Equities around the globe continued to rally on central bank policy, namely the Fed's decision to to hold off on a rate hike. The rally was especially strong in Europe, where the DAX and CAC rose 2.3% and the FTSE 1.1%.

The S&P 500 was a bit less jubilant. It popped at the open and traded in a narrow range to its 0.78% intraday high and then traded sideways to its 0.65% closing gain.

The yield on the 10-year note closed at 1.63%, down three basis points from the previous session and 10 basis point off its interim high seven sessions earlier on September 13th.

Here is a snapshot of past five sessions in the S&P 500.

Here is daily chart of the SPDR S&P 500 (NYSE:SPY) ETF, which gives a better sense of investor participation. The ETF, like the underlying index, has jumped above its 50-day moving average. But investor participation in Thursday's rally continuation was a bit subdued.

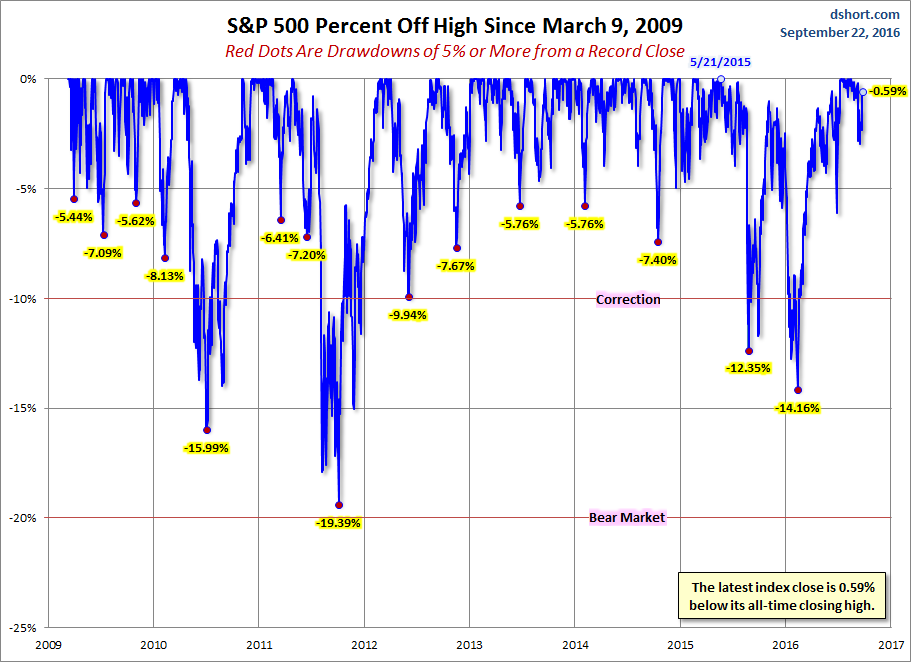

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

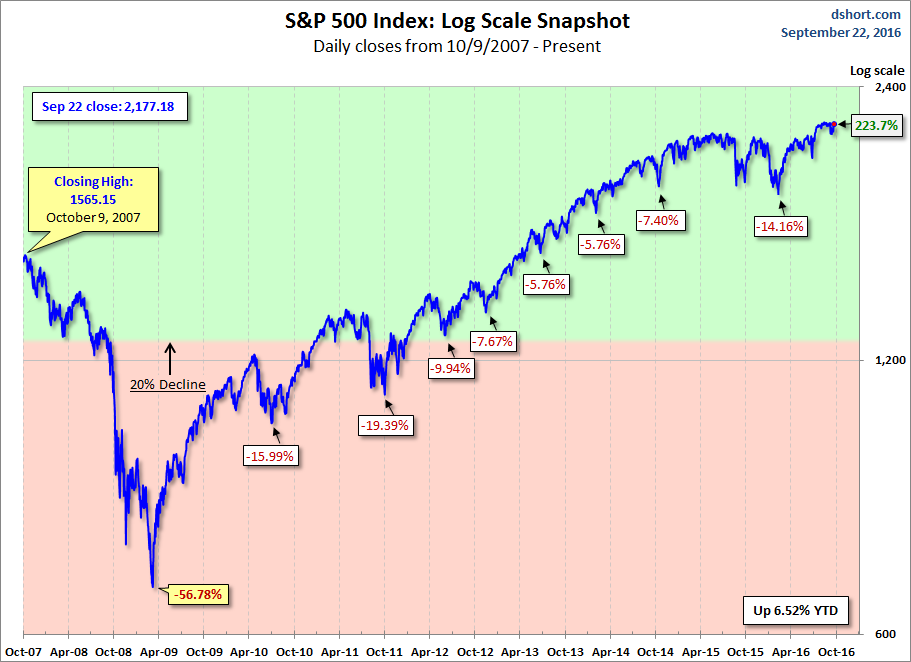

Here is a more conventional log-scale chart with drawdowns highlighted.

