If a person reads US newspapers, it is easy to get the impression that all of the world’s oil problems are over. But this is not really the case.

An Overlooked Part of the Problem: High Oil Prices

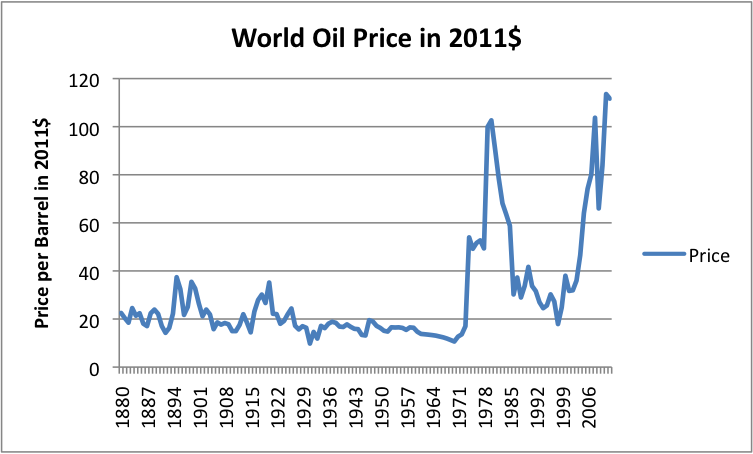

A major piece of the world’s oil problem is high price. Prices continue to be far above historic levels, now in 2013.

Figure 1. World oil price (Brent equivalent) in 2011$, based on BP 2013 Statistical Review of World Energy data.

High oil prices disrupt economies around the world because when oil prices rise, the wages of the vast majority of workers do not rise to compensate. Workers find that they need to adjust their spending patterns because the higher price of oil leads to higher prices for many things, including the cost of commuting, the cost of food, and the cost of buying goods that have been shipped long distance.

When workers adjust their spending patterns, discretionary spending is cut. This leads to patterns we associate with recession, or perhaps just slow growth. Unemployment rises, and there is less demand for new homes and cars.

Governments are also affected, because many of their costs, such as building roads, are higher. They also have to pay benefits to workers who can’t find jobs, or who can only find only low-paying jobs. Governments find it increasingly difficult to collect enough taxes because of the low wages of workers. Problems with rising deficits and the debt ceiling become the order of the day. Does any of this sound familiar?

One of our biggest issues today is that we don’t have a way of getting oil prices back down again, without a drop in oil extraction. The “easy to extract” oil (and thus the inexpensive-to-extract oil) was extracted first. There is still a huge amount of oil in the ground. The issue is that we can’t get it out, except at high prices—the same high prices that either (a) cause recession, or if governments can disguise the problem with deficit spending and low interest rates, (b) cause persistently low employment plus slow growth.

The Recent Rise in US Crude Oil Production

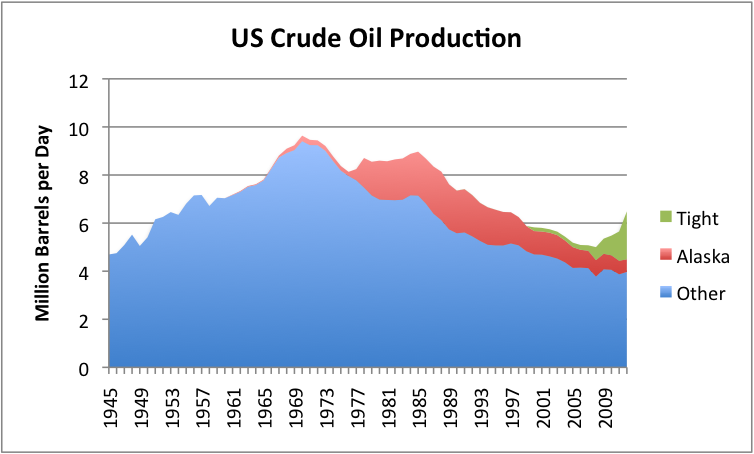

It is true that United States oil production is now higher than it has been in the recent past. The rise in production relates primarily to “tight oil”—the kind of oil production that is enabled by very extensive hydraulic fracturing (also called fracking). (Figure 2)

Figure 2. US crude oil production, divided into “tight oil”, oil from Alaska, and all other, based on EIA data.

