The South African Rand (ZAR) plunged 3.5 % as news emerges of a police summons and a separate investigation of the Finance Minister by tax authorities.

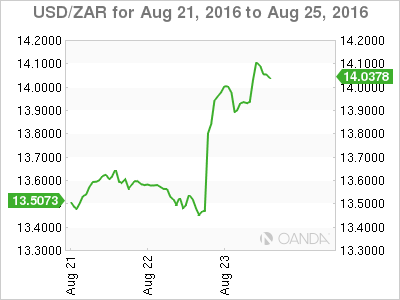

The South African Rand (ZAR) collapsed 3.5 % against the USD in a matter of minutes during the New York session. Moving from 13.50 to 14.05 before settling in Asia trading 14.0000. Headlines broke that the South African anti-corruption unit of the police, otherwise known as the HAWKS, have summoned Finance Minister, the widely respected Pravin Gordhan, to appear at a police station this Thursday.

Separately and perhaps not as widely known the South African Revenue Service (the unfortunately named Sars) has launched a forensic investigation of tender irregularities during his tenure as Commissioner from 1999-2009.

Speculation is rife that the summons of Mr. Gordham and some former Sars colleagues is related to a secret unit set up by Sars at that time. It was charged with spying on prominent South Africans including President Zuma. Mr. Gordham has consistently denied he had anything to do with this, and I am of the opinion the summons may be in fact related to the tender irregularities. Thursday will tell us all.

So why has the ZAR collapsed so aggressively on this news? Well, perhaps the answer is in the Game of Throne’s-esque politics and intrigue in South Africa at the moment. The ruling ANC suffered a terrible municipal election drubbing (by its standards) a few weeks ago. Losing control even of Johannesburg. The ZAR has rallied since then on it being a victory of the reformists over the tainted status quo.

Mr. Gordham is regarded as a leading reformer and a foil to Mr. Zuma on fiscal discipline. To many in South Africa, the timing of this summons smells of political interference. The HAWKS are completely separate to the Presidents Office; however, the cynic in me always says “there’s never just one cockroach.”

The real issue here though that has seen investors running for the door faster than a herd of wildebeests on the Serengeti is the potential implications for South Africa’s credit rating. At this moment it is one notch about “junk” grade with a review due in the next few months. Investors both domestic and international are regarding these events as increasing the possibility exponentially of it being downgraded to junk.

This will have grave consequences for South Africa’s ability to finance itself on international markets and of the Governments ability to fund its deficits. Being shut out of the global borrowing market would have grave implications for both unemployment and growth at a time when both continue to be structurally weak. In other words, the reformist municipal election victory “peace dividend” has been wiped out in less than one hour.

To add even more flames to the fire, President Zuma announced on Monday; he was effectively assuming direct control of most State Owned Enterprises. I told you it was complicated….

International investors may love the Game of Thrones, but they don’t like their investments to be managed like them. When things get “complicated” they tend to run for the door. And this reflects the price action in USD/ZAR last night in New York.

From a chart, perspective USD/ZAR has substantial daily resistance at 14.20000. Being a series of daily lows dating back to April and the original post-election breakout. Daily support is a long way away at 13.8500.

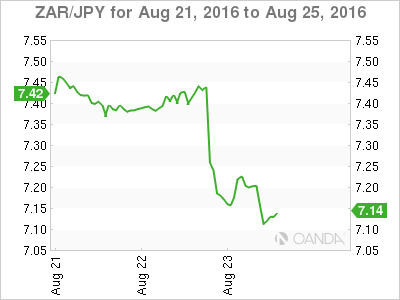

ZAR/JPY has also collapsed breaking support at 7.18 which now becomes resistance. Key long-term support sits in the 7.00/7.05 area, and long-suffering carry traders may well choose (or be) carried out of these carry trades on a daily close below.

In summary, it appears the game is changing in South Africa. Price action will be driven more by politics going forward then fundamentals. A deterioration of the situation, or of a loss of investment grade status seeing the herd stampede for the exit rather than run.