Given the scope for massive short-term volatility, hyperbole is in high gear with everyone discussing Friday’s Non-Farm Payroll.

Without question, Jobs Day is always a monthly highlight, but given the Federal, Reserve Boards tilt at Jackson Hole, it plainly appears it will take a big surprise to derail a 2016 Fed Hike expectation at this point.

Investor odds of liftoff are hovering near 70% for December and Friday’s jobs data will offer more information about the probability of a hike in September, than anything else.

With London on holiday yesterday, markets were wafer thin, and price discovery provided little to no insight.

It’s been a relatively mixed bag to start the week as traders continue digesting the avalanche of Fed Speak at Jackson Hole. None the less, a few possible setups are taking shape.

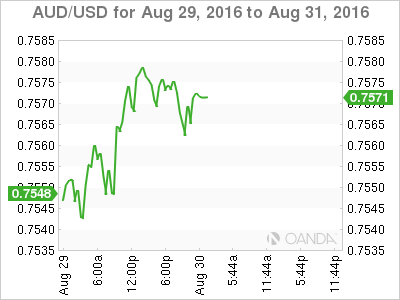

Australian Dollar

The Australian Dollar dug its heels in overnight and while gains were modest, it was one of the G-10’s better performers as traders become skeptical that the Fed will raise rates in September. Taking cues from inflation data, the AUD was underpinned by the US personal-consumption-expenditures price index which came in flat for July.

However, with the markets focus shifting to a high probability of a 2016 Fed lift off, this should ultimately be USD supportive, and the Aussie Yield Appeal could wane.

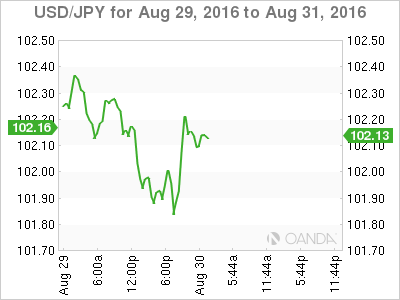

Japanese Yen

There has been little following through on Kuroda’s Jackson Hole rhetoric, which is hardly surprising given the market’s propensity to discount BOJ policy. Regardless, USD/JPY remains supported by the Federal Reserve Board’s recognized hawkish shifting forward guidance, despite cynics abound. Ultimately, I suspect the market will remain in neutral as we approach what’s expected to be a highly charged Non-Farm Payrolls event on Friday.

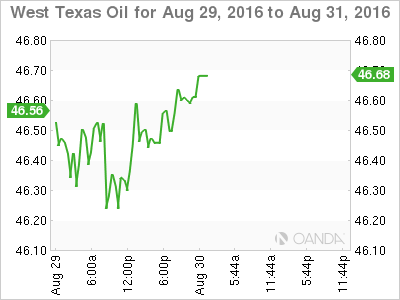

Crude Oil Markets

The US Rate Hike fidgets are weighing on traders sentiment. More significantly, supply concerns are mounting as Middle East producers continued to ramp up production. With exporters like Saudi Arabia production at record levels in July and likely to hit another high in August, one has to question the efficacy of a production freeze as OPEC churns near maximum capacity

.