Oracle Corp’s (NYSE:ORCL) planned acquisition of NetSuite remains on track after the U.S. Department of Justice (DOJ) recently approved the deal. The antitrust clearance from the DOJ will now enable Oracle to proceed with the all-cash tender offer for NetSuite, which is set to expire on Oct 6, 2016.

NetSuite, founded in 1998, was a pioneer in the cloud computing market, as it was the first company to offer business applications over the Internet. Per Bloomberg, NetSuite has more than 30,000 customers, the bulk of which are small and mid-size companies.

In late July, Oracle offered to buy Netsuite for $109 a share, which equates to approximately $9.3 billion. The company expects the acquisition to be “immediately accretive” to earnings on a non-GAAP basis in the year after the deal closes. The transaction will now enable Oracle to penetrate the small and medium-sized business market segment, where it does not have a strong footing.

We note that compared to its peers Oracle is a late entrant in the cloud computing market. The company is striving to boost its cloud computing revenues amid slowing new license revenues for on-premise applications. However, we note that cloud revenues formed only 11.4% of total revenues in the recently concluded first quarter of 2017.

The addition of Netsuite is anticipated to improve Oracle’s competitive position in the cloud computing market, which is currently dominated by the likes of Amazon.com (NASDAQ:AMZN) , Microsoft (NASDAQ:MSFT) , salesforce.com (NYSE:CRM) and Workday.

Of late Oracle has been focusing on expanding its cloud portfolio to challenge the dominance of Amazon and Microsoft. In May, the company acquired Opower, a cloud-services company that assists utilities, for $532 million. Oracle also paid $663 million for Textura, which targets the construction industry.

Most recently, the company announced a plethora of products that not only “complete” Oracle’s cloud portfolio but also make it much cheaper than the Amazon web service (AWS) offerings. The recently announced Oracle’s second generation IaaS data centers are expected to improve the company’s competitive position against Amazon in the IaaS market. (Read More: Oracle Versus Amazon in Cloud Computing War: Who Will Win?).

Zacks Rank

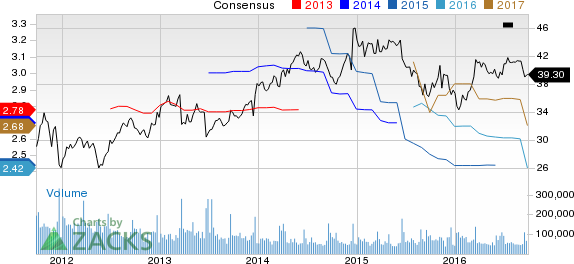

Currently, Oracle has a Zacks Rank #5 (Strong Sell). Both Microsoft and salesforce.com carry a Zacks Rank #3 (Hold), while Amazon carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

AMAZON.COM INC (AMZN): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

SALESFORCE.COM (CRM): Free Stock Analysis Report

ORACLE CORP (ORCL): Free Stock Analysis Report

Original post

Zacks Investment Research