Pre-Yellen Chop

No one wants to be long, and no one wants to be short, or so it seems. As Thursday’s trade came to a close the S&P 500 futures made a lower low from Wednesday’s sell off. As of the close the S&P futures have been down 8 out of the 13 sessions. While this may represent the beginning of a sea change I think it’s best that traders not only get a look at what the Fed chairwoman has to say but how the markets react. Is the crowed getting bearish? Yes. Will the S&P oblige them? Its starting to look that way. As I have said many times since the S&P rallied 10% off the 1981 low, a pull back was long overdue. Will the S&P pull back 3% or 5%? It’s possible but I doubt it.

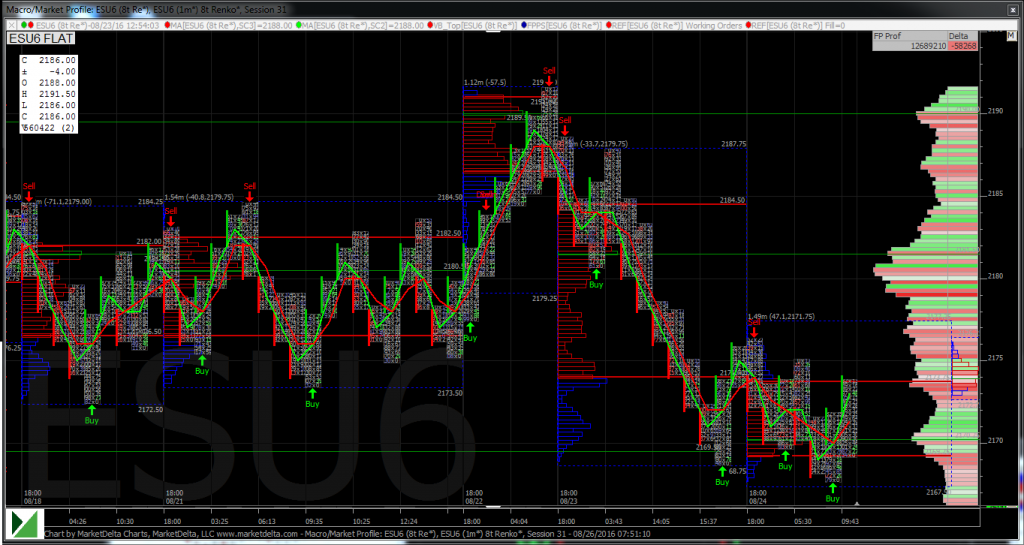

Yesterday’s trade was almost an identical snapshot of Wednesday’s trade. The S&P rallied earlier in the day, sold off, and then sold off again late in the day. The late sell off came when the MiM (MrTopStep Imbalance Meter) started showing over $200 million to sell. Ultimately the bears behaved as they have all summer. They are very reluctant to make a new low. When new lows are made, they’re afraid to push them. Going into the close the ESU6 rallied seven handles from the late day low. There is still the potential for a lower high and then a lower low. We see Wednesday’s selling as just pre Yellen noise.

S&P 500 Futures Risk Off

Overnight Asian and European markets were both sold off. The S&P 500 futures maintained a sideways range between 2172.75 and 2176.25 and traded just over 100k contracts. The most recent GDP number was a miss and didn’t move the markets. The last big speech by Yellen didn’t move the markets either. It’s clear that when Yellen speaks, risk is removed, especially with the equity indexes at all time highs. Sometimes the Fed makes the markets go up, and sometimes the Fed makes the markets go down. Let’s face it, this is the last weekend before Labor Day, and Yellen speaks at 9:00 am cst. If there is any movement it will come early in the day before traders pile out of offices into late summer getaways.

Institutional Comments on Today’s Jackson Hole Speech

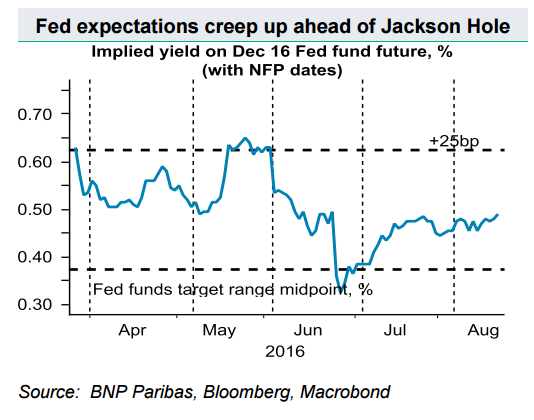

Deutsche Bank: While we do not expect Yellen to explicitly pre-commit to raising interest rates at the September 20-21 FOMC meeting, she will no doubt want to retain the optionality of hiking next month if economic and financial conditions permit. We anticipate that Yellen’s speech will outline the rationale for taking another step in the policy normalization process, but will also discuss the broader ramifications of a potentially lower equilibrium real rate.

Bank of America/Merrill Lynch: We do not expect her comments to have much of an impact on market pricing for the near-term Fed outlook and believe that the market will continue to assign very low odds to a September rate move. Although market participants will be on the lookout for clues about the timing of the next hike from the Fed, we think they will be difficult to find.

Barclays: We believe she may use the opportunity to signal the FOMC’s growing confidence in the outlook for activity and inflation. Given the low market expectations for a September or December Fed rate hike, a repricing at the front end of the rates curve in the event of a hawkish signal should drive a near-term rebound in the USD, accompanying a bear-flattening of the yield curve. We expect Yellen to deliver a stronger signal about the likelihood of a near-term rate hike and retain our view that the next increase will occur in September.

In Asia, 7 out of 11 markets closed lower (Nikkei -1.18%), and in Europe 8 out of 12 markets are trading lower this morning (DAX -0.27%). Today’s economic calendar includes 2-Yr FRN Note Settlement, Monetary policy symposium, GDP, International Trade in Goods, Corporate Profits, PMI Services Flash, Consumer Sentiment, Janet Yellen Speaks, and the Baker-Hughes Rig Count.

Yellen on Tap

Our View: There are some big numbers out this morning. When it’s all said and done, it won’t be the numbers that move the markets, it will be what Janet Yellen has to say. There has been a lot of fed / interest rate hike talk over the last several days, and today, the news algos will be on watch for anything Yellen has to say. After that it should be algo hell. Our view is to sell the early rallies and buy weakness. Remember, I am a day trader, I take what I can get and start over again the next day.