Gold and related assets continue to stun most analysts and investors as they surge relentlessly higher against American fiat currency.

This is the spectacular daily gold chart.

While gold has risen dramatically, the powerful inverse head and shoulders bottom pattern now in play suggests that the upside fun may soon accelerate.

This is the weekly bars USD/JPY chart.

In my professional opinion, the head and shoulders top pattern on this dollar-yen chart was created by bank and forex money manager concerns about a new upcycle for inflation that is beginning to appear as the US business cycle peaks.

If inflation becomes a problem, the Fed will have no choice but to hike rates, creating a surge out of global stock markets that will dwarf the flows that happened after the December rate hike.

The huge liquidity flows into the world’s key risk-off assets of gold and the yen that I predicted would follow the Fed’s first rate hike have already stunned almost everyone, including top analysts at Goldman Sachs.

Goldman was clearly shocked by the latest BOJ (Bank of Japan) announcement. Their analysts are now openly asking the BOJ not to intervene in the forex market to buy the dollar.

It appears Goldman is very concerned that if the BOJ prints yen and buys the dollar, the BOJ could be overwhelmed by market forces betting against them, and the yen would blast higher anyways. That would create a powerful new leg higher for gold, silver, and precious metal stocks!

Gold has been rising against the dollar since the Fed’s rate hike in December. I think the upside action can continue, but it’s going to start becoming more “interesting”; substantial volatility is poised to become a major theme in the short term.

The bottom line is that a one hundred dollar sell-off in gold is likely soon, but so is a near-immediate recovery to another intermediate trend high from there.

For investors who didn’t understand the dollar-yen and dollar-gold symbiotic relationship, this rally has been shocking. Many gold community investors bravely bought at lower prices, but they sold it quickly, for very tiny profits.

If they do buy again now, sharp sell-offs could quickly spook them out of their new positions. That’s a tough situation to be in, and there’s only one solution: Intestinal fortitude.

Investors need to understand that to most value investors, the overall price of gold is now low. That’s also true for gold stocks, because the gold bullion rally has raised mining company profits. So, core positions across the sector can be accumulated here, provided the investor brings the required intestinal fortitude to the table to manage the increased volatility they will have to endure.

I would not buy any trading positions now, even though gold may continue to surge hundreds of dollars higher before any major sell-off occurs. I’m running a light sell program in the $1300 - $1350 area for my trading positions, but it’s certainly not a “top call”.

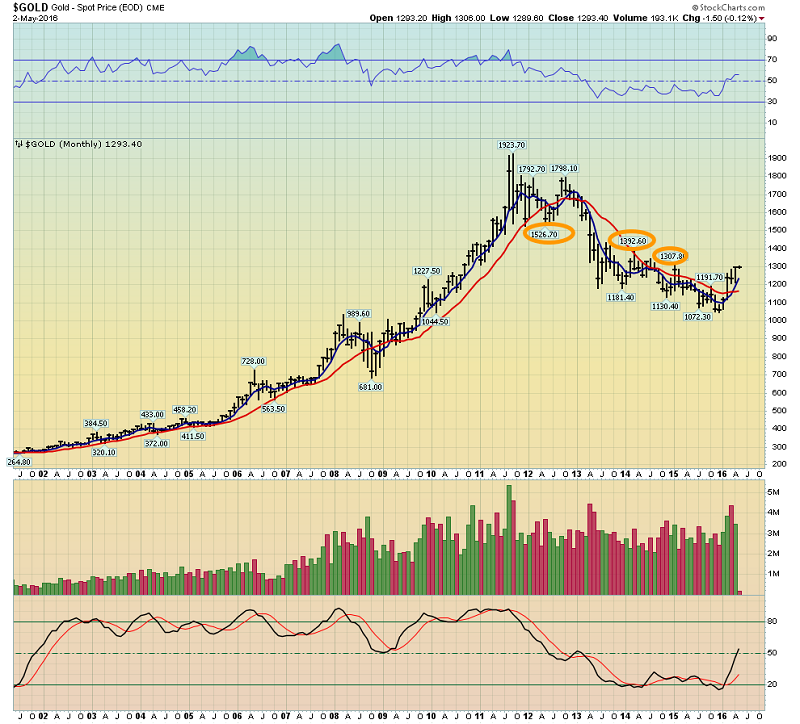

This is the monthly bars gold chart. While short-term charts can be used to fine-tune the big picture, I only use them to buy and sell when the price of gold is near monthly chart support or resistance.

In the current situation, gold is approaching the $1307.80 high just as the dollar approaches the 105 support zone against the yen. It’s probably a “no brainer” play to book a bit of gold market profit now, without calling any top in the market.

The $1392.60 and $1526.70 price areas are the next light profit booking zones of interest for me.

I haven’t annotated this monthly bars silver chart because I really don’t need to do so. Silver can outperform or underperform gold, but its overall price action is generally a mirror image of the gold price action.

Silver enthusiasts can book light profits on silver positions as gold trades near my support and resistance targets of $1307, $1391, and $1526.

It’s normal for long-term technical buy signals to occur just as an asset reaches an area where it may pause in the short term. This price action can confuse investors. As always, intestinal fortitude must be the main tool in every metal investor’s toolbox!

This Market Vectors Gold Miners (NYSE:GDX) daily chart shows the gold stock sector has also entered a profit booking zone, albeit at an area where large value-oriented fund managers are buyers.

As the gold stock rally gained momentum, I suggested that investors could “chase price”. Core position accumulators can still do that, if they sold out earlier in an attempt to “top call” the rally.

Short-term traders can stand aside now, but be ready to board their gold stock rocket ships again if GDX stages a three-day close above $30.

If GDX can do that, the dollar-yen support at 105 would probably be failing badly, and GDX would begin a mighty blast higher, towards my much higher $36 - $38 target zone.

The bottom line for the Western gold community is this: Whether it’s day or night, the main theme is now… higher price delight!

Disclaimer: Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: are you prepared?