Introduction

Switzerland’s ‘Save our Swiss Gold’ referendum was convincingly rejected yesterday by the Swiss electorate following an aggressive anti-Gold campaign in recent weeks that had been closely watched both in Switzerland and abroad.

Unusually, it involved the Swiss National Bank (SNB) very actively, and ultimately successfully, trying to convince the electorate along with the main political parties to return a ‘no’ vote.

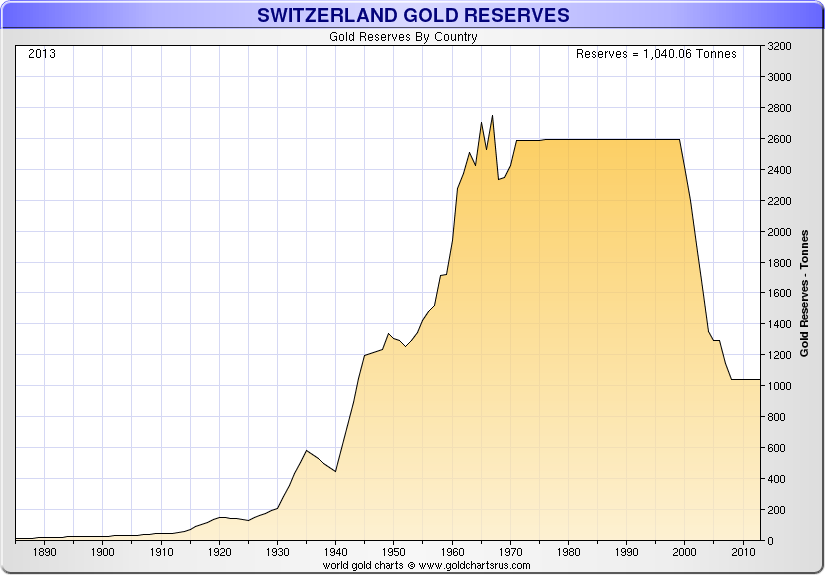

The initiative had proposed a series of measures which would have obliged the SNB to hold a minimum of 20% of its reserves in gold, prevent the SNB from selling any gold, and force the SNB to repatriate that portion of its gold reserves that are currently stored abroad and to store gold in Switzerland.

The referendum campaign had evolved out of a popular initiative which had initially collected over 100,000 signatures between 2011 and 2013. Under Swiss law, this allowed the motion to go forward as an official referendum, even though the Swiss government, Swiss parliament and Swiss National Bank had all come out in opposition to the Gold Initiative.

In rejecting the referendum, the Swiss People voted 77.3% against, versus 22.7% for. Voters in all 23 of Switzerland’s cantons rejected the initiative in what was an unfortunate defeat for the initiative’s organisers. In most cantons, the results showed a three to one ratio in opposition to the initiative, and even a four to one ratio in a few cantons.

Opposition parties, and the SNB, are already pitching the referendum outcome as a ring of endorsement for the SNB’s current monetary policy strategy of pegging the Swiss Franc to the Euro at the 1.20 level. This is not necessarily the case and it needs to be remembered that the result also shows a substantial minority of the Swiss electorate who disapproved of the SNB’s gold reserve management strategy.

Anti-Gold Establishment?

The weak showing for the ‘yes’ vote continues a trend that was seen in the series of opinion polls that were conducted during the campaign in October and November. Two official polls had been produced by political pollster gfs.bern on behalf of state broadcaster SRF. In the October poll, the yes vote was 44% versus 39% no, with 17% undecided. The last poll published on 19 November had shown the yes vote slipping to 38%, with the no vote at 47%, and 15% undecided.

The weakening of the ‘yes’ vote in the final two weeks of the campaign was most likely influenced by more effective campaigning by the no side, as well as the continued intervention of the Swiss National Bank through various media appearances. The fact that none of the main political parties in Switzerland had backed the initiative also looks to have made an impact with the electorate.

