The S&P 500 rally resumed today after yesterday's fractional loss. The index rose at the open, drifted higher through the day until the final hour, when it surged to its intraday high at the close, up 1.19%. This morning's pre-market durable goods report for September was disappointing, showing a 0.5% contraction despite the major decline in gasoline prices over the past few months. The market disregarded the disappointment, choosing instead to take its cue from the strong Consumer Confidence report released 30 minutes after the market opened. The index is now in positive territory for the traditionally volatile month of October.

The yield on the U.S. 10-Year Note closed at 2.30%, up 3 bps from yesterday's close.

Here is a 15-minute chart of the past five sessions.

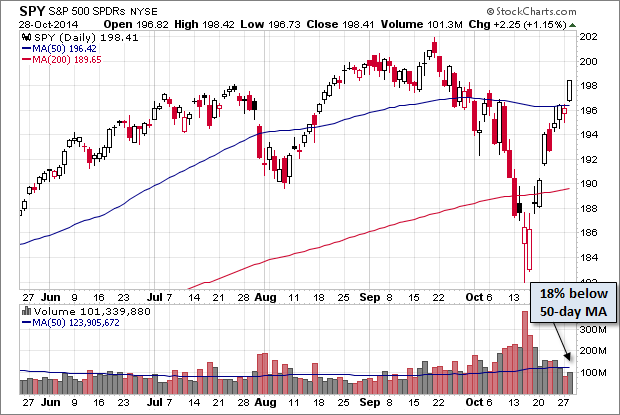

The chart below is a daily look at the SPY ETF, which gives a better sense of investor participation. Today's rally took place on light volume.

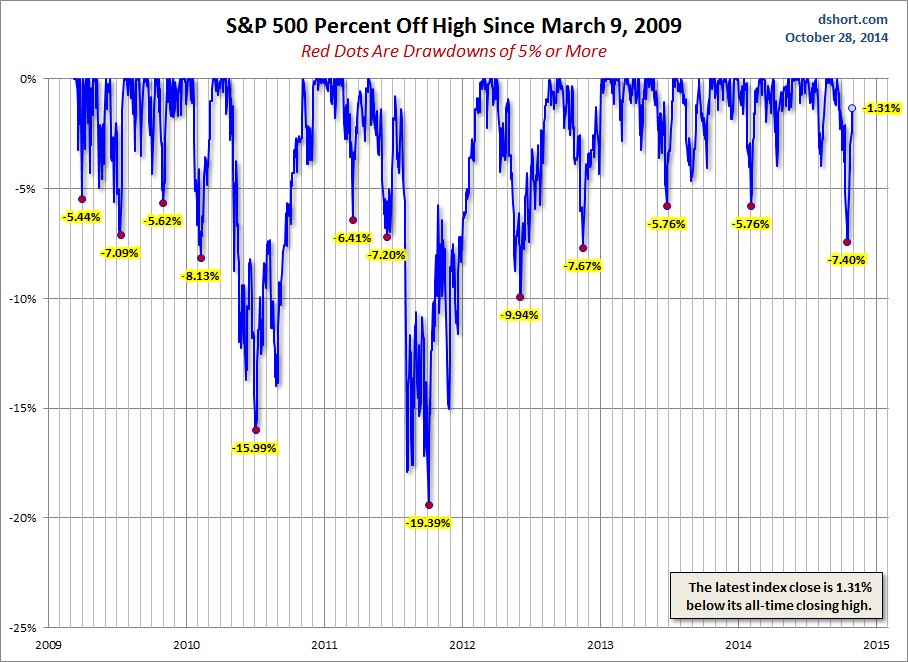

A Perspective on Drawdowns

How close were we to an "official" correction, generally defined as a 10% drawdown from a high (based on daily closes)? The chart below incorporates a percent-off-high calculation to illustrate the drawdowns greater than 5% since the trough in 2009.

