Perth Basin unconventional gas early mover

Norwest Energy NL, (NWE.AX) is among the early movers taking on the unconventional potential of the northern Perth Basin in Western Australia. Early results have been encouraging and point to a potentially substantial unconventional gas resource. The next 12-18 months will be critical as appraisal results from its Arrowsmith-2 discovery are analysed and a horizontal, multi-stage fracked pilot well is drilled to test Arrowsmith’s commercial viability. There is clear scope for substantial upside if Arrowsmith can be demonstrated as viable, towards an eventual full shale and/or tight gas development across the breadth of Norwest’s Perth Basin acreage.

Perth Basin unconventional gas focus

Norwest’s Perth Basin acreage represents a significant foothold in a potentially substantial unconventional gas region in a market context blessed by an enviable network of above-ground infrastructure and LNG-based gas pricing. With multiple operators having demonstrated the presence of stacked tight gas formations along the length of the Perth Basin belt, it is looking increasingly possible that the region could become Australia’s next major development play.

Arrowsmith as beachhead to full development

Norwest is leading the appraisal of the Arrowsmith-2 discovery. The next 12-18 months will be critical while a workover of Arrowsmith-2 is undertaken before the end of CY13, flow data is collected, commercial viability is analysed and a likely horizontal pilot well with multi-stage frac is drilled in the second half of next year. If commerciality can be established, the ultimate prize Norwest is chasing is full development of an Arrowsmith tight gas field comprising perhaps more than 80 wells and 300bcf of produced gas.

Valuation: Much still to unfold as Perth Basin de-risks

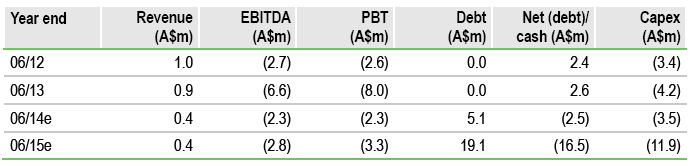

Our analysis includes DCF modelling of a potential full-scale development of an Arrowsmith tight gas field. From this, our risked valuation of 3.0c/share is at a substantial premium to the current share price. If Norwest is able to advance Arrowsmith in parallel with other local operators (principally AWE), value attribution to the remainder of Norwest’s Perth Basin will lift as the region is de-risked. Recent share price volatility appears likely to continue until the situation at Arrowsmith gains clarity. What is clear is that Norwest does not currently have the balance sheet capacity to fully fund its 2014 exploration work programme, nor a field development scenario. We expect capital strategy to be a major focus for the company over the next few months, and we would expect a capital raise to be likely before the end of Norwest’s FY14.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Norwest Energy NL: Perth Basin Unconventional Gas Focus

Published 11/27/2013, 02:38 AM

Updated 07/09/2023, 06:31 AM

Norwest Energy NL: Perth Basin Unconventional Gas Focus

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.