Sometimes things are so bad they can't get any worse. That seems to be the case in the eurozone, which is mired in deep recession and possibly a multi-year depression.

Yet I am seeing signs of improvement. Mario Draghi's ECB has moved to take tail risk off the table. What's more, the periphery is starting to turn around. Walter Kurtz of Sober Look noted last week that peripheral Europe is starting to improve:

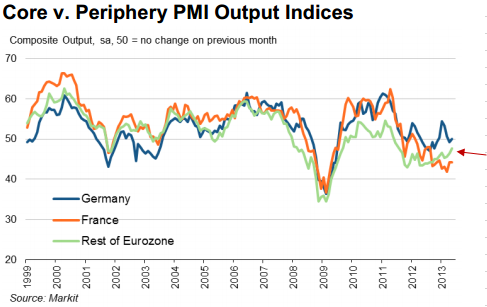

Today we got the latest PMI numbers from the Eurozone (see figure 2). France is clearly struggling and Germany’s growth has been slower than many had hoped – due primarily to global economic weakness. But take a look at the rest of the Eurozone. While still in contraction mode, it shows an improving trend.

Spain printed a trade surplus last month (surprising some commentators), which may be a signal to rethink how valid some of these forecasts really are. Nobody is suggesting we will see Spain or Portugal all of a sudden begin to grow at 5%. But given the extremely pessimistic sentiment of many economists (a contrarian indicator), it is highly possible we are at or near the bottom of the cycle. People should not be surprised if we start seeing some positive growth indicators – especially in the periphery nations – in the next few quarters.

Indeed, bond yields in the periphery have been showing a trend of steady improvement and "normalization". As an example, look at Italy:

Here is Spain:

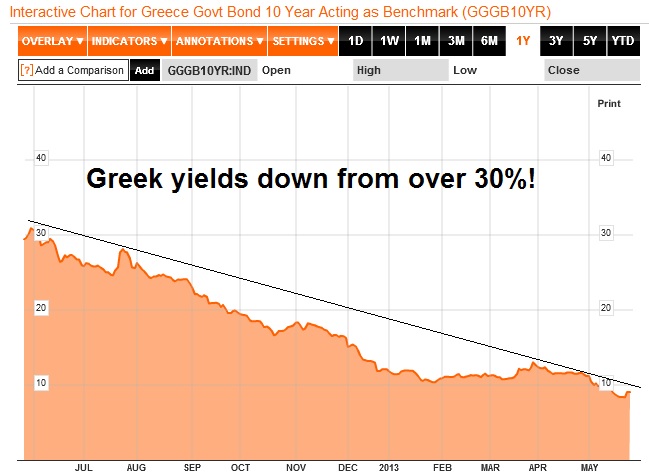

And here is the real clincher. Greek 10-year yields have fallen from over 30% to under 10% today:

As a sign of how the bond markets have normalized and how risk appetite has returned to Europe, consider this account of what happened with Slovenia early this month. Slovenia was doing a bond financing, then Moody's downgraded them two notches to junk:

After several days of roadshowing, the troubled Slovenia decided to open books for 5 and 10y bonds on Tuesday (30 April). Given that in the previous weeks peripheral bond markets rallied like mad, it wasn’t too heroic to assume that the book-building would be quite quick. Indeed, in the early afternoon books exceeded USD10bn (I guess Slovenia wanted to sell something around 2-3bn) and then reached a quarter of what Apple managed to get in its book building. If I were to take a cheap shot I would say that Slovenia’s GDP is almost 10 times smaller than Apple’s market capitalisation* but I won’t.

And then the lightning struck. Moody’s informed the government of an impending downgrade, which has led to a subsequent suspension of the whole issuance process. I honesty can’t recall the last time a rating agency would do such a thing after the roadshow and during book-building but that’s beside the point. That evening, Moody’s (which already was the most bearish agency on Slovenia) downgraded the country by two notches to junk AND maintained the negative outlook. This created a whopping four-notch difference between them and both Fitch and S&P (A-). The justification of the decision was appalling. Particularly the point about “uncertain funding prospects”. I actually do understand why Moody’s did what it did – they must have assumed that the Dijsselbloem Rule (a.k.a. The Template) means that Slovenia will fall down at the first stumbling point. But they weren’t brave enough to put that in writing and instead chose a set of phony arguments.

Did the bond financing get pulled or re-priced? Did bond investors run for the hills and scream that Slovenia is the next Cyprus? Not a chance. In fact, the issue sold out and traded above par despite the downgrade:

Then the big day came – books reopened, bids were even stronger than during the first attempt and Slovenia sold 3.5bn worth of 5 and 10y bonds. On Friday, the new Sloven23s traded up by more than 4 points, which means yield fell by more than 50bp from the 6% the government paid. A fairy tale ending.

Key risk: France

From a longer term perspective, the elephant in the room continues to be France (see my previous post Short France?). French economic performance continues to negatively diverge with Germany. This isn't Greece or Ireland, whose troubles could be papered over. France is the at the heart of Europe and the Franco-German relationship is the political raison d'etre for the European Union. France cannot be saved. It can only save itself.

Despite these dark clouds, the markets are relatively calm over France. The CAC 30 is actually outperforming the Euro STOXX 50:

From a global perspective, European stocks are also showing a turnaround against the All-Country World Index (ACWI):

I am watching this carefully. European stocks could turn out to be the new emerging leadership and the source of outperformance.

Disclosure: Long FEZ

Disclaimer: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Signs Point To European Healing

Published 05/27/2013, 03:38 AM

Updated 07/09/2023, 06:31 AM

Signs Point To European Healing

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.