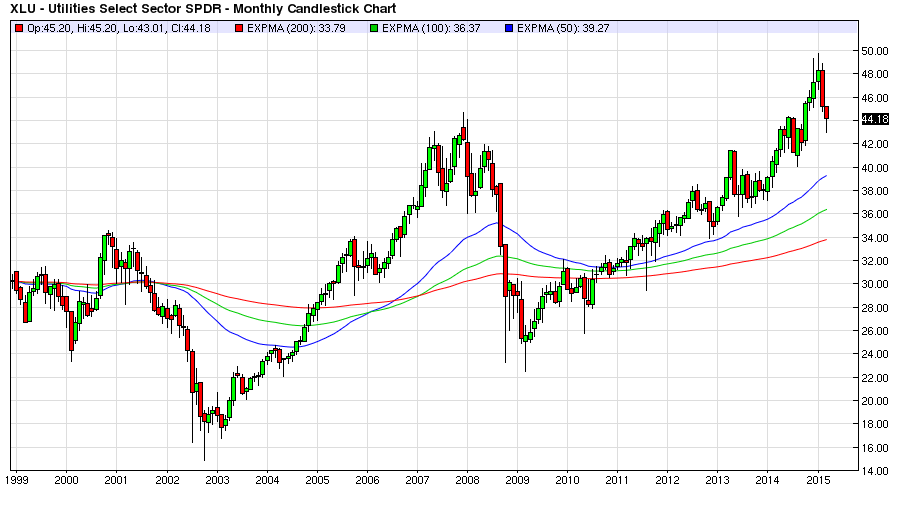

This crowded trade revolves around a common theme Central Bank Policy and its effects on financial markets. The third most crowded trade in our series is the Utility Sector Stocks. Investors have piled into this sector due to the perceived defensive nature of the sector with the fact that this sector pays a hefty dividend, a dividend higher than say a 10-Year Bond. And because bond yields have been driven so low by yield chasers, utility stocks get even more of a bid than they otherwise would given their fundamentals. In short, utility stocks and the utility sector in general have become surrogate bond instruments for investors.

Yield Plays

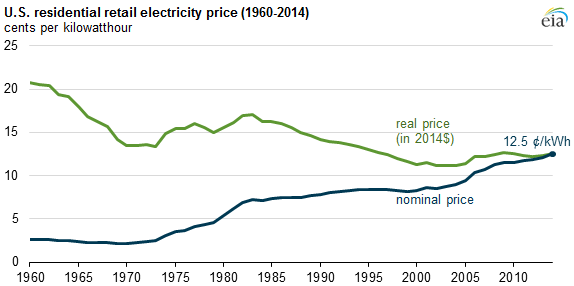

Utilities have always been attractive yield plays for conservative investors, but with the age of 10 basis point borrowing costs and lower, anything with a 2% yield looks attractive, not to mention a 3% plus yield. As a result large investors are playing utility stocks with borrowed money for the substantial yield delta above and beyond their abnormally low borrowing costs.

Low Natural Gas Prices for Longer

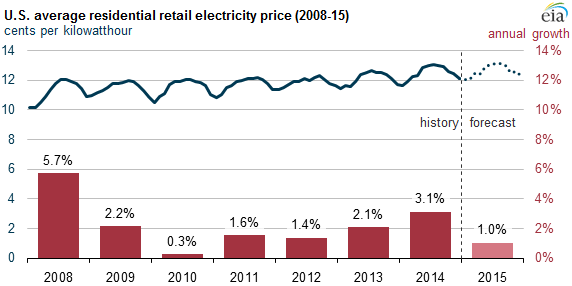

Natural Gas prices are low and steady so electricity prices and margins are not that great for the industry, and we aren`t capacity stretched like we were 10 plus years ago before the financial crisis when the electricity market was much tighter from a supply and demand perspective.

Fundamentals Not So Great

This sets investors up for quite a rude awakening as the fundamentals of the industry are not that great, low for longer natural gas prices are going to keep the peak demand electricity prices much lower in the spike periods of increased demand as this is the swing commodity for bringing increased generation online. Hence the utilities margins are not going to be that robust like they were in 2005.

