The markets have recently been enthralled with the fall of gold and silver as the metals seek to make lower lows. However, Silver is facing a squeeze play as a small double bottom forms on the 4-hourly chart that keen eyes are watching closely.

The silver breakdown started in May and has been vicious for traders with a bullish bias, as prices are currently down over $3.00 an ounce. However, in comparison to gold, the metal has provided some positive signs of late as a small double bottom and wedge pattern are seemingly forming. There is subsequently potential for a base to form at the $14.790 level that could yield some interesting trading opportunities.

Silver and gold both exhibit very different fundamentals as silver is correlated with industrial demand, and to a lesser extent, the equity markets. Silver is a key component of circuitry and, in particular, is heavily used in smart phone production. Subsequently, the metal retains a strong fundamental case for its industrial demand.

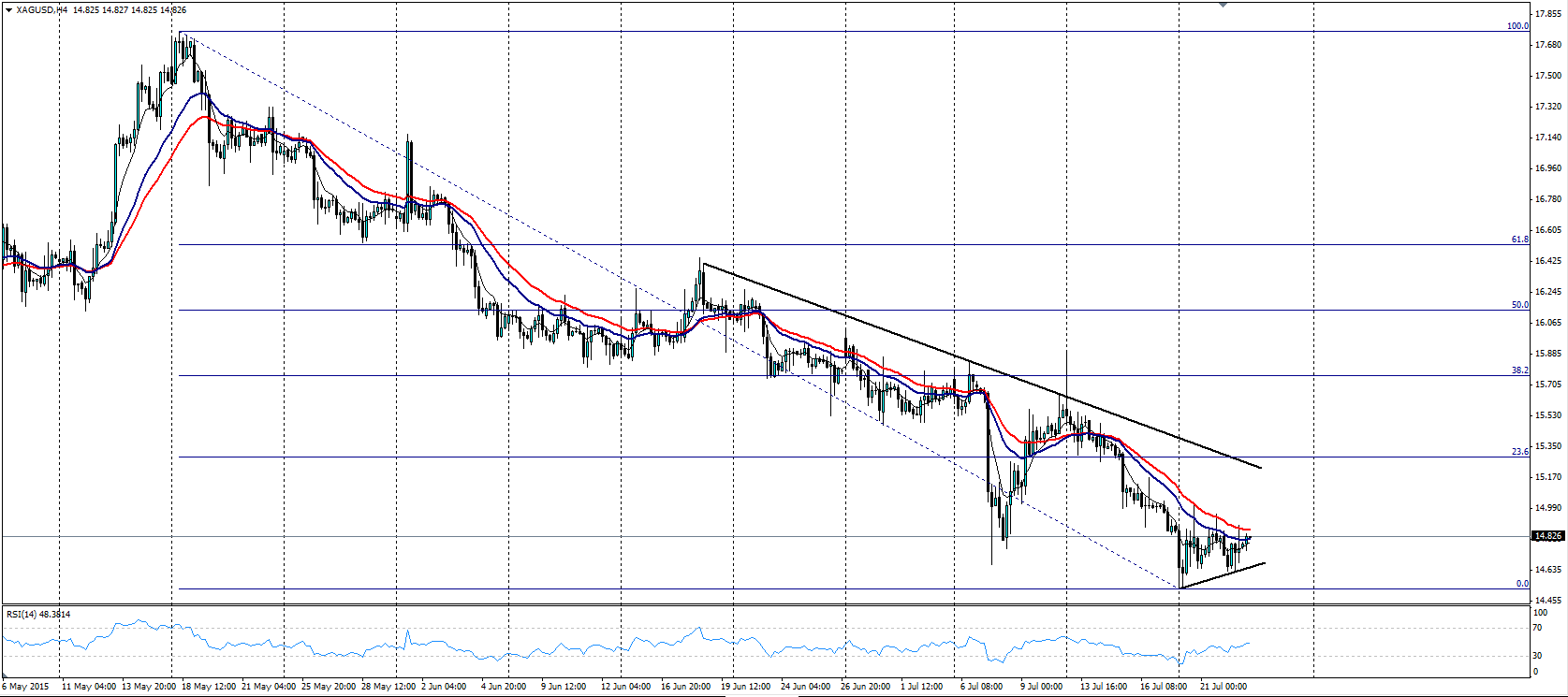

Taking a look at the technical aspects of silver provides an interesting case for a retracement from its current depressed level. The 4-Hourly chart shows that a small double bottom has formed around the $14.60 level. Currently, the lows are becoming higher as a small wedge pattern has appeared from the months low. If this pattern holds, it is probable that a retracement back towards $15.20 will occur.

There has also been some divergence occurring on Silver’s chart as RSI trends higher, away from oversold territory,whilst price remains relatively flat. This gives some credence to the case for a short run retracement back towards the top of the bearish trend line. Along with the RSI oscillator, the moving averages are also turning as the 6EMA trends higher towards the 30EMA.

Overall, wedge patterns and divergence can be difficult to predict, ever more so when it is a counter trend position. However, given Silver’s recent strong falls and the underlying industrial demand for the metal, a long side bias towards $15.20 seems probable. Having said that, like everything in life keep your stops tight and your options open!