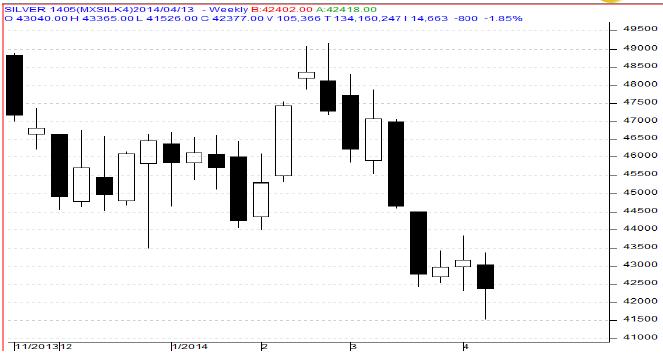

MCX Silver May as seen in the weekly chart above has opened the week at 43,040 levels and during this period prices made a low of 41,526 levels. In the later part of the week prices could not able to sustain on support level and bounced back from these levels towards 42,757 levels. During this week prices closed 1.85% lower and finally closed at 42,377 levels. As per candlestick pattern prices formed a “Bearish Candlestick” type of pattern which is basically indicates bearishness.

For the next week we expect silver prices to find support in the range of 41,200 – 41,000 levels. Trading consistently below 41,000 levels would lead towards the strong support 39,000 levels and then finally towards the major support at 38,000 levels.

Resistance is now observed in the range of 43,800 – 44,000 levels. Trading consistently above 44,000 levels would lead towards the strong resistance at 45,000 levels, and then finally towards the major resistance at 46,500 levels.

MCX / Spot Silver Trading levels for the week

Trend: Down

S1 - 41,200 / $ 19.10 R1 - 43,800 / $ 20.30

S2 - 39,000 / $ 18.00 R2 - 45,500 / $ 21.10

Weekly Recommendation: Sell MCX Silver May between 43,300 – 43,800, SL- 45,000, Target – 41,200 / 40,50