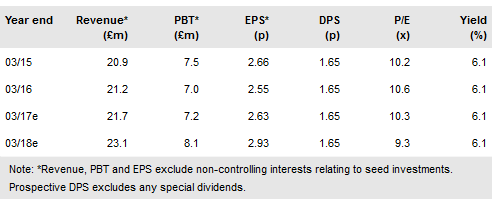

Record's (LON:RECL) Q217 trading update was encouraging as it showed an increase in assets under management equivalents (AUME), a maintained client count and an indication that investors are taking an interest in a range of the company’s products following a period of heightened currency volatility. In this context, the prospective rating with an FY17e P/E of just over 10x and the yield of 6.2% (ex any special payment) seems very conservative.

Q217 update

At end September Record’s AUME stood at $55.8bn, an increase of 5.2% compared with end June or +8.3% in sterling terms, reflecting weakness in the pound. Net fund flows and market movements were roughly equal contributors to the increase with exchange rate movements a minor negative. Other features of the update were positive performance figures for most of the currency for return strategies and management’s indication that investors have become more sensitive to the risks and opportunities of currency volatility.

To read the entire report Please click on the pdf File Below