Something has seriously changed in the Silver market as traditional indicators no longer seem to matter. Normally, when the price of a commodity falls, so does demand. However, we are seeing quite the opposite as investors continue to buy silver bullion hand over fist.

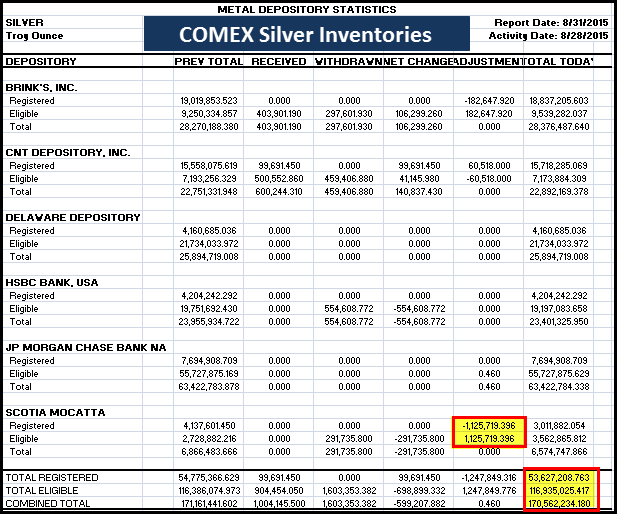

This surge in physical silver demand has put more stress on global silver inventories. Let’s take a look at the last two COMEX Silver Inventory updates. On Monday’s update (8/31/15), the COMEX reported a total deposit of 1 million oz (Moz) and 1.6 Moz withdrawal for a net 600,000 oz decline. Actually, it was a net 599,207 oz withdrawal, but what’s a few ounces between banker friends.

While the 600,000 oz net withdrawal was somewhat interesting, the real item to focus on was the cool 1,125,719 oz transfer of Scotia Mocatta’s Registered silver to its Eligible category. Thus, this now puts the total COMEX Registered silver at 53.6 Moz compared to the 55.8 Moz last week.

That might not seem like a lot, but total COMEX Registered silver inventories were 70.6 Moz back in April. That’s nearly a 25% decline of total Registered silver inventories at the COMEX in five months. We must remember, Registered inventory means that the silver is available for delivery to those who demand bullion by being registered as such with a bullion dealer.

So, only 53.6 Moz of silver is now available for delivery. On the other hand, Eligible silver inventories means that the silver is in a condition that conforms to the standards of delivery. Size and quality of the bar in other words. It is being stored at the Comex warehouse, but is not offered for delivery into contracts. The majority of silver at the COMEX is stored in the Eligible category.

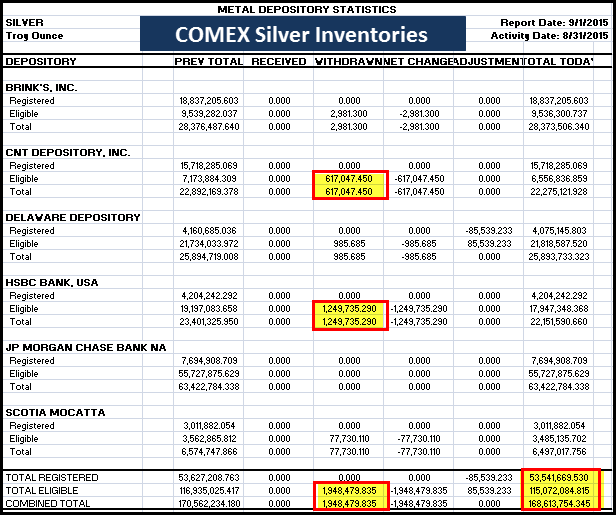

That being said, the Eligible inventories experienced another whopper of a decline yesterday as nearly 2 Moz of silver were withdrawn:

As we can see, there was almost a FULL HOUSE of withdrawals from the Eligible inventories. By a FULL HOUSE, I mean a withdrawal from every warehouse. The only warehouse that did not report a withdrawal was JP Morgan. However, there were two large withdrawals from the CNT Depository (617,047 oz) and HSBC (1,249,735 oz) for a total of 1,948,479 oz.

Currently, total silver inventories at the COMEX stand at 168.6 Moz, down from a peak of of 184 Moz in July.

Surging Physical Silver Demand Is The Culprit For Falling Inventories

As I mentioned in several of my interviews, this spike in physical silver investment is much different from what took place in 2008. Why? The Fed was just starting its massive QE policy (monetary injections) and Treasury and MBS (Mortgage-Backed Security) purchases. After seven years of this monetary insanity, the U.S. and world financial system is in much worse shape.

Furthermore, the Fed has very little it can do when the broader stock market and economy really starts to crash. I believe the huge surge in retail silver investment demand will not fall off like it did in 2008. Why? Many more investors today realize the situation may get totally out-of-hand…. so why stop buying??

