A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators suggested, heading into the week, that the equity markets looked healthy but maybe a bit extended on the short term basis. Elsewhere looked for Gold (SPDR Gold Trust (ARCA:GLD)) to possibly reverse higher in its downtrend while Crude Oil (United States Oil Fund (NYSE:USO)) might also be ready for a reversal of trend higher. The US Dollar Index (PowerShares db USD Index Bullish (NYSE:UUP)) might continue to consolidate in its uptrend while US Treasuries (iShares Barclays 20+ Year Treasury (ARCA:TLT)) consolidated the move lower at support. The Shanghai Composite (SSEC) looked like it could take a breather from its run higher while Emerging Markets (iShares MSCI Emerging Markets (ARCA:EEM)) continued to be biased to the downside. Volatility (iPath S&P 500 Vix Short Term Fut (ARCA:VXX)) looked to remain subdued after the spike higher keeping the bias higher for the equity index ETF’s SPY, iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). Their individual charts showed the iShares Russell 2000 Index (ARCA:IWM) and QQQ consolidating in the short run while the SPDR S&P 500 (ARCA:SPY) inched higher, but all 3 better to the upside in the intermediate trend.

The week played out with Gold trading in a tight range before launching higher before to end the week up while Crude Oil took another leg lower. The US Dollar did hold steady while Treasuries continued to try to make a bottom. The Shanghai Composite tested the 2500 level and paused while Emerging Markets held firm, resisting the downside. Volatility settled in, back at the low levels and under the moving averages. The Equity Index ETF’s were flat to higher, with the SPY and QQQ making new highs and eh IWM flat, but making a higher high intra-week. What does this mean for the coming week? Lets look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

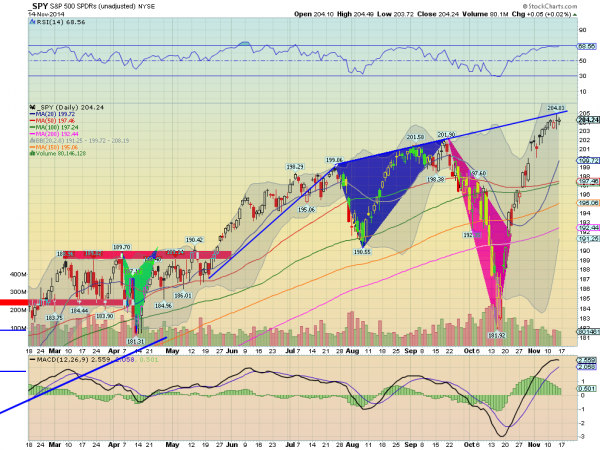

SPY Daily, SPY

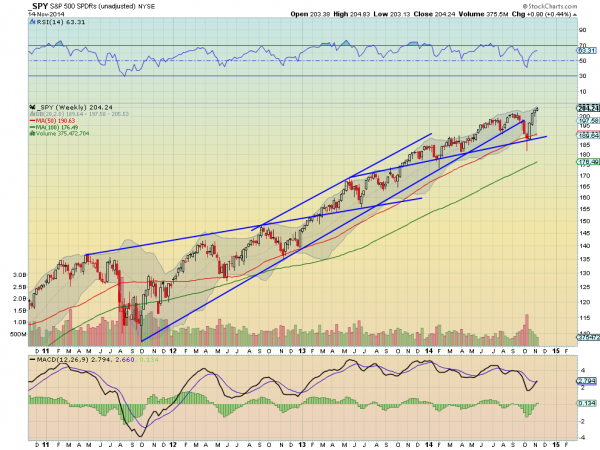

SPY Weekly, SPY

The SPY crept higher on the week, making a new all-time high in the process. The price touched the extension of the rising trend resistance line Thursday and printed a Spinning Top, signaling indecision. That resolved higher Friday though. The daily chart shows the remnants of the failed 5-0 harmonic pattern, wondering if the trendline will stop it, shifting the 5-0 to the right one wave. The RSI is holding strongly in the bullish zone and refusing to move into the overbought region while the MACD is leveling at high levels. The weekly picture shows the slowing candles as it makes a new high. The chart is very promising though, with a RSI that is bullish and rising and with room above. The MACD is also about to cross bullish. There is resistance at 204.80 and then free air higher with 209.53 the 138.2% extension for the down leg higher. Support may come lower at 203.25 and 201.90 followed by 200 and 199. Continued Upward Price Action.

Heading into the last full week before the Holiday season and November Options Expiration, the equity markets continue to look better on the longer timeframe than on the daily. Elsewhere look for Gold to continue the bounce in its downtrend while Crude Oil heads lower. The US Dollar Index looks to continue to move sideways with a chance of a pullback while US Treasuries are level in their pullback. The Shanghai Composite may consolidate in the uptrend while Emerging Markets muddle along sideways with a slight upward bias. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are not as firm in that regard though, with the IWM in consolidation mode short term and the SPY and QQQ stronger but also looking better in the longer timeframe. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.