Before the US market opened, Japan's Nikkei had posted a -5.40% plunge for the day. The Nikkei is in a bear market, down 22.9% from its interim high in late June of last year, and it has taken a dive of 8.2% since its central bank announced its negative interest on January 29th. And today its 10-year went negative. Interestingly enough, the popular financial press (aka CNBC) is reporting that the Fed has told US banks to include negative Treasury rates as a scenario in their stress tests.

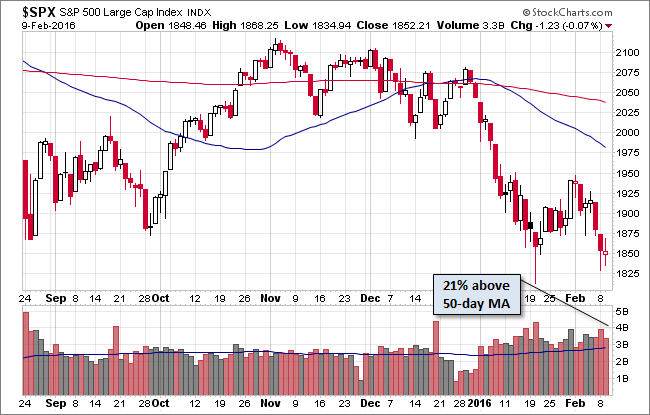

The S&P 500 plunged at the open, rallied into the green and then sold off in a couple of waves to its -1.00% intraday low shortly after the lunch hour. It then rallied to is 0.80% intraday high at the threshold of the final hour before selling off its a fractional -0.07% loss.

The yield on the 10-year note closed at 1.74%, down 11 basis points from the previous close and hovering at its lowest level since February 2nd of last year.

Here is a snapshot of past five sessions.

Here is a daily chart of the index. Volume remains elevated, although lower than on yesterday's volume surge of 42% above the 50-day moving average.