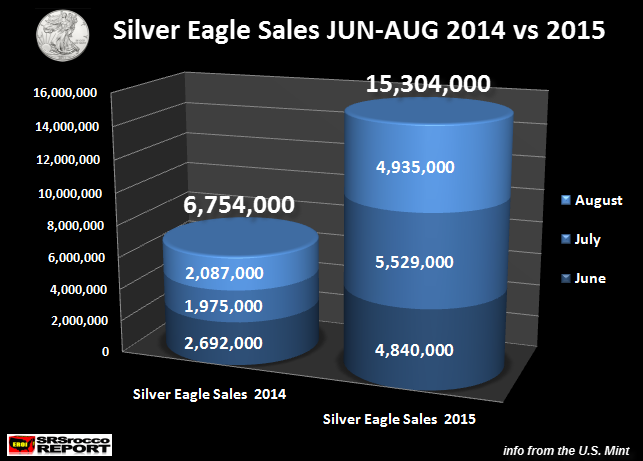

This recent spike in physical silver demand started when the situation in Europe came under stress due to a possible Greek exit. Investors starting buying Silver (and Gold) Eagles in a big way in the third week of June. Thus, buying turned into a torrent as the U.S. Mint suspended sales on July 7th. Sales of Silver Eagles did not resume until two weeks later. Even with the suspension of sales, the U.S. Mint sold a whopping 5,529,000 for the month of July.

The chart below shows just how much more investors purchased Silver Eagles during June, July and August compared to last year:

From June to August 2014, a total of 6,754,000 Silver Eagles were sold. Now, compare that to the massive 15.304,000 sold during the same period this year. Not only did Silver Eagle purchases double, they were 126% more than last year. Remember, when Silver Eagle sales go up, so do most of the other official coins, such as the Canadian Silver Maple Leaf.

Silver Maple Leaf sales have been so strong, some dealers are listing them as “Out of Stock” because they can’t access reliable supply and provide a specific time for delivery. I would imagine this supply shortage situation could become much worse if we experience a continued crash in the broader stock markets over the coming weeks-months.

NOTE: The huge increase in physical silver demand is predominantly an “Investment based phenomenon.” While silver jewelry demand is up marginally in 2015, I would imagine industrial and silverware consumption is lower.

Gold Eagle Sales More Than Triple Compared To Last Year

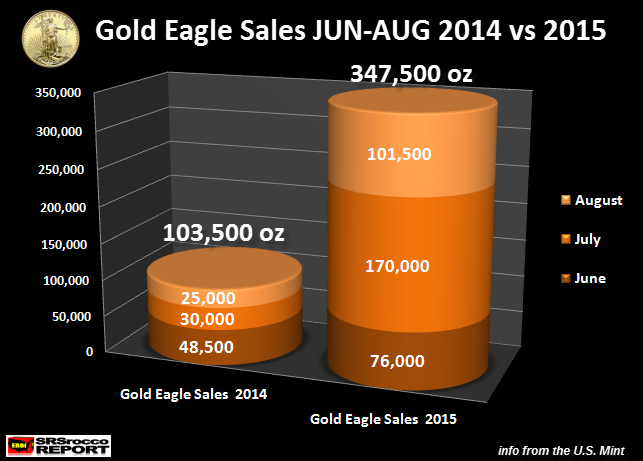

If investors thought Silver Eagle sale spiked over the past three months, take a look at Gold Eagle sales:

Here we can see Gold Eagle sales exploded to a total of 347,500 oz during June to August compared to 103,500 oz during the same period last year. Again, Gold Eagle sales spiked in July due to the possible financial contagion of a Greek Exit of the European Union.

As events in Europe seem to have calmed down on the surface, the recent 1,800 point market crash in the Dow Jones sparked more fear and more Gold Eagle buying. The majority of Gold Eagle purchases for August came at the latter part of the month.

Even though the market isn’t experiencing the kind of shortages in the retail gold market as we are seeing in the retail silver market, it may be just a matter of time. Investors need to realize just how more dire the economic and financial system is today compared to 2008.

This next financial and economic crash will be much worse than 2008. This is why I believe physical demand for silver and gold will only continue to increase going forward. It may come to a time when investors don’t really care about the paper price they pay for gold or silver, but the guarantee of delivery will be their major concern.

I converse with many investors and I can tell you that some tell me they were glad to finally receive their silver in mail. It’s stressful to have to wait 2-4 weeks or more for your silver. What happens when things really get out of hand and the sales person tells you that they can’t guarantee a delivery time?

Again, I believe that time is coming. I am not saying this to hype or spook investors into buying gold or silver, rather I believe it’s better to have a good holding of metal now, then wait until it becomes increasing difficult to get acquire.