When government officials surveyed the failing American financial system this week, they didn't see only a collapsed investment bank or the surrender of a giant insurance firm. They saw the circulatory system of the U.S. economy—credit markets—starting to fail.

A similar crisis had happened before and bankers understood that if the circulatory system, i.e. credit markets, [continued] to fail, a deflationary collapse in demand even more severe than the Great Depression would happen. In 2008, aggregate levels of debt were far higher than in the 1930s and the consequences would be also.

If the 2000 collapse of the US dot.com bubble was an economic heart attack, the 2008 economic collapse was a stroke, a stroke so severe that the usual central bank response, to lower interest rates, did nothing to revive economic growth.

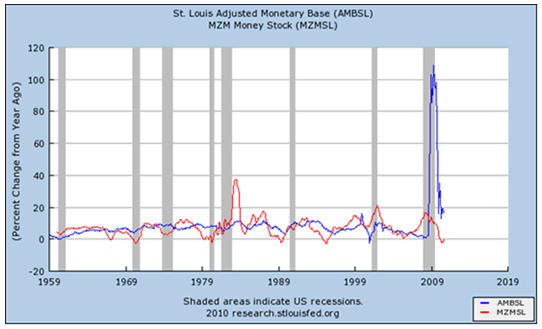

Fed Chairman Ben Bernanke utilized Milton Friedman’s ivory tower solution to fix the real world problem that Greenspan’s Fed had created. At the University of Chicago, Friedman had theorized that during a severe deflationary contraction, central banks should expand the money supply to reverse the contraction.

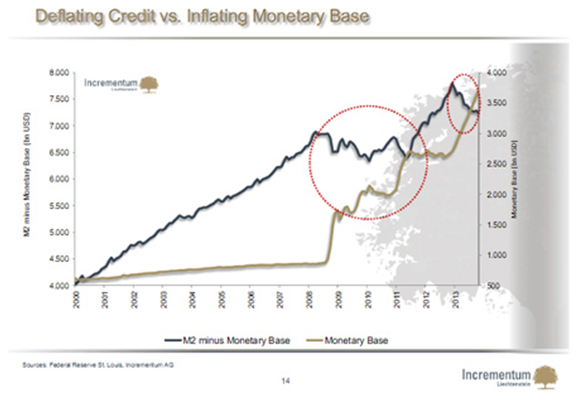

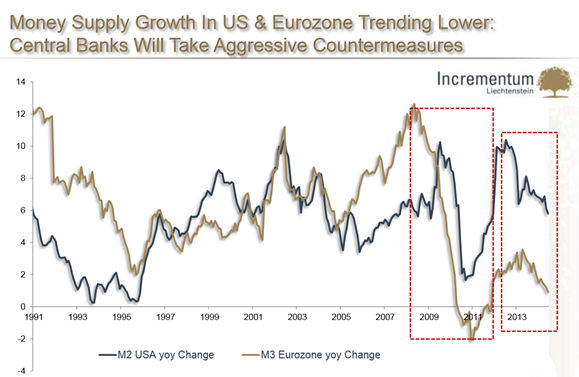

Friedman’s solution, however, didn’t work. Powerful deflationary forces awakened by the collapse of Greenspan’s two speculative bubbles, the dot.com and US real estate bubbles, negated Bernanke’s attempts to expand the money supply.

In capitalist economies, bankers substitute credit and debt for money; and when large speculative bubbles collapse, credit disappears leaving only the constantly compounding shadow of its former self, debt, in its place.

Central bankers are then forced to inflate the monetary base to keep the now slowing circulatory system of the economy—credit markets—from collapsing.

WHEN ALL ELSE FAILS: QUANTITATIVE EASING

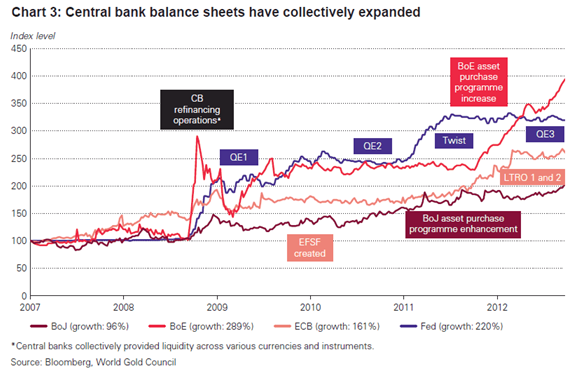

Quantitative easing (QE) is an unconventional monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.

Lowering interest rates to increase the circulation of credit and debt is the response of central banks to slowing demand; but, in 2009, despite Bernanke’s almost zero percent rates, demand continued to slow forcing Bernanke to implement a highly unorthodox strategy to keep credit and debt circulating.

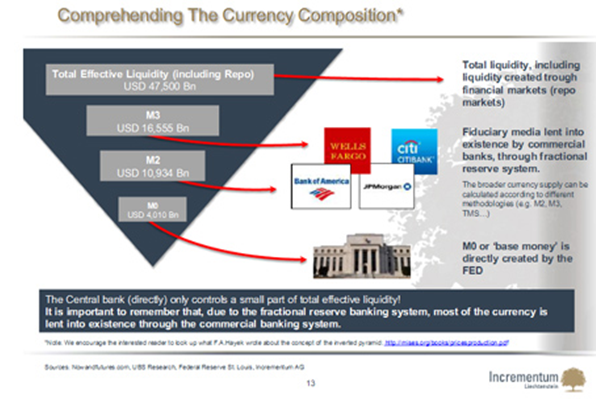

Quantitative easing, QE, is another form of money printing; and while lowering central bank interest rates costs central bankers nothing, quantitative easing is costly. Monetary aggregates, M2 and M3, are lent into existence by commercial banks through fractional reserve system; but M0 is money directly created by the FED by borrowing.

http://www.scribd.com/doc/197397458/Monetary-Tectonics-Inflation-vs-Deflation-Chartbook-by-Incrementum-Liechtenstein

The absence of monetary leverage differentiates expanding the money supply through QE instead of lowering interest rates. Lowering interest rates to increase M2 and M3 costs bankers nothing; it indebts those that borrow. Quantitative easing, however, created by Fed borrowing, M0, indebts central bankers themselves.