We are often told that this rise in production is because of the invention of fracking. This is not really true; fracking has been used for decades, but not in the quantity it is used today. Oil production is up because oil prices continue to be high. High oil prices allow producers to use fracking in the quantity it is used today, on sites that without the technique would not be able to produce oil. Even with recent improvements in techniques, fracking remains expensive. Continued extraction of tight oil depends on oil prices remaining high.

There are other things besides high oil price that enable tight oil production. One of these things is plenty of credit, available at low interest rates. Tight oil by its nature requires considerable up front investment. Cash flow tends to be negative as production is ramped up. This means that there is a need for a lot of debt financing, so low rates are helpful. Ultra low interest rates, such as those provided by quantitative easing, also enable equity (stock) financing, because investors are so starved for reasonable returns that they will buy stocks of iffy companies, in the hope of capital gains.

Another thing that enables tight oil extraction in the United States is our law structure. In the United States, property laws permit landowners to share in the profits from oil drilling. In most other countries, profits are split between the company and the government, with nothing for local property owners. Because of the financial incentive, US property owners are often willing to put up with the hassles of hydraulic fracturing. This isn’t necessarily true elsewhere.

The United States also has other advantages that are not available in much of the world: lots of pipelines already in place, many drilling rigs available, a reasonable level of water supply, and population which is not terribly dense, so that fracking can often be done away from populated areas. The spread of technology for doing fracking around the world is far from a slam-dunk, because of the many obstacles to extraction elsewhere. These can at times be overcome with different techniques, but this adds another layer of costs, meaning oil prices need to be higher yet.

The amount by which tight oil production will continue to rise is open to a variety of interpretations. If oil prices drop because of recession, there may be very little additional production. If credit availability dries up, tight oil production may drop. If everything goes well, US production may rise. If miracles happen, tight oil production may even rise in many areas around the world.

As I have indicated previously, I am concerned about a financial discontinuity in the very near future–a few months to a year or two–a discontinuity that is ultimately related to high oil prices. This financial discontinuity could even be related to the current government shutdown, if it goes on for an extended period. If we are reaching a discontinuity, credit markets may be so disrupted and other changes may be so significant that past projections will be irrelevant.

A Second Overlooked Part of the Problem: Inadequate Rise in World Oil Production

The second major issue we are encountering now, besides high oil price, is an inadequate rise in world oil production. Many people are concerned about a possible unplanned decrease in world oil supply (so-called “peak oil”). While this may happen, worrying about this issue misses an important issue that comes earlier: for a growing world economy, we really need a reasonably large annual increase in oil supply.

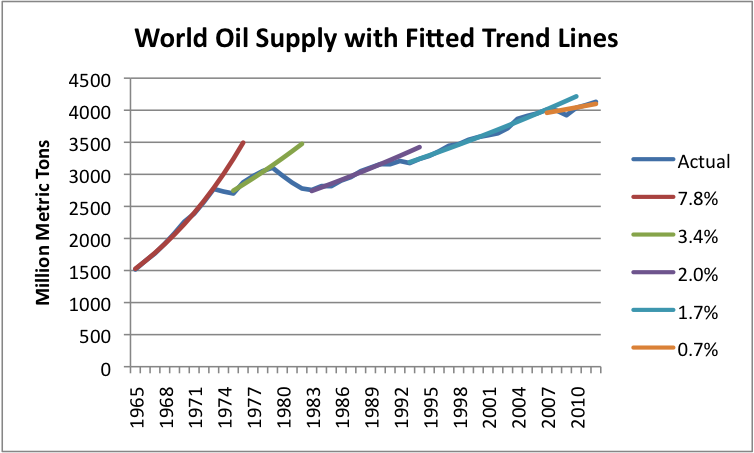

Even if we include all kinds of liquids that aren’t quite oil, such as ethanol, natural gas liquids, and coal-to-liquid, the growth of oil supply has tapered off considerably in the last 50 years. (Figure 3).

