With the recent volatility in gold and silver prices, it would be nice to get an idea of what kind of sentiment is being generated. Measures of sentiment tell us if there is too much optimism or pessimism in a particular market. There are a number of sentiment trackers for stocks, but very few are readily available for precious metals. One that we track is the premium or discount on shares of Central Fund of Canada (CEF).

Central Fund of Canada (CEF) is a closed-end mutual fund that owns gold and silver exclusively -- the metals, not stocks -- at a ratio of about 48 oz. of silver to 1 oz. of gold. Closed-end funds trade based upon the bid and ask, without regard to their net asset value (NAV). Because of this, they can trade at a price that is at a premium or discount to their NAV. By tracking the premium or discount we can get an idea of bullish or bearish sentiment regarding precious metals.

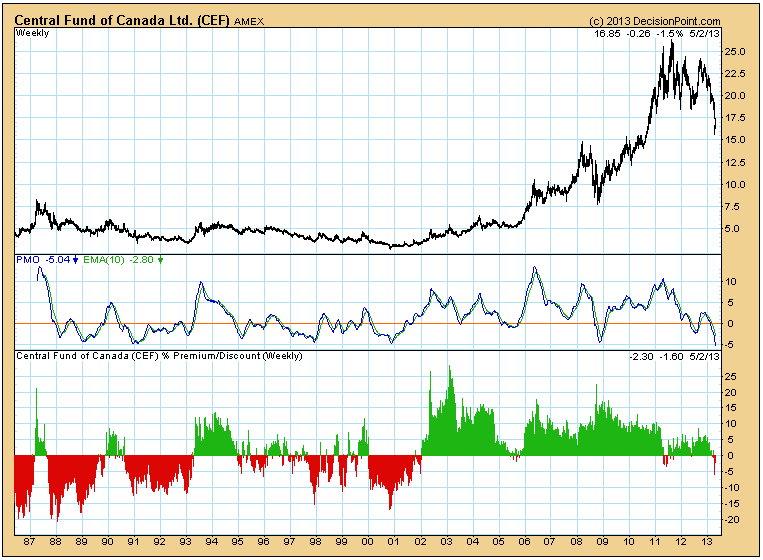

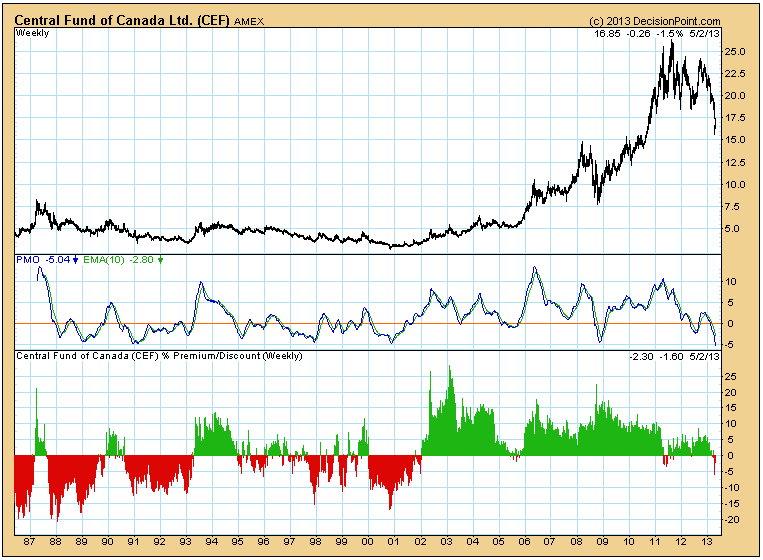

The following chart shows CEF history going back to 1986, and the bottom panel shows the amount of premium (green) or discount (red) at which CEF shares were selling. It is amazing to see that there have been discounts of lower than -20% and premiums approaching +30%. I suspect that a good deal of this extreme behavior can be accounted for by the fact that some of the buyers and sellers simply did not know how closed-end funds work.

It is interesting to note that in the last two years, sentiment swings have held a much more reasonable range. The extended topping action probably had something to do with that. More to the point is that recent bearish sentiment has been fairly low, considering the sharp decline in precious metals prices. This does not tell us if prices are going to continue lower, but it does show us that bearishness has not reached the kind of extremes that would prompt us to start looking for a price bottom.

by Carl Swenlin

Central Fund of Canada (CEF) is a closed-end mutual fund that owns gold and silver exclusively -- the metals, not stocks -- at a ratio of about 48 oz. of silver to 1 oz. of gold. Closed-end funds trade based upon the bid and ask, without regard to their net asset value (NAV). Because of this, they can trade at a price that is at a premium or discount to their NAV. By tracking the premium or discount we can get an idea of bullish or bearish sentiment regarding precious metals.

The following chart shows CEF history going back to 1986, and the bottom panel shows the amount of premium (green) or discount (red) at which CEF shares were selling. It is amazing to see that there have been discounts of lower than -20% and premiums approaching +30%. I suspect that a good deal of this extreme behavior can be accounted for by the fact that some of the buyers and sellers simply did not know how closed-end funds work.

It is interesting to note that in the last two years, sentiment swings have held a much more reasonable range. The extended topping action probably had something to do with that. More to the point is that recent bearish sentiment has been fairly low, considering the sharp decline in precious metals prices. This does not tell us if prices are going to continue lower, but it does show us that bearishness has not reached the kind of extremes that would prompt us to start looking for a price bottom.

by Carl Swenlin