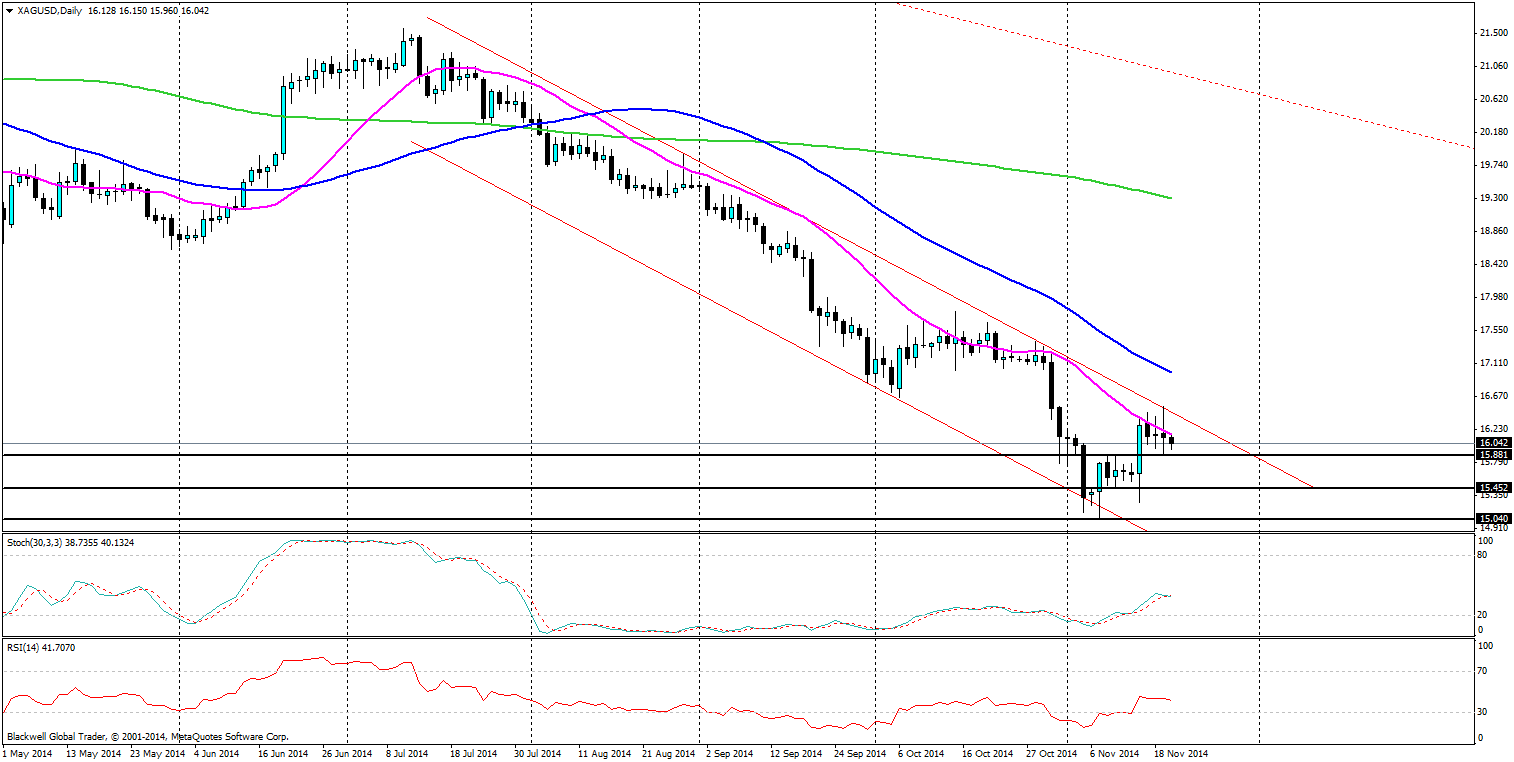

Source: Blackwell Trader (XAGUSD, D1)

Silver markets were pushed up higher overnight as FOMC shook the markets up. What was no surprise for them though was the power of the channel in play as it looked to hold against further highs on the charts.

If you’re a silver bug, then you’re going to be disappointed by what I have to say, but there is very much a bullish channel at work on the charts, and it’s all down hill after last night's rejection of the inside of the channel. While markets may be acutely aware of the downturn, it does not stop profit taking and ranging along the channel, so many are now looking for the market to fall further if possible.

What is interesting to note is that how strictly silver is obeying the 20 day moving average, to the point where it is closing below the 20 day moving average and allowing the trend to carry it lower. Markets will likely be looking to close it lower if possible in the long run as it has failed that testing level.

So the key levels to target now for short to medium term traders will be at 15.881, 15.452 and 15.040; all of which are looking like solid support levels. Especially the 15.040 level, which has held up very nicely when it was first tested and silver was looking to fall below 15 dollars.

Overall, Silver is looking like a profitable short for traders, and you shouldn’t shy away from the metal. If you’re looking for a stop loss I would suggest it outside the trend line, but that may be too far out for some traders now. Either way look for a slight pullback up to enter in the short term and you may get a decent risk reward on this trade.