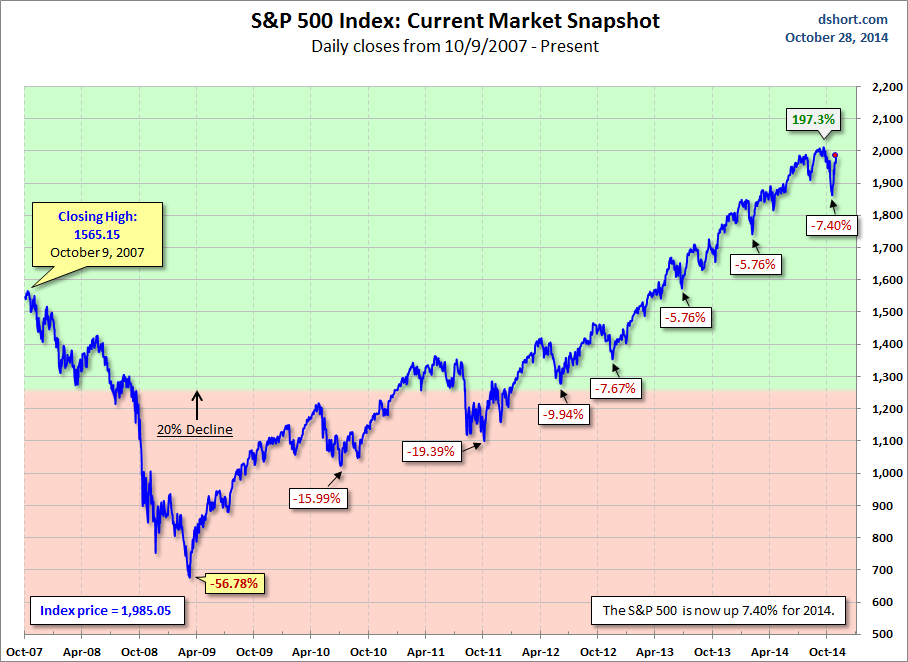

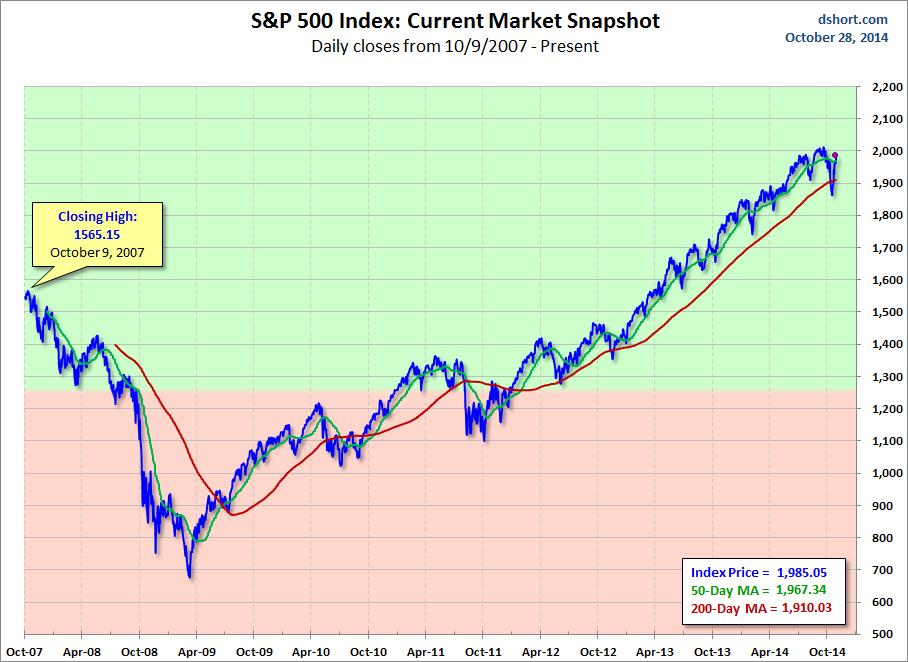

For a longer-term perspective, here is a pair of charts based on daily closes starting with the all-time high prior to the Great Recession.