A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators suggested, heading into April Options Expiration, saw the equity markets had gained some strength.

Elsewhere looked for Gold ARCA:GLD to continue higher in the short term while Crude Oil NYSE:USO moved in its consolidation zone. The US Dollar Index NYSE:UUP was moving higher again while US Treasuries ARCA:TLT were biased lower in the short term. The Shanghai Composite NYSE:ASHR and Emerging Markets ARCA:EEM were both biased to the upside with the Chinese market looking overheated again.

Volatility ARCA:VXX looked to remain subdued keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ, despite the moves higher the prior week. Their charts also looked good for more upside with the IWM steady and the QQQ and SPY with some short term hurdles to overcome.

The week played out with Gold doing nothing, shuttling around 1200 while Crude Oil broke out to the upside, guess I got those two backwards. The US dollar reversed lower while Treasuries started lower before bouncing to end the week. The Shanghai Composite continued to melt to the upside while Emerging Markets finally met some resistance late in the week and pulled back.

Volatility was low and stable most of the week before moving up again Friday. The Equity Index ETF’s all started the week well moving higher, but Friday ended that with the SPY, IWM and QQQ giving back all of the gains and then some. What does this mean for the coming week? Lets look at some charts.

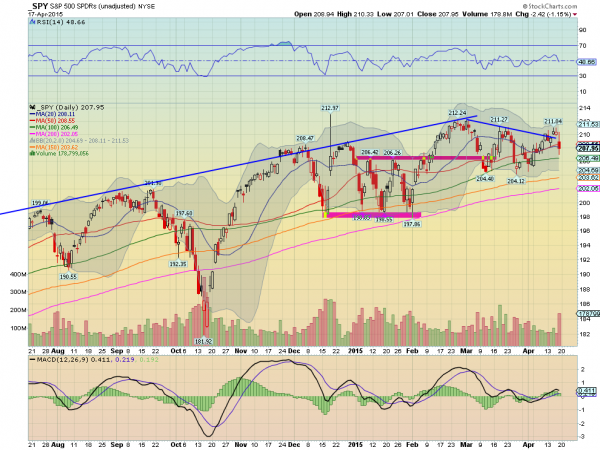

SPY Daily, SPY

The SPY started the week pulling back from falling resistance. A brief touch at the 50 day SMA on Tuesday though pushed it back higher and then a gap up Wednesday moved over the trend line. All was not rosy though with an upper shadow and a second one the next day, back to back Evening Stars. These confirmed lower with a vengeance on Friday, leaving an island top. Or, if you like, two open gaps above. The volume on the sell off Friday was high too. The daily chart shows the RSI is just cracking below the mid line and remains in the bullish zone, while the MACD is starting to rollover. Not a sign of strength, but also not really weak either on this timeframe.

Moving out to the weekly chart the price action remains in the top half of the consolidation box. The RSI on this timeframe is holding over the mid line and bullish while the MACD is slowly moving lower. It still has some room to the rising 50 week SMA below which has launched it higher in the past. There is resistance higher at 209 and 210.25 followed by 211 and 212.25. Support lower comes at 206.40 and 204.40 followed by 203 and 201.25. Continued Consolidation Sideways in the Long Term Uptrend.

SPY Weekly, SPY

Heading into next week the equity markets remain positive in the longer run but mixed with a bit of trepidation in the short term. Elsewhere look for Gold to continue to hold around 1200 while Crude Oil continues its short term bounce. The US Dollar Index looks to continue to consolidate sideways while US Treasuries are biased higher if they break their consolidation range. The Shanghai Composite is on fire and frothy but who know when it will stop while Emerging Markets consolidate their recent move higher.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts suggest that the longer term view remains stronger while in the short term the IWM continues to be the strongest but with some short term trepidation and the SPY and QQQ with a decent possibility to start the week lower. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.