Objectivity!

One of the most important questions for consumers of punditry is whether the source is intellectually honest about methods and interpretation. The test is a simple one:

- If an indicator is cited as support for a market position, take note.

- If the observer decides to change indicators, there should be a logical explanation – best done when it is not an excuse for maintaining current viewpoints.

- If the indicator is dropped when it no longer supports the pre-conceived viewpoint, be warned!

Since I read widely from many sources, I am often intrigued by provocative claims. If you want to challenge your own biases, you must be willing to see an opposing viewpoint. If you learn that a source has turned a blind eye that should be a red flag.

Two Examples

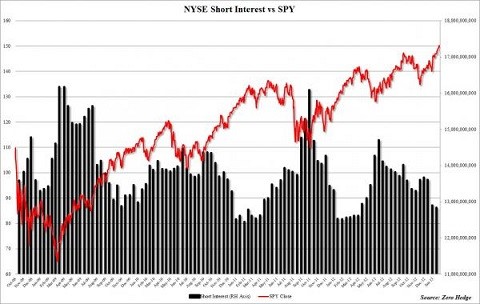

Case one: There has been a lot of recent buzz about high levels of margin at the NYSE. For a time, your favorite conspiracy site insisted that this had nothing to do with short interest, since that was declining as the S&P was rising. Here was the chart:

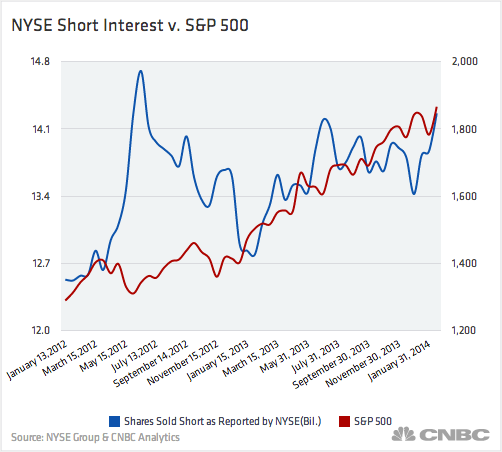

Let us now compare with more recent data via CNBC:

It is pretty obvious that the ZH post coincided with the one big diversion in this series. Do not hold your breath waiting for an update!

Case two: A famous pundit who is generally bearish identified an interesting indicator – purchase of dental services. The basic idea was that many dental procedures were discretionary and therefore a great real-time indicator of consumer strength. Since I admire the source and his ability to find innovative ideas, I thought this was quite interesting. I put the key stock, which he recommended as a short, on my quote screen. One of his several public comments (and not the first) was in mid-2012 when he noted that the stock was at an all-time high. Here is the stock chart:

We can see that the stock is up 50% since the time of this widely-publicized article. You probably did not short it, and neither did I. Our hero (no doubt) had a nice stop on his short. That is not the point.

What about the status of this great, little-noted indicator? Has something happened so that the "discretionary" dental purchases are not a good indication? Maybe there was an explanation that I missed, but it seems like just another discarded indicator. Meanwhile, the pundit continues to write daily about headwinds and new reasons to short the market. How about an explanation of what has changed about discretionary dental expenditures?

How Investors Can Use this Concept

It is pretty simple. Make some notes about the reasoning – not just the conclusions – of your favorite sources. Look at the indicators and specific forecasts.

It is perfectly acceptable to change your mind about an indicator. In my weekly updates I am quite clear about what is important and what is not. If there is a change, I explain it. This is the standard that you should expect.

There are dozens of similar examples. I invite nominations from readers.