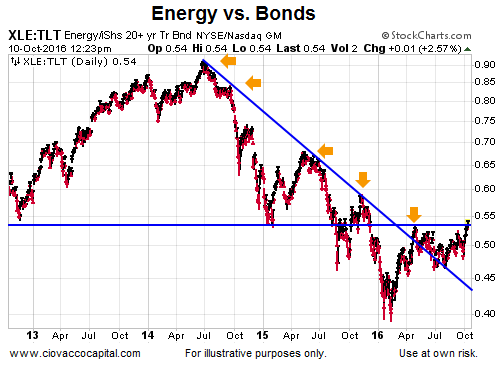

Energy Stocks Above Prior Resistance

When investors are more confident about economic and market outcomes, they typically prefer to own growth-oriented sectors, such as energy, over more defensive-oriented bonds. The chart of energy stocks (Energy Select Sector SPDR (NYSE:XLE)) relative to long-term Treasury bonds (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) is trying to hold above an important point of prior resistance. The longer XLE can hold the breakout relative to TLT, the more meaningful it becomes.

Deterioration In Numerous Asset Classes

Many interest rate sensitive assets, including gold, bonds, and REITS, sold off last week. This week’s video looks at the deterioration in the context of risk management. Updated longer-term charts are also covered for the S&P 500 and broad NYSE Composite Index.

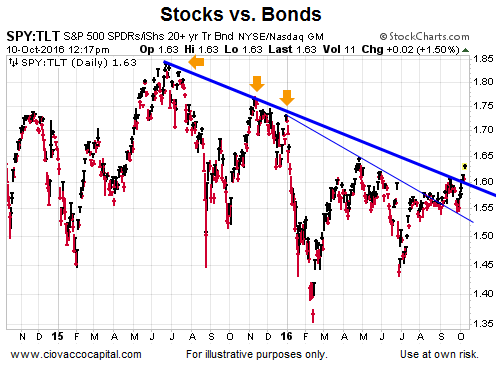

Stocks vs. Bonds

The chart of stocks (SPDR S&P 500 (NYSE:SPY)) relative to bonds (TLT) is sending similar messages to those seen in the energy/bonds ratio. The SPY/TLT ratio was rejected at the thick blue trendline, three times in 2015 (see orange arrows) and again in September 2016. The longer SPY can hold the breakout relative to TLT, the more meaningful it becomes.

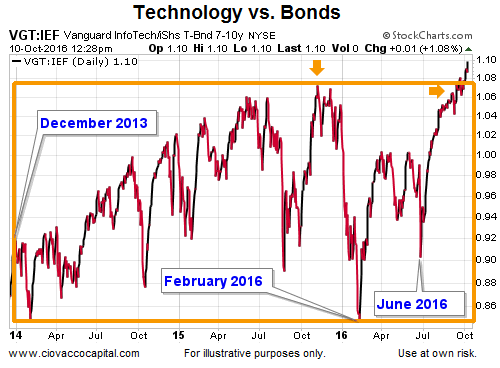

Tech Trying To Clear A Long-Term Box

The chart below shows the performance of technology stocks (Vanguard Information Technology (NYSE:VGT)) relative to intermediate Treasury bonds (iShares 7-10 Year Treasury Bond (NYSE:IEF)). The ratio entered the long-term orange consolidation box in December 2013 (almost three years ago). The ratio was near the lower end of the box as recently as June 2016. The breakout sends signals about the economy and interest rate expectations.

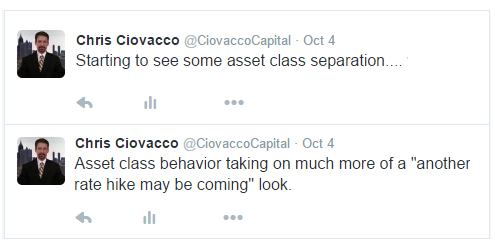

Rate Hike Odds

On October 4, following some strong economic data, asset class behavior started to signal two things: (1) the odds for a Fed rate hike in December were increasing, and (2) the economy and markets might be able to withstand the hike this time. Obviously, with quite a bit of time between now and the Fed’s December meeting, 1 and 2 above fall into the TBD category.

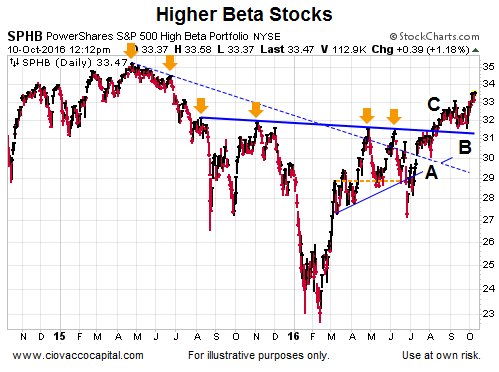

Similar Messages From High Beta

The High Beta ETF (NYSE:SPHB) has higher weightings in materials (Materials Select Sector SPDR (NYSE:XLB)), energy (XLE), and financials (Financial Select Sector SPDR (NYSE:XLF)) relative to the S&P 500’s weightings (SPY). As shown in the chart below, this economically-sensitive investment is trying to hold the recent break above an area that has acted as resistance for a year.

As recently as June 28 (point A below), SPHB looked to be on the ropes. Since then, SPHB has made a higher low (point B) and a higher high above point C.

The longer SPHB can hold above point C, the more meaningful it becomes.