Emerging Markets (NYSE:EEM) have gained a lot of attention lately and the Brazil story highlights the situation very well. The Olympics are about to start there, a plus, but the Zika virus is scaring many and the country’s economy is in a shambles. Russia is another one. Flexing their world muscles as their athletes get banned from the Olympics for doping. The parallel is that the Emerging Stock markets have both good and bad signals.

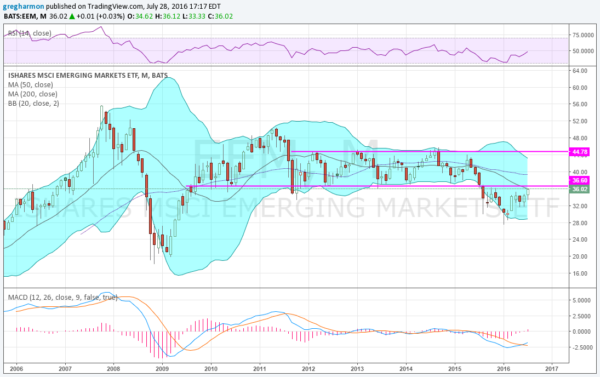

The chart below shows the full long-term story. A strong ramp up from the 2009 low made a top in 2011. So did the US market. But where the US market overcame the pullback to move to new highs, emerging markets were mired in a sideways channel. It stayed that way for almost 4 years before getting worse. Then emerging markets broke the channel to the downside. They found a bottom at the start of this year and began to move higher.

So far the move up has not been very aggressive. Coming into the end of July, the price is rising to meet the 20-month SMA. It has not been over this for more than a year. The good news. It is also still a little short of the prior 4-year channel. The bad news is that Momentum indicators are turning higher. The RSI is about to cross the mid line and the MACD is crossed and rising. The chart looks promising but until it can clear the lower bound of the prior channel it is nothing more than a weak bounce. Perhaps August will bring resolution.