Last week’s review of the macro market indicators suggested heading into November Options Expiration and the last week before the shortened Thanksgiving holiday, the Equity market had again shown an inability to make new highs, without giving up the positive longer term perspective.

Elsewhere looked for gold (N:GLD) to continue its downtrend, but with a possible short term reversal while crude oil (N:USO) worked lower. The US Dollar Index (N:UUP) looked to continue higher, while US Treasuries (N:TLT) were biased lower, but also might see a short term reversal. The Shanghai Composite (N:ASHR) was building energy for another leg higher, while Emerging Markets (N:EEM) were biased to the downside again.

Volatility (N:VXX) looked to remain above the lower range, making things difficult for equities, but looked for a pullback after the spike in short order. The equity index ETFs N:SPY, N:IWM and O:QQQ, all looked better to the downside this week.

The week played out with gold probing lower but slowing the fall while crude oil consolidates against support lower. The US dollar moved slightly higher finding resistance while Treasuries did bounce higher. The Shanghai Composite moved sideways around 3600 while Emerging Markets rebounded higher.

Volatility reversed the move higher from last week, easing the headwinds to equities. The Equity Index ETFs all responded by finding a bottom Monday and rising all week. What does this mean for the coming week? Lets look at some charts.

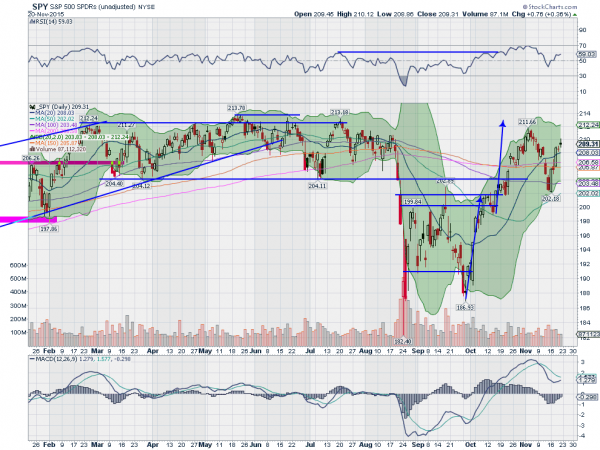

SPY Daily

The SPY started the week on a good note, with a bullish engulfing candle Monday. The spinning top Tuesday failed to confirm the reversal higher though, but without negating it. Wednesday provided the confirmation with a bullish candle, a near Marubozu, to the upside. But then Thursday and Friday added back the uncertainty, despite moves higher, with back to back dojis. These signal indecision in the market and many will will be looking lower to start next week.

The daily chart shows the RSI cruising back higher and the MACD turning up toward a bullish cross. The price action now gives two Measured Moves to the upside. One at 214.20 and the second above at 227. Moving out to the weekly chart, the bullish engulfing candle for the week suggests that new all-time highs may be coming soon. The RSI on this timeframe pulled back to the mid line and is resuming higher with the MACD rising, both support the upside.

There is resistance higher at 210.25 and 211 followed by 212.50 and 213.78. Support lower comes at 209 and 208.40 followed by 206.40 and 204.40. Continued Short Term Uptrend.

SPY Weekly

Heading into the shortened Thanksgiving Holiday week, the equity markets have moved strongly higher, maybe a bit too fast in the short run. Elsewhere look for gold to continue lower while crude oil consolidates in its downtrend. The US Dollar Index is consolidating with an upward bias and US Treasuries are moving higher in the consolidation range.

The Shanghai Composite looks ready to resume the move higher out of consolidation and Emerging Markets are biased to the upside short term in their downtrend. Volatility looks to remain low, adding some wind to the backs of the equity index ETFs SPY, IWM and QQQ.

Their charts look good in the short term, with the SPY and QQQ moving higher and the IWM biased higher in consolidation. Longer term the SPY and QQQ look ready to attack their all-time highs, while the IWM lags behind. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.