Another ‘unofficial’ series of on-line polls, run by the ’20 Minuten’ media group, had always put the no side in front, and in a poll published on 18 November, had found the ‘yes’ vote at 28%, versus 65% for no, with 8% undecided.

Cantonal wipe-out

Every canton, except the Italian speaking Ticino canton, rejected the initiative by more than 70%. Turnout for the referendum was 48.7%, with about 581,000 of the electorate voting in favour of the motion, versus approximately 1,974,000 against.

The two cantons with the largest populations, namely Zurich and Bern, only returned yes votes of 20.6% and 21.6% respectively.

The cantons of French speaking Switzerland, aka Swiss Romande, recorded the highest no vote, with one canton, Vaud, rejecting the initiative by a huge 83% to 17% margin. Switzerland’s French-speaking region comprises the western cantons of Geneva, Vaud, Neuchatel, Jura, and most of Fribourg, as well as parts of the Bern canton and the western areas of the Valais canton.

In Geneva, for example, the electorate returned a vote of 23.5% yes vs 76.5% no, while the Jura canton voted 19.4% yes vs 80.6% no, and the Neuchatel canton recorded an outcome of only 20.0% yes vs 80% no.

The Italian speaking canton of Ticino, which is in the south-east of the country, recorded the highest yes vote at 33.3% vs a no vote of 66.7%. In the opinion polls in the run-up to the referendum, Ticino had shown the highest yes vote, so the relatively stronger yes vote in Ticino compared to other cantons was expected, albeit, the yes vote still collapsed in Ticino relative to what the earlier polls had indicated. Incidentally, Ticino is the canton where three of the four largest gold refineries in Switzerland are located, namely, Pamp, Valcambi and Argor-Heraeus.

Apart from Italian speaking Ticino, the strongest showing for the yes vote was seen in the cantons located in the north-east of the country, such as St. Gallen, Thurgau, and the two half cantons of Appenzell Ausserrhoden, and Appenzell Innerrhoden, and also the more centrally located canton of Schwyz. St. Gallen, for example, returned a 27.4% yes vote vs 72.6%, while Schwyz recorded 29.3% vs 70.7% no.

SNB Satisfaction

In a press release, the SNB said that it was “pleased to hear of the outcome of the gold initiative vote”, and that the gold initiative would have constrained its ability to maintain price stability. The SNB also reiterated that it will continue to impose its defence of the 1.20 CHF/EUR exchange rate with the ‘utmost determination’ and that it is prepared to buy ‘unlimited’ quantities of Euros for this purpose.

Luzi Stamm, National Councillor for the SVP, and one of the organisers of the gold initiative campaign, believed that the Swiss National Bank’s involvement helped the no campaign, saying that “the credibility of the SNB is obviously very high.”

Yves Nidegger of the SVP, another proponent of the yes campaign, said that the defeat was probably not a surprise given that none of the main parties officially supported the initiative.

Christophe Darbellay, national councillor and president of the Christian Democratic People’s Party (PDC), whose party was also against the initiative dramatically said that “the People have clearly said no to the SVP group (Swiss People’s Party) who wanted to put the SNB and Switzerland on morphine”.

The committee representing the large group of politicians who had opposed the gold initiative said in a statement following the vote that “the result confirms the confidence of the population towards the SNB and its recent monetary policy", and that the Swiss people had “testified to the importance of a National Bank that is free and independent in its capacity to act."

A similar point was made by Eveline Widmer Schlumpf at a press conference of the Swiss Federal Council (the Swiss Government) that was held following the results. Widmer Schlumpf is a member of the Federal Council and head of the Department of Finance, was also a committee member of the no-campaign.

Conclusion

Given that the gold initiative campaign was up against a well organised and well funded coalition of the main political parties and the SNB, the referendum outcome is probably not all that surprising.

The Swiss media and banking sector were also, on balance, more aligned with the SNB’s arguments, and the media failed to really ask any tough questions about the nation’s gold reserves and the SNB’s custodianship of said reserves.

