Key Points:

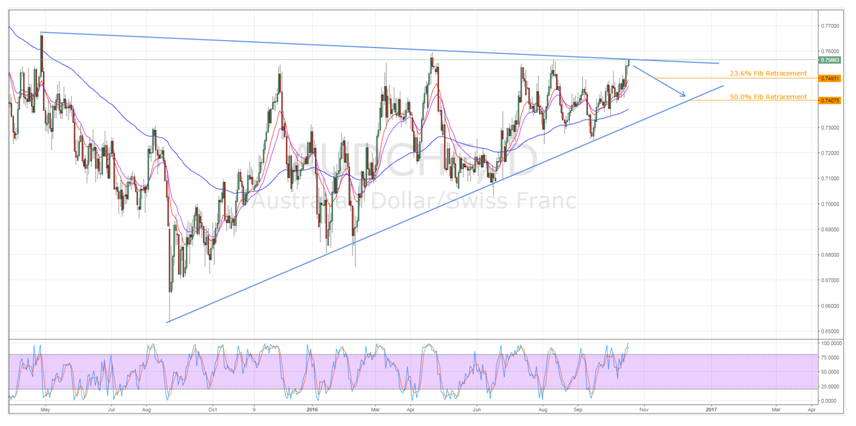

- Pennant exerting downward pressure on the pair.

- Stochastics in overbought territory.

- ADX no longer signalling a strong uptrend.

If you are looking for something a little bit different to follow this week, the AUD/CHF could be worth taking a look at. Specifically, the pair is setting up for what could be a rather sharp technical reversal and subsequent decline in the coming weeks. Whilst this may at first seem counterintuitive given the highly bullish EMA bias, a closer look at the pair’s technical indicators tells a different story.

Firstly, and probably most importantly, the AUD/CHF’s recent price action has seen it challenge the upside constraint of a long-term consolidation structure. As a result of this, the pair is expected to retreat as the pennant begins to exert downward pressure.

However, as mentioned above, there is some understandable uncertainty over the likelihood of a downturn given the rather voracious bullish bias of the daily EMA readings. Fortunately, there are also a number of countervailing technical factors which should offset any bullish sentiment generated by the moving averages.

Specifically, the heavily overbought reading present on the stochastic oscillator will be giving the bulls pause for thought. In addition to this, any traders still hopeful for an upside breakout should take note of the RSI oscillator, which continues to trend higher towards overbought territory.

If this wasn’t enough of an argument against ongoing bullishness, the ADX readings are also beginning to slip below the key 25 mark which is indicative of slowing trend momentum. All in all, the technical bias for the AUD/CHF seems to be turning bearish in the near-term which would be in line with our expectations given the presence of the long-term pennant.

On the fundamental front, there is little in the way of influential Australian or Swiss news to help the pair break free of its consolidating phase. In fact, it is not until Thursday that anything of note will be released which leaves the pair fairly open to technical influences. What’s more, Thursday’s Australian Employment data is forecasted to worsen which will exacerbate any declines that take hold in the early stages of the week.

Looking at the downside potential of the tumble, it is expected that the AUD/CHF could travel as low as the 0.7407 mark before running into serious support. This is predominantly due to the fact that this price is the intersection of the 50.0% Fibonacci retracement and the downside constraint of the pennant structure. However, there issome support present around the 0.7493 mark which has not only historically proven itself to be a turning point but is also the 23.6% Fibonacci retracement.

Ultimately, there is a fairly replete body of evidence suggestive of a reversal and spate of near-term bearishness for this pair. Specifically, the combined influence of the pennant, overbought stochastics, and faltering ADX reading should provide the necessary pressure to fuel a retreat back to the 0.7407 mark. However, it will be worth keeping an eye on Thursday’s employment data as it could inspire an early correction back to the upside or even encourage a breakout to the downside.