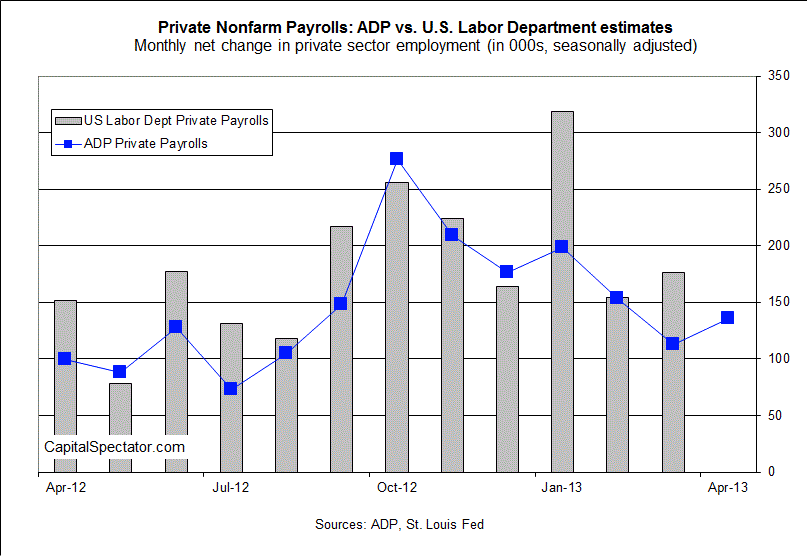

The pace of growth in private-sector payrolls picked up a bit last month, according to today’s ADP Employment Report. The modest improvement is enough to assume that May’s full economic profile, once all the numbers are published, will reflect more of what we’ve seen lately: a sluggish but still positive rate of expansion. But expecting something better continues to require a level of confidence that’s not supported in the numbers.

Private sector employment added 135,000 jobs on a net basis in May, ADP reports. That’s up a bit from the company's April estimate of a 113,000 gain, and so the change in direction is encouraging. In turn, the slightly better monthly comparison lends support for thinking that Friday’s official payrolls report from the Labor Department will also deliver a decent if unspectacular round of data.

"The job market continues to expand, but growth has slowed since the beginning of the year," says Mark Zandi, chief economist of Moody’s Analytics, in the accompanying ADP press release "The slowdown is evident across all industries and all but the largest companies. Manufacturers are reducing payrolls. The softer job market this spring is largely due to significant fiscal drag from tax increases and government spending cuts."

Whatever the cause of the downshift, no one will be confuse today’s release -- or the trend in last several months, for that matter -- as robust and today’s news from ADP doesn’t change the big picture. Actually, once we consider Monday’s disappointing update for the ISM Manufacturing Index for May -- it signaled contraction in the sector for the first time since last November -- slower growth in the labor market looks troubling. Ditto for last week’s weak report on consumer spending and income for April.

There’s still no smoking gun if you’re looking for a high confidence signal that tells us that the business cycle has tipped over to the dark side. But there’s a bit less margin for disappointment from here on out after the latest round of economic updates.

Deciding if there’s something ominous the weeds will take time but a few more weeks should do it. Tomorrow’s jobless claims report is first on the list, as it offers an early look at how the June payrolls trend is unfolding. Friday, of course, is the big news for looking backward, although today’s ADP report lets us breathe a bit easier.

The consensus forecast via Econoday.com for the Labor Department’s private payrolls number for May calls for a 178,000 increase in jobs, or only a hair above April’s gain. Not great, but not terrible either. If accurate, that’s enough to minimize the worst fears while leaving plenty of room for debate about where we go from here.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Slow Growth In U.S. Payrolls Persists In May

Published 06/05/2013, 02:23 PM

Slow Growth In U.S. Payrolls Persists In May

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.