Last week’s review of the macro market indicators suggested, heading into the first week of April that the Equity markets were mixed with the IWM strong but the SPY and QQQ weaker and maybe ready for some short term downside.

Elsewhere looked for Gold (ARCA:GLD) to bounce around 1200 as it consolidated while Crude Oil (NYSE:USO) churned back in its consolidation channel. The US Dollar Index (NYSE:UUP) would generally move sideways but with an upward bias while US Treasuries (ARCA:TLT) were biased lower short term in their consolidation. The Shanghai Composite (NYSE:ASHR) looked very strong and Emerging Markets (ARCA:EEM) were getting jealous, and trying to join it to the upside.

Volatility (ARCA:VXX) looked to remain subdued keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts pointed to consolidation or even a downside bias for the SPY and QQQ, while the IWM seemed the place to be, holding up well at the all time highs.

The week played out with Gold probing higher before pulling back toward 1200 again while Crude Oil found the top of the channel and was pushed back. The US dollar found support and moved higher while Treasuries leaked lower but in a tight range. The Shanghai Composite continued higher breaking 4000 while Emerging Markets joined the party continuing higher.

Volatility opened higher Monday before falling back the rest of the week. The Equity Index ETF’s moved higher over the week against this back drop, with the QQQ seeing most of the gains, with the SPY starting strong and then adding a bit more Friday, while the IWM drifted higher. What does this mean for the coming week? Lets look at some charts.

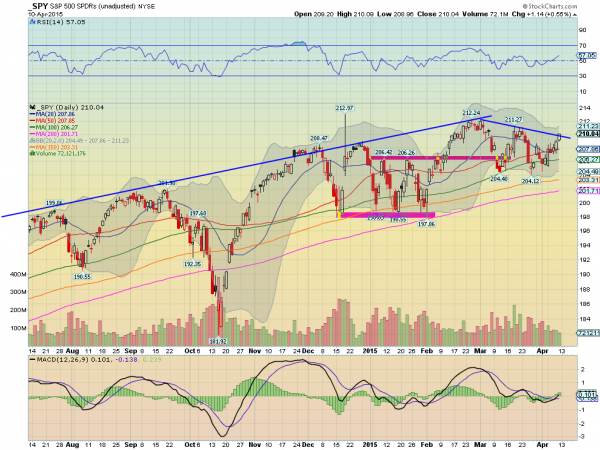

SPY Daily, SPY

The SPY started the week with a hard move higher off of the 100 day SMA to the 50 day SMA. That became its support for the rest of the week before a lift off on Friday. The week ended over the falling trend resistance line and near the high of the day. The momentum indicator RSI is rising over the mid line with the MACD crossing up, supporting a further push higher. The Bollinger Bands® are also hinting that they will open to allow a move higher.

Out on the weekly chart the price action remains in the consolidation zone at the all-time highs. The RSI is in the bullish zone and the MACD may be bottoming short term. Many will point to the RSI and MACD diverging lower but neither is making new lows. Not a worry at this point. There is resistance at 210.25 and 212.25 before free air to the upside and new highs. Support lower comes at 209 and 206.40 followed by 204.40. Short Term Upward Price Action the Intermediate Consolidation in the Long Term Uptrend.

SPY Weekly, SPY

Heading into April Options Expiration, the equity markets have gained some strength. Elsewhere look for Gold to continue higher in the short term while Crude Oil moves in its consolidation zone. The US Dollar Index is moving higher again while US Treasuries are biased lower in the short term. The Shanghai Composite and Emerging Markets are both biased to the upside with the Chinese market looking overheated again.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the moves higher this week. Their charts also look good for more upside with the IWM steady and the QQQ and SPY with some short term hurdles to overcome. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.