Although the referendum has produced the desired outcome for the Swiss National Bank, the Bank now has to return to its main problem of dealing with the relative strength of the Swiss Franc versus the Euro.

With the CHF/EUR rate currently at the 1.20 mark, a line which the SNB has insisted it will defend, the immediate question for the financial markets is whether the Swiss Franc will now weaken slightly or whether the SNB will need to intervene in the short term by expanding its balance yet further via the purchase of large quantities of Euros.

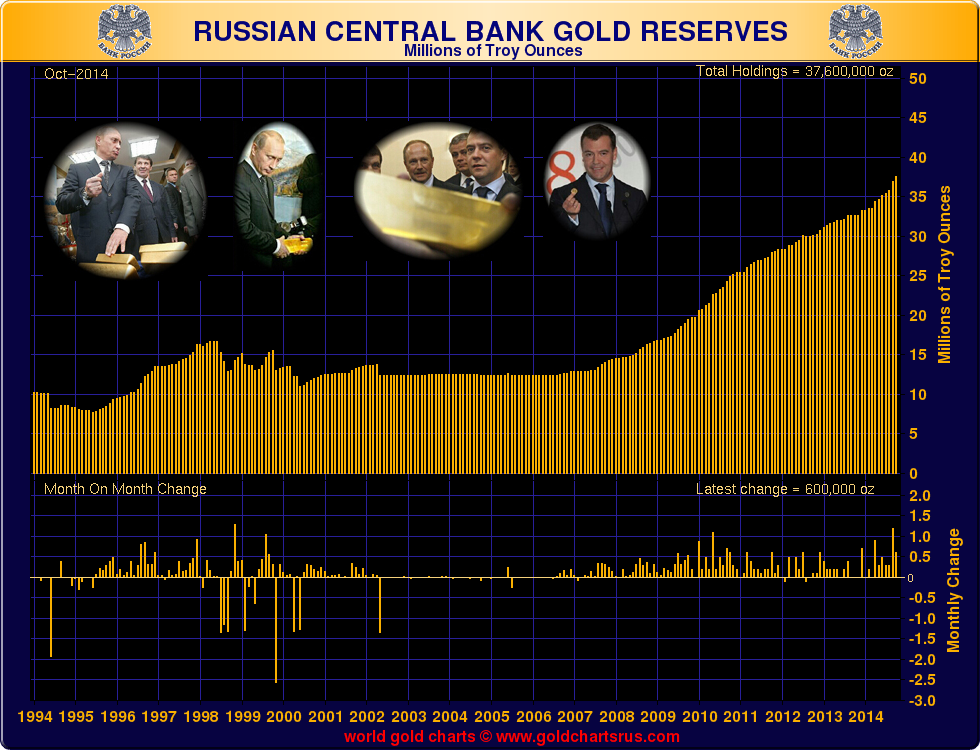

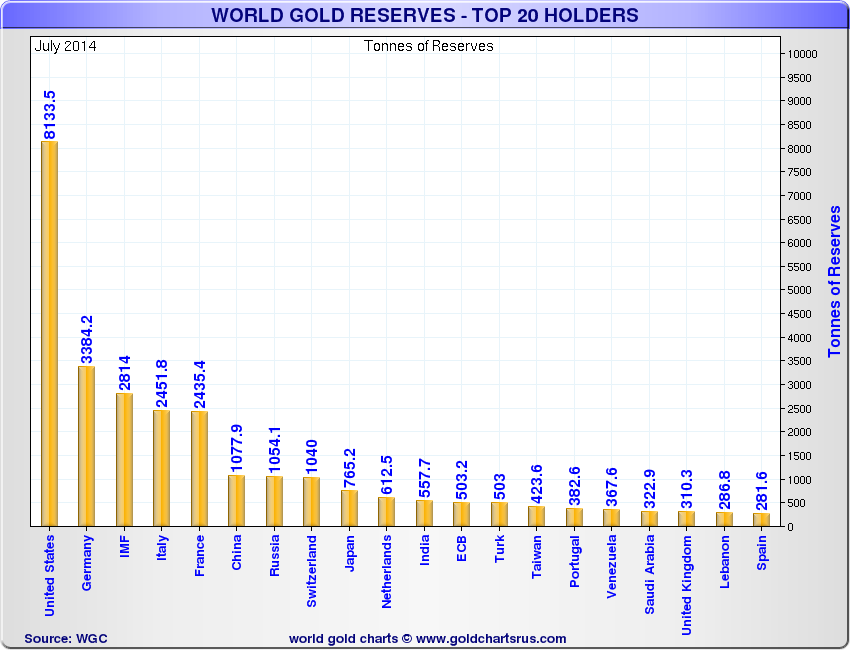

The gold price has taken a short term hit, no doubt partially due to the Swiss referendum result. However, it is important to remember today’s context -- with central banks in Russia and China and other creditor nation’s central banks continuing to diversify into gold and adding to their gold reserves, and with countries such as the Netherlands and Germany beginning to repatriate their existing gold reserves. Thus, there may come a point in the next few years when the Swiss will look back at this referendum and wonder whether it was a lost opportunity to reverse the debasement of the once venerable Swiss Franc.

Importantly, the Swiss gold referendum may be another contributing factor to the people of European countries demanding transparency regarding their gold reserves and to a demand for repatriation of and audits of national gold reserves.