Figure 3. Growth in world oil supply, with fitted trend lines, based on BP 2013 Statistical Review of World Energy.

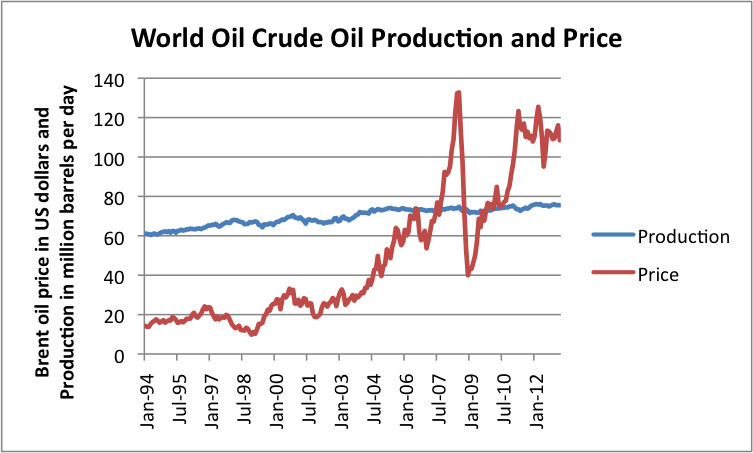

If we fit trend lines to historical oil production, we see that the lines become progressively flatter. To make matters worse, the number of potential customers for this oil has been rising, thanks to globalization. The World Trade Organization was formed in 1995. Adding China to the World Trade Organization in December 2001 particularly ramped up demand for all types of energy products, including oil. As China’s use of oil products soared, it put huge pressure on world oil prices. The combination of flat production and rapidly rising demand led to rapidly rising oil prices between 2003 and 2008 (Figure 4, below.) Oil prices temporarily dropped during the Great Recession, but are now back up above $100 barrel.

Figure 4. World crude oil production and monthly average Brent spot oil price, both based on EIA data.

Whether or not recent oil production really is sufficient for a growing world economy is debatable. Certainly in terms of supply equaling demand, there was enough. But in terms of how this supply was divided, it has been very unequal (Figure 5).

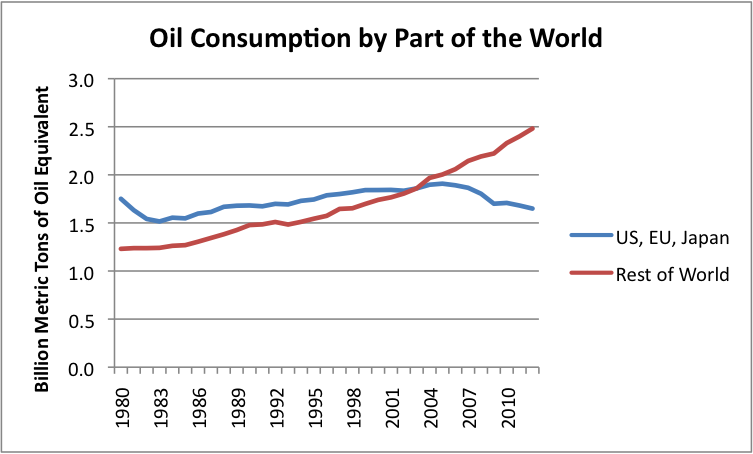

Figure 5. Oil consumption based on BP’s 2013 Statistical Review of World Energy.

The big historical users of oil, that is the United States, the European Union, and Japan, have seen their use of oil drop, while oil use has continued to rise in the rest of the world. The countries that have seen a drop in oil consumption also tend to be the countries that experienced the greatest downturn during the Great Recession. These same countries are now struggling with slow economic growth and little gain in the number of high-paying jobs available.

