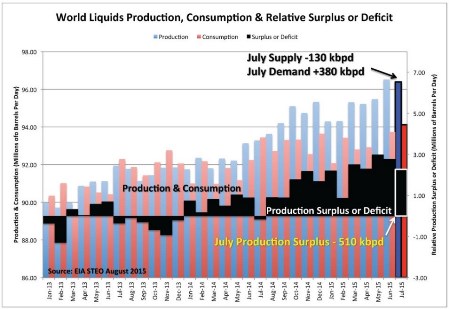

The EIA Short Term Energy Outlook (STEO) published today reports that world oil supply decreased 130,000 bpd and demand increased 380,000 bpd in July compared to June. This reduces the relative production surplus (supply minus demand) by 510,000 bpd to 2.3 mmbpd (Figure 1).

U.S. crude oil production decreased 100,000 bopd in July compared to June.

As I wrote in my post yesterday,

“Don’t get me wrong: this is not going to be anything dramatic but, if I’m right, it will add another month of data that suggests flattening production and increasing demand.”

Related: Midweek Sector Update: Have We Reached A Bottom For Oil Prices?

Figure 1. World liquids production, consumption and relative surplus or deficit. Source: EIA and Labyrinth Consulting Services, Inc.

(click to enlarge)

The world still has a huge problem with more than 2 million barrels per day of surplus production and I don’t want to minimize that concern. Nor do I want to offer false hope that oil prices will rebound as a result of this new supply and demand data.

Related: The Saudi Oil Price War Is Backfiring

Oil futures have fallen considerably today on news that China will devalue its currency and prices could fall further. I recommend that you read my colleague Euan Mearns’ post today on that troubling possibility.

The significance of the EIA STEO is that we now have two months of data that show the potential beginnings of a trend toward a more balanced market. I await IEA’s Oil Market Report tomorrow for more insight.