In this article I will provide my view on the EUR/GBP, NZD/USD and the AUD/USD. These are the pairs that I am currently interested in or was interested in last week for trading with the Hybrid Grid strategy. I will pick one to analyse in more detail from the pairs that have not been discussed yet recently.

- All trades are based on specific rules according to the FxTaTrader Hybrid Grid strategy.

This articles will provide:

- The weekly currency chart for the analyzed pair.

- The daily(timing) chart for the analyzed pair.

- Possible positions for the coming week and positions taken.

According to the TA Charts, the "Currency score" and the "Ranking & Rating list", the best pairs to trade are the USD/JPY, GBP/JPY, EUR/USD, AUD/USD, CAD/JPY, GBP/AUD, EUR/GBP and the EUR/CAD. See also my previous article of this weekend about the "Currency score".

There are some rules for taking positions according to the FxTaTrader Hybrid Grid Strategy. The strategy can open multiple positions of a currency pair but each currency may only be present once in the pairs chosen for trading. It means that not all the possible positions of this coming week can be opened. For more information see FxTaTrader Hybrid Grid Strategy. Another rule is that a pair outside the Bollinger Band® in the Weekly chart is considered overbought/oversold. No positions are taken for these pairs which are in this case the JPY pairs. The preference for this coming week goes to the AUD/USD with the EUR/GBP.

Last week (pending) orders were placed for the EUR/GBP and the NZD/USD with profit 2x EUR/GBP and 2x NZD/USD.

Open/pending positions of last week

EUR/GBP

This pair will be analyzed briefly, for more information read the article Review FxTaTrader Strategy Wk 39/40. Profit was made last week on 2 positions.

The pair looked interesting in the last few weeks for going short. The situation is more or less similar to last week and the chances are high that the downtrend will resume shortly after the current consolidation period. The monthly and weekly chart are still showing strength for going short.

- In the daily chart the Ichimoku meets all the conditions.

- The MACD is in negative territory but consolidating in the last few days according to the histogram.

- The Parabolic SAR is going short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 46

Rank: 8

Rating: - -

Total outlook: Down

NZD/USD

This pair will also be analyzed briefly, for more information read the article Review FxTaTrader Strategy Wk 42&43. Profit was made last week on 2 positions.

The pair looks interesting in the last few weeks for going short. Price made a new temporary low last week but recovered fast making a Long-Legged Doji in the Weekly chart. Although it seems this pair can go lower it may not be in this coming week when also taking into account that the Currency score difference is now just 3 and the NZD itself is having a Currency score of 5 being in the middle of the Currency score range. See my previous article of this weekend Forex Weekly Currency Score Wk 46. The situation is more or less similar to last week and the chances are high that the downtrend will resume shortly after the current consolidation period. The monthly and weekly chart are still showing strength for going short.

- In the daily chart the Ichimoku is meeting all the conditions.

- The MACD is in negative territory but slowing down slightly.

- The Parabolic SAR going short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 46

Rank: 11

Rating: -

Total outlook: Down

Possible positions for coming week

AUD/USD

This pair will be analyzed in more detail. The situation compared to the last weeks has improved and the pair is interesting for the Hybrid Grid strategy. At the moment the pair is no more oversold in the Weekly chart. Price made also a new temporary low and it seems the downtrend can resume at any moment.

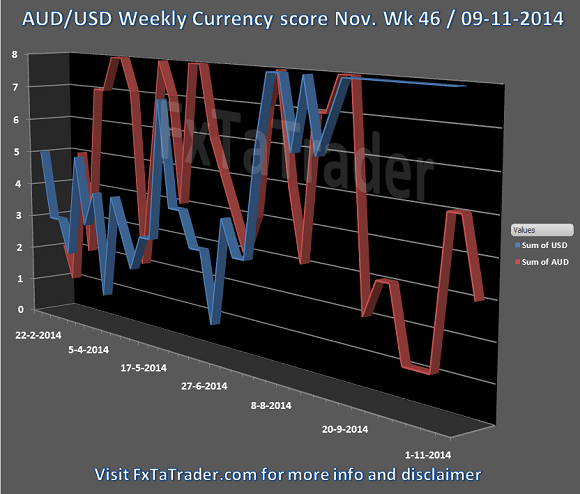

- As can be seen in the Currency Score chart in my previous article of today Forex Weekly Currency Score Wk 46, the AUD is having a score of 3 and the USD a score of 8. With a Currency score difference of 5 it is an interesting pair for going short.

- The rank in the Ranking and Rating list in the last weeks also shows that the pair is attractive for taking short positions. In the recent list of this weekend Forex Ranking & Rating Wk 46 the pair has a rank of 4. This list is used as additional information besides the Currency score and the Technical analysis charts.

- Besides the general information mentioned the outlook in the TA charts also makes it an attractive opportunity.

Ranking and rating list Week 46

Rank: 4

Rating: + +

Weekly Currency score: Down

Based on the currency score the pair looked interesting in the last 3 months. The USD did not show any dips in that period and did almost all the time have the highest score. The AUD changed from being one of the stronger currencies to an average performing currency. It seems it is starting to weaken even further and may become one of the weaker currencies for the coming period. After the recent pull back and topping at a score of 5 it found the way down again. Based solely on this information the pair looks interesting for going short.

Monthly chart: Down

- On the monthly(context) chart the indicators are looking reasonable for going short.

- The Ichimoku is meeting almost all the conditions. The Chikou-Span is still above the cloud and price is within the cloud.

- The MACD is in negative area and getting stronger according to the histogram.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

- Since the monthly chart is used to get the context where that pair is in for the long term the indicators are looking fine because they are showing reasonable strength in the current downtrend.

Weekly chart: Down

- On the weekly(decision) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and still strong.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

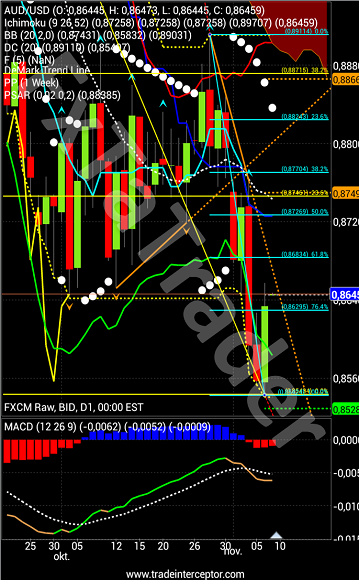

Dayly chart: Down

- On the daily(timing) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area trying to pick up the downtrend again.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Total outlook: Down

Although the explanation may seem simple and clear there is always risk involved. I added a disclaimer to my blog for this purpose.

Disclaimer: The article is my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you