German Bund yields holding on to last week’s gains confirm the market’s recessionary mood. We identify potential drivers for 10-year yields crossing below 1%. US data should add to the economic gloom

Bund resilience is more evidence of the market’s recessionary mood

This week is still in its infancy, and summer trading conditions can throw conflicting signals to market participants. That being said, price action so far has reinforced our view that the themes we identified for euro rates are the correct ones. Perhaps the most notable takeaway is that euro government bonds have held on to Friday’s outsized gains without much of a partial retracement, which is a rare occurrence.

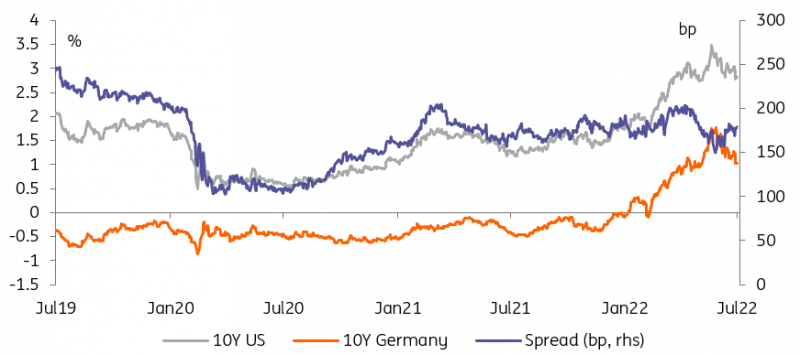

Bund yields dropping faster than Treasuries highlights European gloom

Source: Refinitiv, ING

The looming recession will stop the ECB in its tightening tracks

Let us start with the German Bund’s Homeric resilience in the face of hawkish European Central Bank soundbites. Public comments by the likes of Robert Holzmann and Martins Kazaks, about the next hike iterations being potentially 50bp or more, could perhaps be dismissed by markets as fringe hawkish views. Ignacio Visco, a more dovish member, also keeping the possibility of 50bp on the table should in theory have elicited more of a sell-off in front-end rates, however, alongside his implicit downgrade of gradualism. We can only explain this by the market’s sudden realisation that the looming recession will stop the ECB in its tightening tracks.

1% in sight, with help from Russia and the US

In longer tenors, the Bund’s failure to follow Treasury yields lower is also ominous for proponents of higher euro market rates. In a week when the most significant bear case for bonds is a more hawkish FOMC, the divergence between Bunds and Treasuries is a notable development. Our view is that central banks will increasingly struggle to push long-end rates higher no matter how hawkish they get. This is particularly true of the ECB due to the more immediate eurozone recession risk (which could be as soon as this winter), and its uncontrolled nature (due to worries over gas supplies rather than monetary tightening).

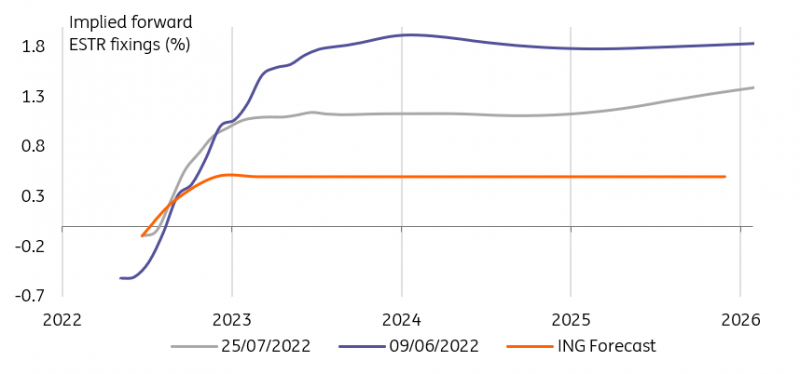

Further pricing out of ECB hikes would bring more Bund yield downside

Source: Refinitiv, ING

In that light, we started the week thinking that only good news on either Russian gas flows or Chinese Covid cases could reasonably keep 10-year Bunds away from testing the 1% level to the downside. It turns out, the latest reports suggest the resumption of Russian gas flows last week was only an ephemeral piece of good news, with Nord Stream 1 flows to be significantly curtailed to only 20% of capacity (down from 40%) as soon as tomorrow. The nature of this risk is such that it is much easier for markets to extrapolate bad news and dismiss good news.

The resumption of Russian gas flows last week was only an ephemeral piece of good news

Incidentally, 1% is also the level we identified as a medium-term 10-year Bund forecast. The fact that Bund yields have reached this level while pricing out hikes, but not as much as we forecast, tells us that there is more downside to Bund yields despite all the bad economic news they have already priced since last week. It is only a matter of time before the market realises how limited the ECB’s room to hike is, with the penny likely to drop in and around the September meeting, in our view.

Market view

US data is the main item on the economic menu and none of the releases makes for an appetising reading. Housing numbers (house prices and new home sales) should confirm that the housing sector is most immediately hit by the Fed’s tightening cycle, and our economics team stresses that they will put downward pressure on inflation’s housing component next year. Sentiment indicators, in the form of consumer confidence and the Dallas Fed manufacturing index, are also expected to dip from already Tartarian depths.

Italy will sell 2-year and inflation-linked debt in challenging market conditions.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more