Sector Switch for Dividend Investors

This sector really is a central bank play, and most of the run-up the last five years, and last three years specifically is the result of the yield chasing bond proxy investment class. As interest rates rise, and they are only going up from here, not only in the United States, but around the globe, this sector is in for some major pain. Actually for the conservative yield investors they may want to switch out of this Utility sector for beaten down energy companies where the dividend will remain safe, and there is no bankruptcy concerns regarding some of the niche shale producers.

Think in terms of Exxon Mobil Corporation (NYSE:XOM) as they have never cut their dividend, and my father has owned this stock since oil was $5 a barrel. But these conservative investors who normally seek refuge in utilities are going to lose a lot of principal gains when the momentum players leave the sector as interest rates rise both in the US, and eventually around the globe over the next 5 years.

Utilities never meant to be Sexy Momentum Asset Class

Utilities were never supposed to become a sexy investing sector, and that has been what they have become, sexy momentum plays not just for the yield returns but for the price appreciation gains. It is one thing when the fundamentals are robust in the industry, but this isn`t the case, and it isn`t going to be the case for the foreseeable future. The utility sector has become very much a momentum sector just like an Apple (NASDAQ:AAPL) stock, and that should worry investors who normally invest in this sector.

This sector has a whole lot of investors and capital that is playing around in this sector who normally don`t invest in utilities. This is fast money, and it isn`t in for the long haul, and unfortunately their mass exodus is going to take a lot of your conservative principal along with it as this massive trade unwinds. Ergo, the utility sector is set for some major declines over the next five years as the crowded nature of this trade becomes ‘less crowded’!

February Exodus

Investors were seeking safe haven in utilities providing a further boost to the sector during the January overall market selloff. However as the market gained traction investors transferred out of this sector into more perceived riskier stocks as the market rose in February. There has been some rotation out of the sector, but this is from the all-time highs, and if you consider the fundamentals of the industry versus the gains in the sector over the last 5-7 years there is still ultimately significant downside risk for investors in this sector.

However when I look at the individual yields of the companies for this sector they are quite appealing compared to bonds. This tells me that the fundamentals for this sector are even worse than I first diagnosed, some of the individual name`s charts look quite bearish, and dividend cuts may be in the cards for some of these companies, which would put more downside risk for investors in this sector.

Better Valuations Than Anticipated in this Sector

As I started this analysis I had a preconceived bias for this sector that it was just off the charts over-valued, but after some further digging, and a little reflection, the utilities sector is not as over-valued as other parts of the market. It wouldn`t make my top five after this research project, it is good to keep an open mind and be flexible to new information in financial markets as you research investment themes. I would probably replace Utilities with some other sector like Bio-Tech.

But who knows in comparison to my first two pieces in this series being Apple, and the Bond Market everything looks like a much more decent value proposition. This research just further validates my thesis that those two are blatantly over-valued and frankly bloated pigs of investment. Investors should be running for the hills in those two investments. When you consider Apple`s market cap overlays so many fortune 500 solid companies total value if you put a Venn Diagram Market Cap analysis over the entire market it really points out the absurdity of Apple`s current and unsustainable stock price.

In other words, I would take the other companies business prospects over Apple`s business prospects from a Market Cap expansion standpoint even if the overall Market Cap of the market contracted. Apple`s Market Cap would contract more versus the rest of the fortune 500 companies in the Venn Diagram as a spread trade.

Final Thoughts

The sector will be hurt by the momentum players leaving this sector and despite the recent profit taking, the utilities sector was up 24% in 2014. Thus despite what appears to be attractive yields for some of the individual companies with the sector, bad earning`s releases are going to be punished in 2015. Moreover, given the fundamentals of the industry I expect a lot of continued profit taking as interest rates rise the second half of 2015.

Therefore, sell the spikes in utilities or use these spikes to take profits in your positions and wait for the yields to become even better values down the road. Yield returns can only go so far when you lose 24% of your principal as the momentum investors leave this sexy 2014 investing sector.

And finally be careful just like in the energy sector, some of these attractive dividends may be cut, so do your individual research on the history of what the company does when their stock falls due to weaker results – do they stay the course with the dividend during tough revenue periods? Maybe take a lower dividend from a company within the sector which has a solid history of standing by their dividend even during difficult times like Exxon Mobil Corporation (NYSE:XOM) in the Energy Sector. But as my father says he hopes (XOM) falls another $15 a share so he can add to his current position. Therefore like Warren Buffet sometimes the best position is no position, having a large cash position near market tops is not such a dreadful investment strategy. Buy when there is real “blood in the streets”!