There is also the fact that there is a growing level of awareness regarding the importance of gold as a monetary asset and store of value to protect against systemic and monetary crisis.

MARKET UPDATE

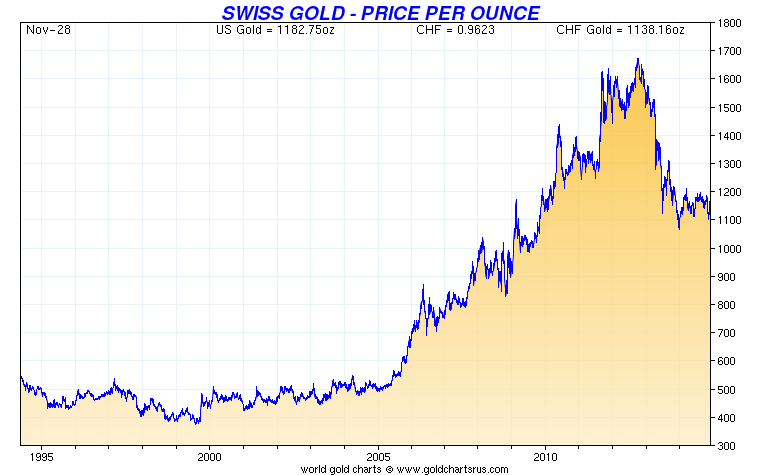

Today’s AM fix was USD 1,178.75, EUR 945.46 and GBP 750.56 per ounce.

Friday’s AM fix was USD 1,184.50, EUR 950.80 and GBP 753.98 per ounce.

On Friday, gold declined over 2% and silver lost nearly 7%. The scale of the losses, particularly for silver, surprised participants as there was no breaking news story and markets had largely priced in a no victory in the Swiss gold referendum.

Gold in USD - 5 Years (Thomson Reuters)

The Swiss public rejected the proposal to boost central bank gold reserves yesterday and the precious metals weakness continued at the open in Asia when gold fell 2.1% and silver slumped 6.7%, reaching the lowest in five years at $14.42/oz.

The precious metals then rebounded in the course of the Asian trading day, as there was an increase in physical demand and some traders closed out bearish bets leading to a “short squeeze.”

Spot gold rebounded to a high of $1,182.70 an ounce, and was up 1% at $1,179.00 an ounce in late morning trading in Europe. Silver was up 2.7% at $15.83 an ounce, having earlier rallied as much as 6% to a high of $16.34.

