The second quarter earnings season has picked up momentum and results from 103 S&P 500 members or 25.8% of the index’s total market capitalization are already out.

Per the latest Zacks Earnings Trend report, total earnings for these 103 index members are down 2.1% year over year on 1.4% higher revenues, with 68.9% beating EPS estimates and 56.3% coming ahead of top-line expectations.

For the technology sector, we have Q2 results from 30% of the sector’s total market capitalization in the S&P 500 index. So far, total earnings are down 5% year over year on 2.6% lower revenues, with 84.6% beating EPS estimates and an equal proportion beating revenue expectations.

A few semiconductor companies are slated to report their earnings on Jul 25. Let’s have a quick look at four such companies - Amkor Technology, Inc. (NASDAQ:AMKR) , Texas Instruments Inc. (NASDAQ:TXN) , GigPeak, Inc. (NYSE:GIG) and Monolithic Power Systems, Inc. (NASDAQ:MPWR) .

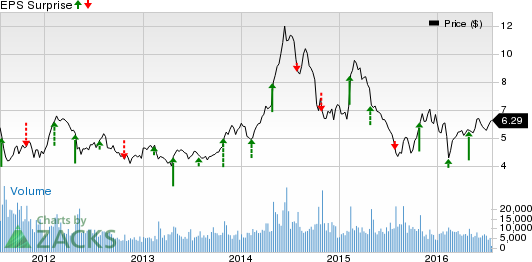

Amkor Technology is a leading provider of semiconductor packaging and test services.

For the quarter, this Zacks Rank #2 (Buy) stock has an Earnings ESP of 0.00% as both the Most Accurate estimate the Zacks Consensus Estimate are pegged at a loss of 8 cents.

Last quarter, the company posted a positive earnings surprise of 100%. Notably, the company has exceeded the consensus mark twice and matched it once in the preceding four quarters, resulting in a positive average surprise of 95%.

The company is expected to continue progressing in its key business areas due to increased demand across most end markets. The company’s key strength is China where it continues to pick up market share.

However, earthquakes in Japan have disrupted operations at Amkor’s Kumamoto factory and the results are likely to reflect its impact. (Read more: What's in Store for Amkor Technology in Q2 Earnings?)

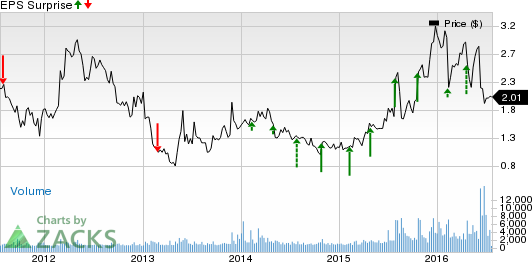

GigPeak provides semiconductor ICs and software solutions.

For the quarter, GigPeak has an Earnings ESP of 0.00% as both the Zacks Consensus Estimate and the Most Accurate estimate are poised at 2 cents and it carries a Zacks Rank #3 (Hold).

Last quarter, the company posted a positive earnings surprise of 50%. The company has exceeded the consensus mark thrice and matched once in the preceding four quarters, resulting in a positive average surprise of 62.50%.

Monolithic Power Systems provides integrated power semiconductor solutions for systems for industrial applications, telecom infrastructures, cloud-computing, automotive and consumer applications.

For the quarter, this Zacks Rank #3 stock has an Earnings ESP of 0.00%. The Zacks Consensus Estimate for the quarter is pegged at 32 cents.

Last quarter, the company posted a positive earnings surprise of 36.8%. In the preceding four quarters, Monolithic Power exceeded the consensus mark twice and missed it on two other occasions, resulting in a positive average surprise of 3.77%.

Texas Instruments is a global semiconductor company and one of the world's leading designers and suppliers of digital signal processors and analog integrated circuits.

For the quarter, the company has an Earnings ESP of 0.00% and it carries a Zacks Rank #4 (Sell). The Zacks Consensus Estimate for the quarter is pegged at 72 cents.

Last quarter, the company posted a positive earnings surprise of 4.84%. Texas Instruments has beaten earnings in three of the last four quarters with an average beat of 5.29%.

Texas Instruments continues to prudently invest its R&D dollars in several high-margin, high-growth areas of the analog and embedded processing markets. This is gradually increasing its exposure to the industrial and automotive markets as well as dollar content at customers, while reducing its exposure to the volatile consumer/computing markets.

The company’s compelling product line, the differentiation in its business and lower-cost 300mm capacity are expected to remain bright spots. However, lackluster demand for personal electronics, particularly PCs, and communications equipment, remains a concern.

AMKOR TECH INC (AMKR): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

MONOLITHIC PWR (MPWR): Free Stock Analysis Report

GIGPEAK INC (GIG): Free Stock Analysis Report

Original post

Zacks Investment Research