A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators noted that as the books closed on September Options Expiration the markets were again teetering between bullish and bearish. Elsewhere looked for gold to test support and if it fails see a move lower while Crude Oil continued down. The US Dollar Index had short term strength and should continue higher while US Treasuries iShares 20+ Year Treasury Bond (NASDAQ:TLT) consolidated in their pullback.

The Shanghai Composite was biased to the downside at support and iShares MSCI Emerging Markets (NYSE:EEM) looked to continue consolidation in the down draft. Volatility iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX) looked to remain in the normal range keeping the bias neutral to higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all flashed consolidation in the longer timeframe but on the shorter one the IWM and SPY (NYSE:SPY) were at risk of more pullback while the QQQ headed higher.

The week played out with Gold holding at support and then moving higher after the Fed meeting while Crude Oil found support and moved higher late in the week. The US Dollar drifted lower but in a very tight range while Treasuries found support and started back higher. The Shanghai Composite bounced up off of 3000 while Emerging Markets moved higher. Volatility continued its move lower, moving back into the abnormally low range.

This gave the Equity Index ETF’s a wind at their backs that caught their sails and moved them higher following the Fed meeting. The SPY ended back near its all-time highs set in August, while the IWM also returned to the August highs, but still below all-time levels, and the QQQ rocketed up to new all-time highs. What does this mean for the coming week? Lets look at some charts.

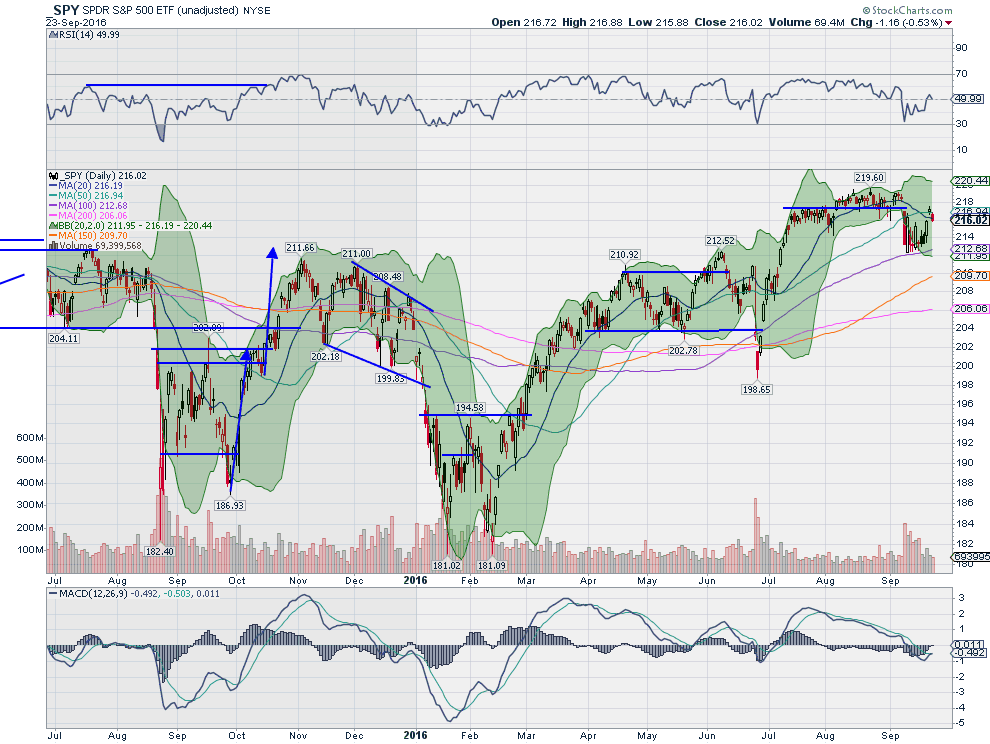

SPY Daily

The SPY entered the week after a small body candle the prior Friday failed to confirm a would be reversal higher. Monday saw a press higher fall and that was followed by the same thing Tuesday, although both were with in tight ranges. A gap higher open Wednesday also failed, falling back and closing the gap ahead of the FOMC announcement. But following the initial uncertainly and squaring around the statement it took off to the upside.

Thursday continued, with a gap higher, taking it into the open gap from September 9th. It stalled there and fell back to fill the Thursday gap on Friday. The short term pattern confirms an Evening Star reversal lower, which could continue next week or already be done. The daily chart shows the RSI is stalling at the mid line, while the MACD is crossing up. A mixed message.

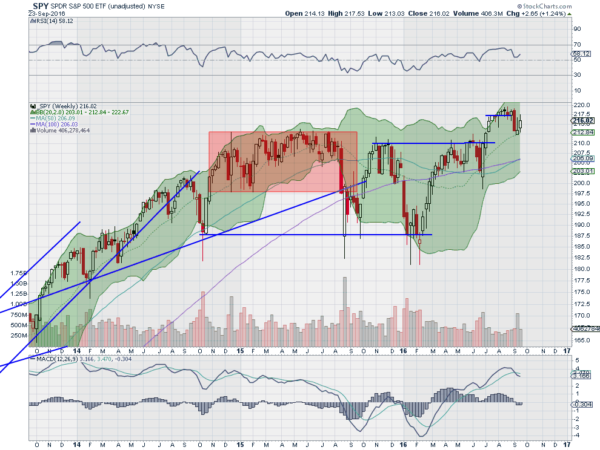

The weekly chart is confirming a Morning Star reversal higher. Timeframes matter. The RSI on this timeframe is bullish and turning back up while the MACD is stalling in its pullback. There is resistance at 217 and 218 followed by 219 and 219.50. Above that there is a new Measured Move to 232. Support lower comes at 215.70 and 215 followed by 214 and 212.50, then 210. Possible Short Term Weakness in Uptrend.

SPY Weekly

Heading into the last week of September the Equity Indexes are looking strong, especially on the longer timeframe. Elsewhere look for Gold to move higher short term in consolidation while Crude Oil consolidates. The US Dollar Index also looks to continue to move sideways while US Treasuries are biased higher. The Shanghai Composite looks to drift higher while Emerging Markets are biased to the downside in the short term.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show strength in moving higher at the end of the week, especially in the longer timeframe. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.