The US services sector in April continues to expand at a brisk pace as manufacturing stumbles. That’s the message in yesterday’s economic updates in context with recent numbers available for this month. The case for anticipating a second-quarter bounce back for the US economy, in other words, remains a bit challenged, based on the available data so far.

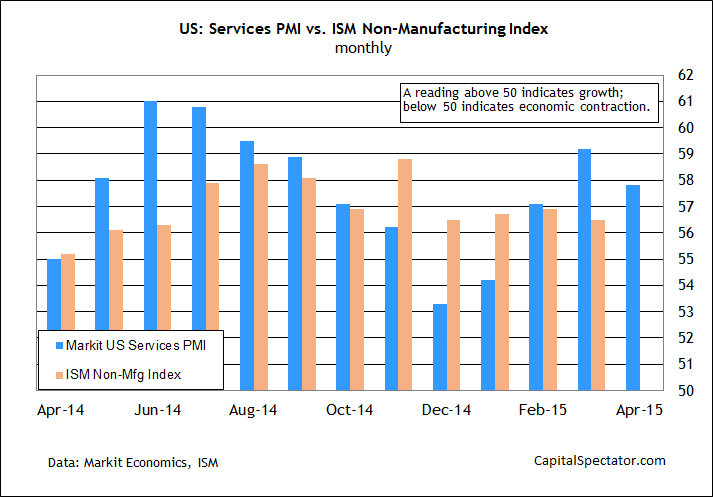

The main source for Q2 optimism at the moment draws heavily on Markit’s flash estimate of its purchasing managers index (PMI) for the services sector. Although this month’s preliminary estimate dipped to 57.8 from 59.2 in March, this PMI remains at a high level vs. recent history. That’s a sign that economic activity in this corner of the US economy will remain strong. The employment component for services looks especially upbeat. As Markit noted in this month’s press release, “the latest survey pointed to the sharpest rise in US private sector payroll numbers since June 2014, largely driven by robust job creation at service providers in April.” (This month’s data for a competing benchmark, the ISM Non-Manufacturing Index, is scheduled for release next Tuesday, May 5.)

The manufacturing profile for April, by contrast, suggests that this sector is struggling with modestly stronger headwinds. That’s old news in the wake of last week’s initial PMI estimate for this month in this cyclically sensitive sector. “Manufacturers saw a disappointing start to the second quarter, reporting the weakest growth since January,” Markit advised on Apr. 23. The latest numbers aren’t terrible–there’s still a fair amount of growth here, as implied by the PMI for US manufacturing overall at 54.2 for April. But the headline PMI’s decline from 55.7 in March implies that the directional bias has weakened by more than a trivial degree.

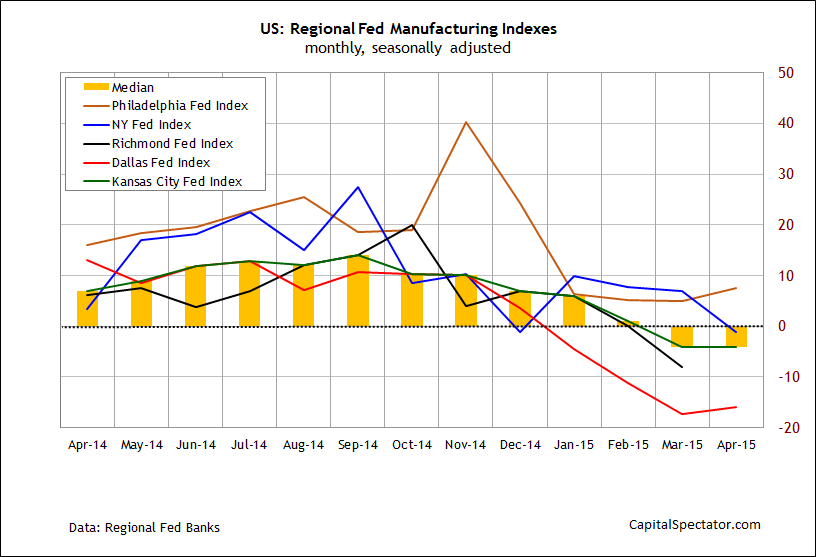

Yesterday’s update of the Dallas Fed survey data for manufacturing activity in the bank’s region certainly points to ongoing weakness in the kickoff to Q2. The news adds to the view that the regional survey trend for April has suffered. With four of the five regional Fed indexes for April published, the government’s data supports the message in Markit’s flash April data: manufacturing output has hit a soft patch lately. Indeed, the median change for the four regional indexes published for April is negative… for the second month in a row. (The fifth index via the Richmond Fed is due tomorrow, Apr. 29.)

Reviewing all the data for April so far still suggests that a moderate growth bias for the US prevails. But on the matter of deciding if the Q1 slowdown will quickly fade with the arrival of a Q2 snapback, the jury’s still out. It’s still early, of course, and the statistical crumbs for the current quarter may be misleading us. But for now, the debate rolls on for deciding if we’ll see a repeat performance of 2014, when a Q1 downturn gave way to a sharp revival in growth later in the year.