With no economic news today, there was little to distract from International Business Machines (NYSE:IBM)'s pre-market announcement of disappointing Q3 earnings. The company (my employer in a special business unit from 1984 to 1997) plunged at the open. It trimmed its closing loss to -7.17%. The popular press reports that the Oracle of Omaha (aka Warren Buffett) lost about $1 Billion today, based on his latest SEC filings. In contrast, after today's close Apple Inc (NASDAQ:AAPL) announced strong earnings and upward sales guidance. It was up 2.14% today and is trading higher after the close.

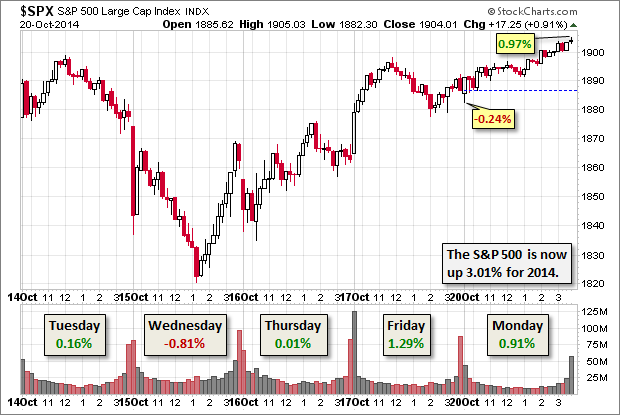

The S&P 500 was minimally impacted by the IBM fiasco. The index hit its -0.24% intraday low shortly after the open but quickly recovered and chugged higher through the day, closing with its third consecutive advance, up 0.91% and not far off its 0.97% intraday high.

The yield on the 10-Year Note closed at 2.20%, down 2 bps from Friday's close.

Here is a 15-minute chart of the past five sessions.

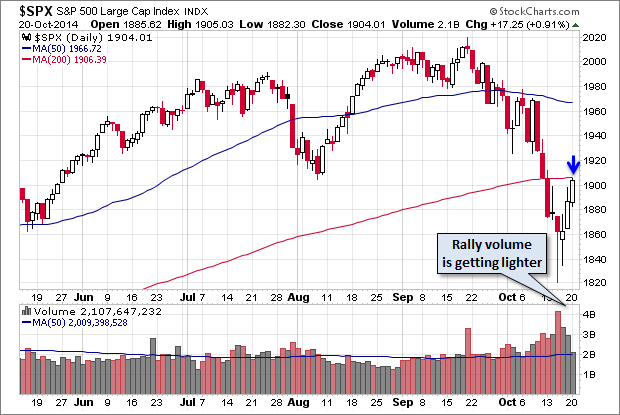

Here is a daily chart of the index. We can see that today's intraday high was virtually spot on the 200-day moving average, a level the technicians will be watching this week. Rally volume is sloping downward.

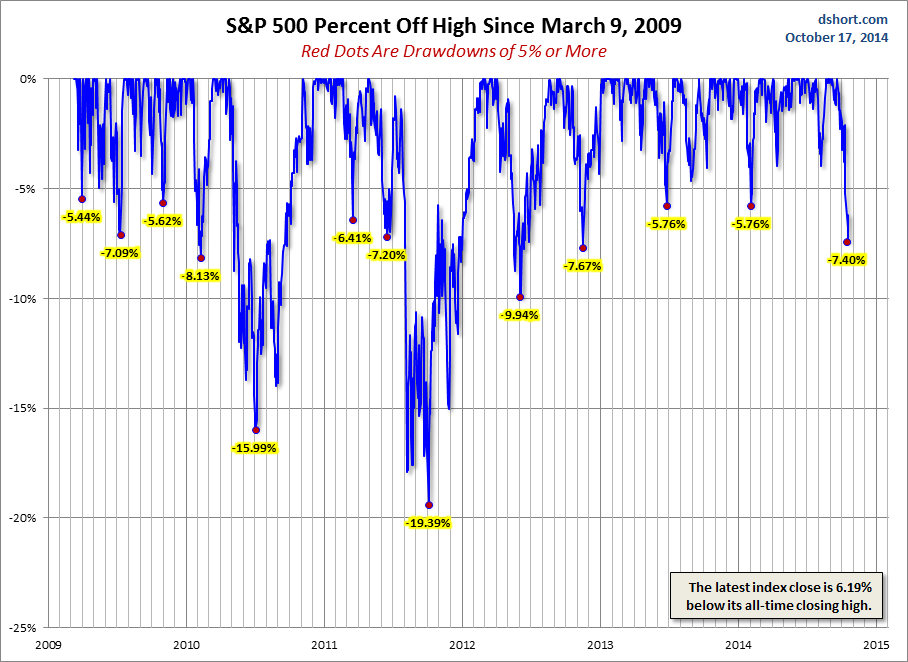

A Perspective on Drawdowns

How close were we to an "official" correction, generally defined as a 10% drawdown from a high (based on daily closes)? The chart below incorporates a percent-off-high calculation to illustrate the drawdowns greater than 5% since the trough in 2009.

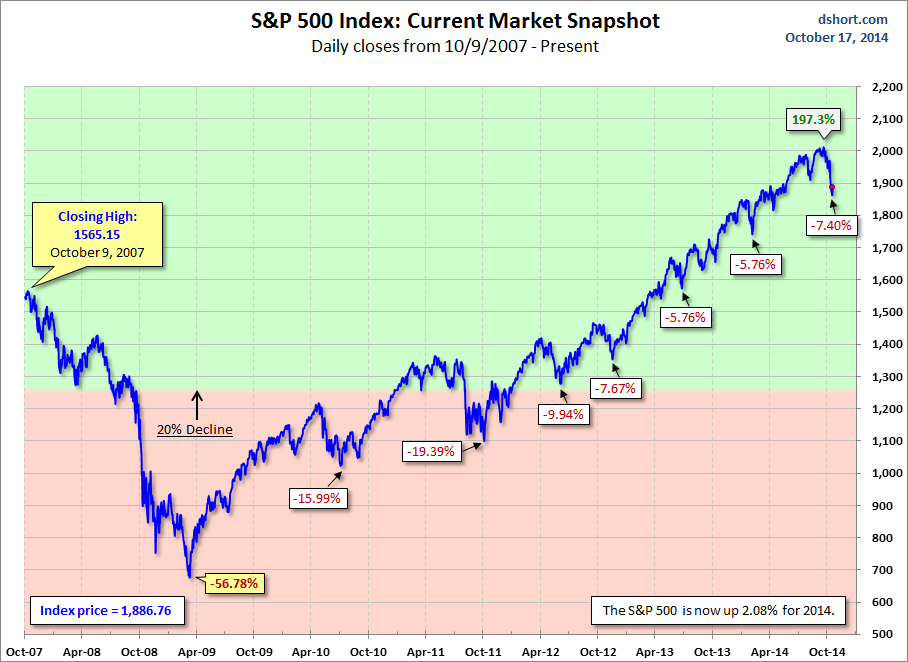

For a longer-term perspective, here is a pair of charts based on daily closes starting with the all-time high prior to the Great Recession.