Spot Platinum was up 0.6% at $1,203.70 an ounce, while spot palladium was down 0.4% at $801.90 an ounce.

Moody's cut Japan's sovereign rating, plummeting the Japanese yen to a seven-year low against the Euro, also created a demand for gold, traders told Reuters.

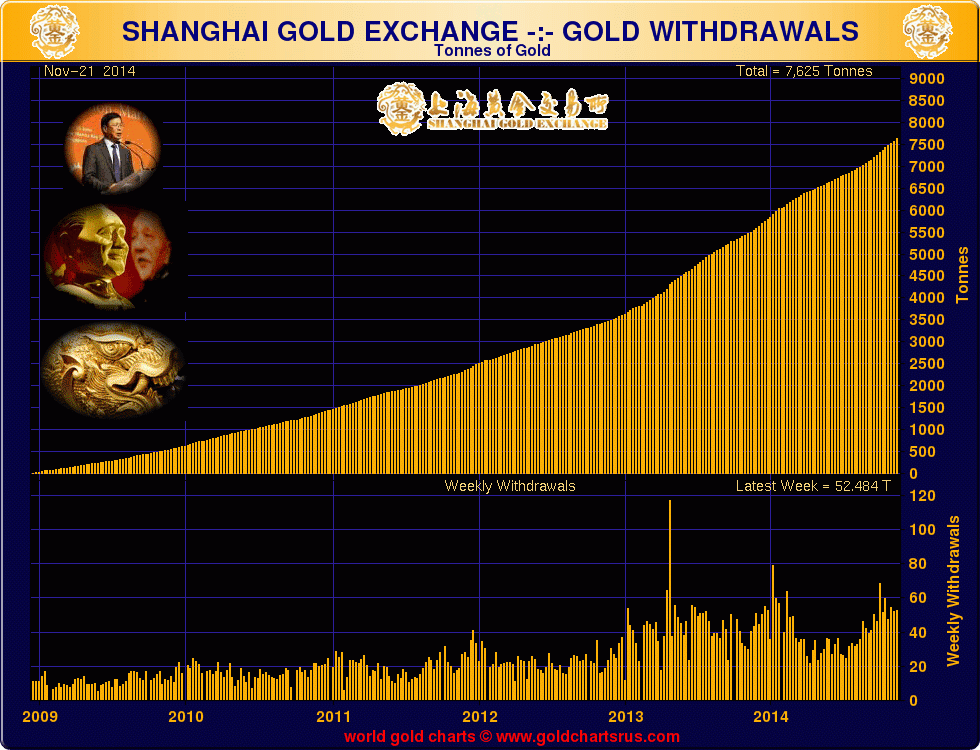

Premiums in China remained steady near $1-$2 and demand in China remains very robust with withdrawals on the Shanghai Gold Exchange (SGE) at 52 tonnes last week. This means that total Chinese demand for gold is headed for 2,000 tonnes in 2014.

SPDR Gold (ARCA:GLD) Shares, the world’s largest gold-backed exchange-traded fund, saw holding fall another 1.2 tonnes on Friday to 717.6 tonnes, to 6-year low as weak hands continue to liquidate ETF holdings.

On Friday, India the second largest importer and buyer of gold bullion, removed its import tax and other restrictions on gold imports, which is a bullish development

The Perth Mint's silver sales in November climbed to their highest since January as lower prices attracted retail investors, while gold sales fell to a three-month low. The Perth Mint runs the only gold refinery in Australia, the world's second biggest gold producer after China. Silver coin sales jumped to 851,836 ounces in November from 655,881 ounces in October, data on the mint's website showed

Sales of gold American Eagle coins from the U.S. Mint reached 60,000 oz in November down 11% month on month but up 25% on November 2013. Silver Eagles sales in November reached 3.426 million oz, down 41% month-on-month but up nearly 50% year-on-year.

Essential Guide to Storing Gold Bullion In Switzerland