There is good reason to expect that oil use and economic growth would be highly correlated. This expected correlation comes in two different directions—from the demand side and from the supply side. From the demand side, if businesses are growing, and if workers have jobs that allow them to buy an increasing amount of goods that use oil (such as cars or motorcycles, or new houses), the demand for oil products is likely to be growing as well.

Availability of oil is also important from the supply side—that is making and transporting goods. As mentioned previously, oil is required to transport goods, and it is used in many other places in the economy—such as in growing food, in the construction of buildings, and as a chemical feedstock. Of course, if oil is cheap, it is much better on the supply side than if it is expensive, because if it is expensive, the high price of oil tends to send the required selling price of goods upward, and (oops!) lead to fewer sales, cutbacks in production and recession.

How Financial Limits Tie in With Oil Reserves

There is a common belief that we have plenty if oil, because companies and governments report high oil reserves. For example, using BP’s 2013 Statistical Review of World Energy, the amount of oil that companies seem to think is extractable is (1668.9 billion barrels of oil reserves/ 31.5 billion barrels of oil produced in 2012) = 53 years worth of oil at the 2012 rate of production. If we look at oil resources that are supposedly available, which include oil that may be available with further exploration and development, the amount seems to be higher yet. So it doesn’t look like there could possibly be a problem.

The reason why this belief is false is because the real cut-off is financial, and those making the estimates have no way of figuring out when the financial cut-off will occur. So they assume that we can extract oil that is very likely to stay in the ground indefinitely. One way of illustrating this problem is shown in Figure 6.

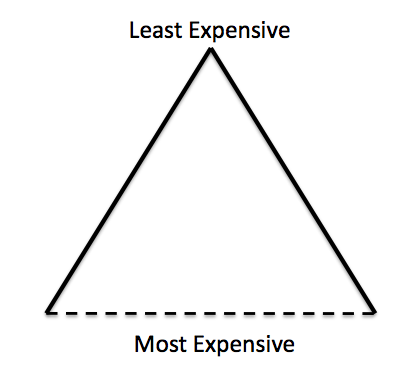

Figure 6. Resource triangle, with dotted line indicating uncertain financial cut-off.

Oil resources in the ground can be thought of as being somewhat like the triangle of resources shown. There is a lot of oil that is expensive to extract near the bottom of the triangle, but relatively little that is inexpensive to extract at the top. Oil companies start with the inexpensive to extract oil at the top of the triangle, and gradually work their way down through the triangle.

The least expensive oil is the oil that can be extracted with minimal problems. It is typically located near the surface, onshore, and can be extracted with the simplest equipment. Most of the easy, and thus cheap, to extract oil is now gone.

Now, if we want oil, we are being force to extract the more expensive oil, found lower in the triangle. Such oil may be deep under the sea, or near the North Pole, or may require hydraulic fracturing to extract. Sometimes the higher oil cost relates to indirect expense. For example, governments of oil exporters usually charge high taxes on exported oil. These taxes are used to keep their populations pacified with food subsidies and other benefits, such as desalinated water, so they do not revolt.

At the bottom of the triangle is an invisible financial limit, which I have shown as a dotted line. One way the limit “works” is by inducing recession in countries that obtain a very large percentage of their energy consumption from high-priced oil. Another way the financial limit works is by inducing financial collapse in oil companies. This happens when companies have huge up-front expense before they can recover their costs by selling oil they have extracted at high oil prices.

As an example of a company hitting such a financial limit, Brazil’s second largest oil company, OGX, is trying to extract oil offshore Brazil, including the presalt area (that is oil beneath a salt layer that is difficult to drill through). OGX recently missed a debt payment because of its inability to obtain sufficient financing to work its way around a long-term negative cash flow situation. It reports that most of the oil fields it has explored are not economically viable–the cost of extraction would be higher than the price available in the world oil market.