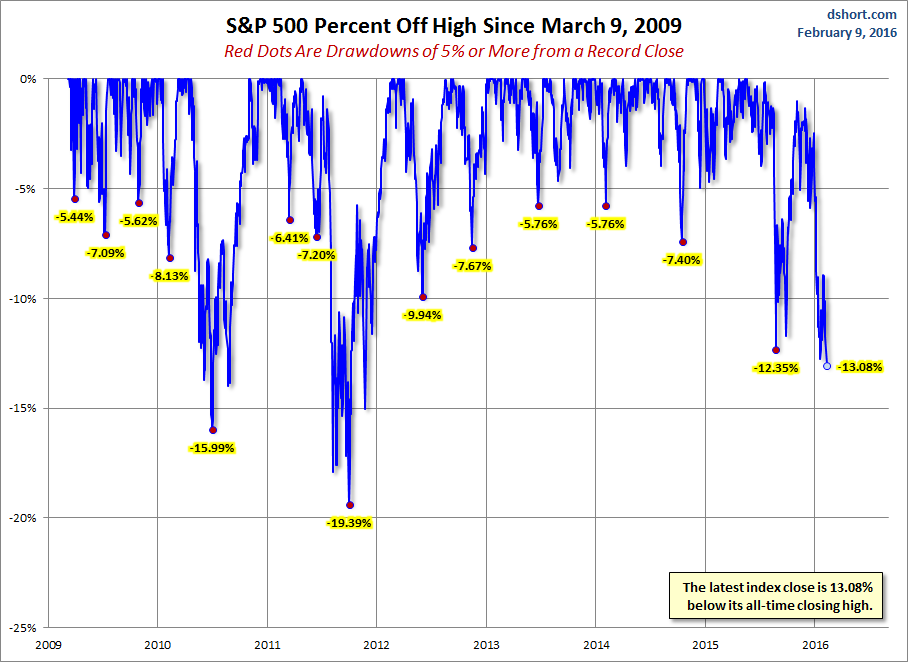

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

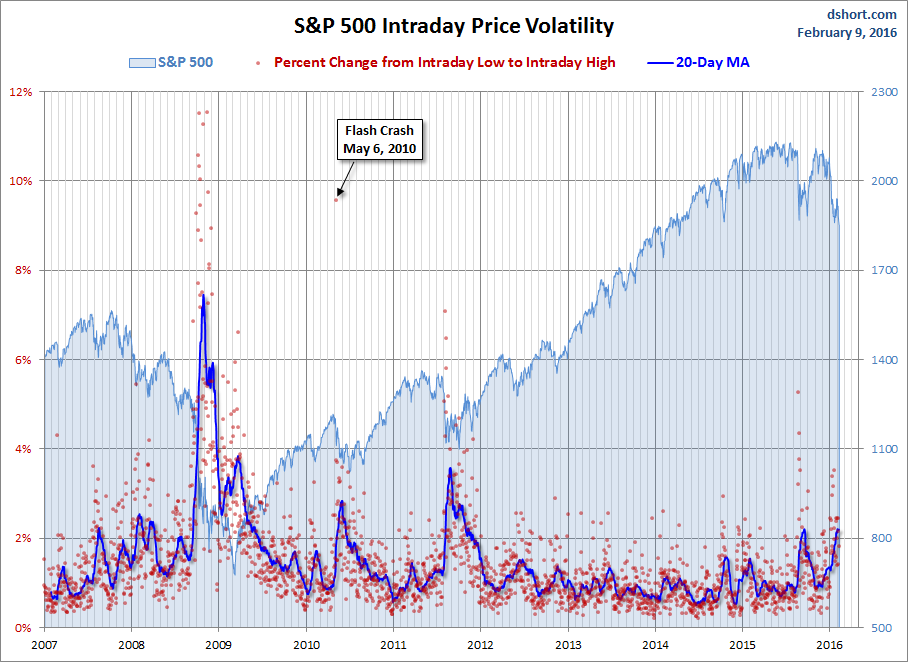

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.

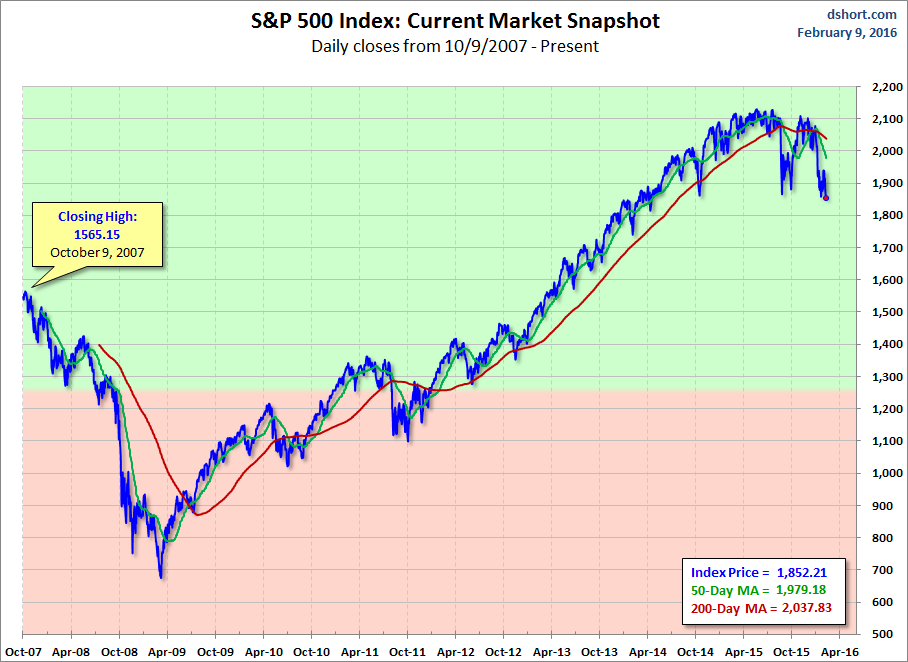

Here is the same chart with the 50- and 200-day moving averages.