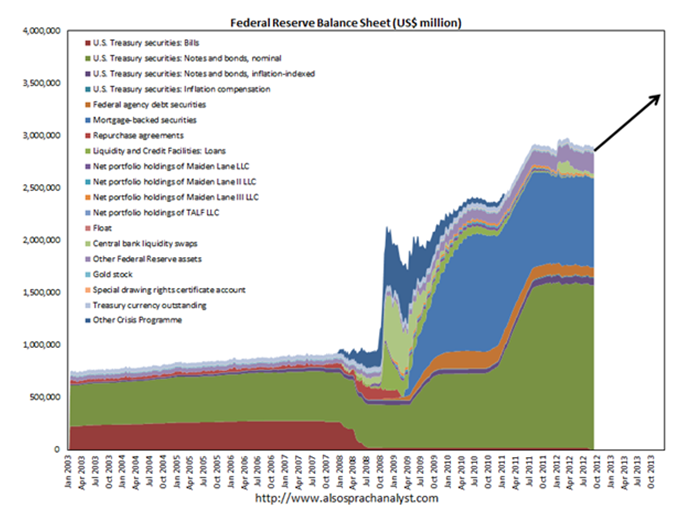

In 2009, the Fed’s balance sheet began filling with US Treasury and toxic mortgage debt, e.g. Maiden Lane LLC, offloaded onto the Fed from AIG which had the requisite greed and stupidity to insure subprime mortgages; and rather than let AIG fail, the Fed then rescued AIG by buying its debt and the US Treasury bought its shares.

THE TREATMENT IS KILLING THE PATIENT

…iatrogenic deaths—i.e. deaths induced inadvertently by a physician or surgeon or by medical treatment or diagnostic procedures— in the US annually is 783,936. By comparison, approximately 699,697 Americans died of heart [disease] in 2001, while 553,251 died of cancer… the American medical system is itself the leading cause of death and injury in the US.

Gary Null, Death by Medicine, www.webdc.com

On January 29, 2014, in Is A Currency Crisis Knocking At The Door? Todd Harrison observes that quantitative easing increases the possibility of a seismic currency ‘readjustment’:

As governments take on more risk -- as they price assets on behalf of the market and transfer debt from private to public -- the common denominator, or release valve, becomes the currency...and if we inject drugs that mask the symptoms rather than medicine to cure the underlying disease, the likelihood of a seismic readjustment increases in kind.

This happened in the 1920s when the Reichsbank, the German central bank, resorted to currency ‘fixes’ to ‘solve’ underlying systemic stresses in the German economy:

…experimenting with the currency was like walking a knife-edge. A moderate degree of inflation does not remain moderate for long. At some point the public loses confidence in the authority’s power to maintain the value of money, and deserts the currency in panic.

p. 126, The Bankers Who Broke The World, Liaquat Ahamed, 2009

In my 2009 article, Why Gold And Why Gold Now, I wrote that in combination with a deflationary depression, a monetary crisis of epic proportions will happen in the US and that gold is the chosen refuge:

Economic cycles of expansion and contraction are the inevitable result of central credit flows. So, too, are deflationary depressions and hyperinflations. Though far less frequent, the destruction caused by deflationary depressions and hyperinflations more than make up for their infrequency; and, today, after perhaps the longest absence of each in recent history, we are now about to experience both—perhaps this time in tandem.

This will not be just a deflationary depression, it will be deflationary depression accompanied by a monetary crisis of epic proportions.

In my new youtube video, Deconstructing Money and Reality, I address the issues that are now playing a part in the revolutionary changes moving through our world.

The economic crisis is only part of a much larger and far more significant paradigm shift. Gender, cosmic polarities, institutions, cultures and consciousness will all be affected. These are dark times but it is also true that it is darkest before the dawn.

When government officials surveyed the failing American financial system this week, they didn't see only a collapsed investment bank or the surrender of a giant insurance firm. They saw the circulatory system of the U.S. economy—credit markets—starting to fail.

A similar crisis had happened before and bankers understood that if the circulatory system, i.e. credit markets, [continued] to fail, a deflationary collapse in demand even more severe than the Great Depression would happen. In 2008, aggregate levels of debt were far higher than in the 1930s and the consequences would be also.

If the 2000 collapse of the US dot.com bubble was an economic heart attack, the 2008 economic collapse was a stroke, a stroke so severe that the usual central bank response, to lower interest rates, did nothing to revive economic growth.

Fed Chairman Ben Bernanke utilized Milton Friedman’s ivory tower solution to fix the real world problem that Greenspan’s Fed had created. At the University of Chicago, Friedman had theorized that during a severe deflationary contraction, central banks should expand the money supply to reverse the contraction.

Friedman’s solution, however, didn’t work. Powerful deflationary forces awakened by the collapse of Greenspan’s two speculative bubbles, the dot.com and US real estate bubbles, negated Bernanke’s attempts to expand the money supply.