Because the financial limit is invisible, companies and government agencies have no way of excluding the too-expensive-to-extract oil from their estimates. A reasonable case can be made that at $100 barrel, oil price is already adversely affecting the economy. Without quantitative easing and deficit spending, the economy would be in recession from high oil prices now. Thus we are already hitting the financial limit, even though companies can see a huge amount of more oil that is theoretically available to extract. The only minor catches are that (a) consumers need to be able to afford to purchase the high-priced oil, and (b) oil companies need to be able to obtain ever-more cheap financing to extract it.

How Oil Limits Tie in with Energy Returned on Energy Invested (EROI)

Dr. Charles Hall and others have calculated Energy Return on Energy Invested (EROI) for various fuels (Hall and Klitgaard 2012). The basic premise is that the more energy is needed to extract a fuel, the less efficient it is for providing needing desired energy for society. Hall’s research has shown that over time, the EROI for each fuel extracted tends to decline. This is very similar to the rising cost of extraction over time I am showing in Figure 6. The main difference is that I include all relevant costs, including wage costs, taxes, financing costs, and distribution costs, rather than just energy costs associated with extraction.

I have talked about required oil prices already being too high, and thus causing recession. In many ways, this is parallel to saying that the EROI of oil is already too low, and is leading to recessionary problems.

Some people (for example, Garcia 2009, which seems to be used in used in Randers 2012) would like to use EROI comparisons to determine what might be a suitable substitute for oil. I do not consider this a suitable use for EROI for several reasons:

- Substitutability away from oil is very poor in the short-term, especially if we are up against a financial limit that will make substitution even more difficult in the future. The use of EROI in this manner assumes that substitution is really possible.

- EROI does not consider some important variables, including the timing of investment (and thus the need for long-term financing), and governments’ dependence on tax revenue from oil. Even in the US, governments obtain considerable revenue from oil extraction. According to Barry Rogers in the Oil & Gas Journal, in North Dakota, the total “government take” amounts to $33.29 on an average $80 barrel of tight oil.

- If substitution were to take place, huge transition costs would be incurred, such as early retirement of the current vehicle fleet, and higher capital costs (and thus more energy expenditure) related to the new vehicles. Simply considering EROI would miss these costs.

Conclusion

When we hit oil limits, we are really up against Liebig’s Law of the Minimum. Applied in this situation, this law would say that if a necessary fuel is missing, the economy will not operate properly. This law originally was used to describe a problem in raising agricultural crops. If a necessary nutrient (such as phosphorous) was not present, it didn’t matter whether excess amounts of other nutrients were added. The plants could not grow properly unless the missing nutrient was available.

With oil, the situation is pretty similar. The economy cannot operate as usual, without an adequate supply of cheap oil (or in EROI terms, high-EROI) oil. All of the talk about substitution for oil is irrelevant, if our problem is a financial problem we are hitting right now, or in the very near future.

In order to have prevented our financial problems, several years ago we would to have needed to put in place a substitute for oil with very little or no transition costs. Ideally, the substitute could have kept transportation costs very cheap—comparable to the cost before the run-up in oil prices in starting about 2003. Ideally, the substitute would also have worked for other oil uses, such as for powering irrigation pumps, for powering agricultural equipment, and as a chemical feedstock for asphalt, for medicines, for herbicides and pesticides. To be truly an oil substitute, the new product would need to be available sufficiently cheaply that it could be taxed heavily, to make up for lost revenue from oil royalties and other taxes.

Now we are faced with what looks like an unsolvable problem. We need a cheap oil substitute, yesterday. The stories we heard saying, “Substitutes will work when the oil price rises high enough,” were a bunch of nonsense. The folks who came up with this idea didn’t realize what a negative impact high oil prices have on the economy. A high-priced substitute for oil is not at all helpful. Neither is one with huge transition costs.

Without a substitute, we need to figure out how to live in a very changed world, one facing financial collapse–a very difficult problem indeed.