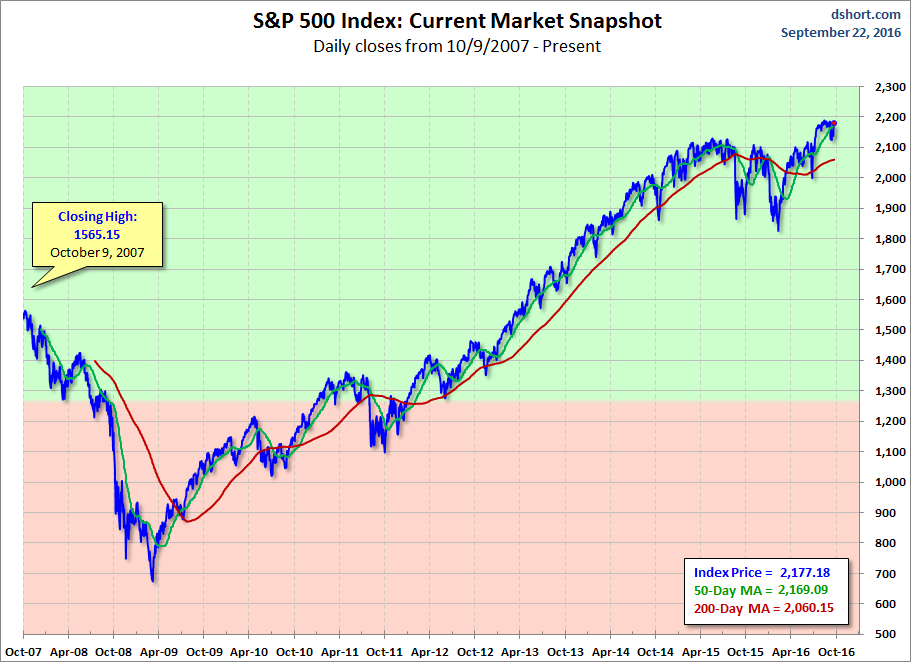

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

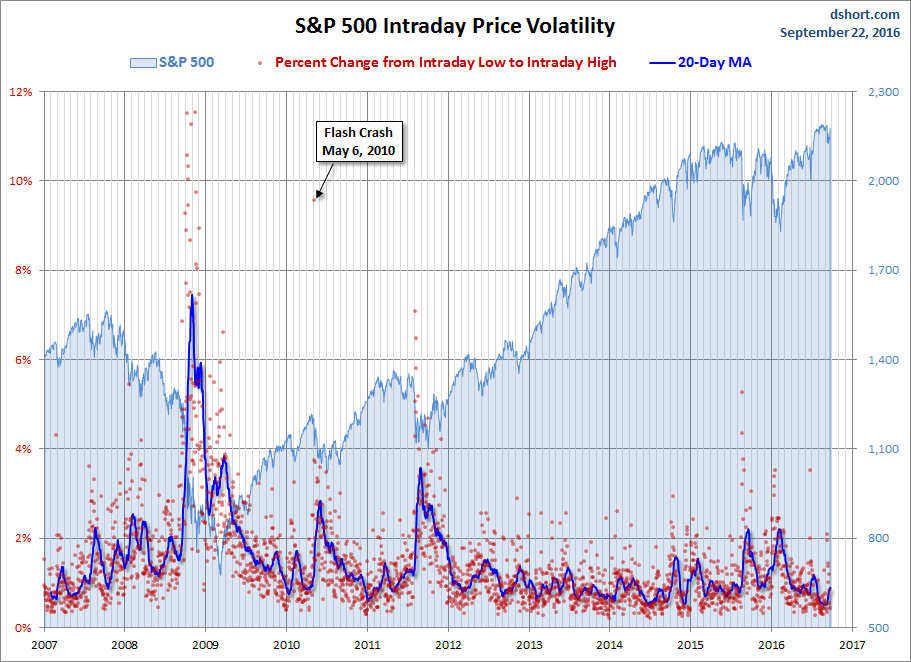

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.