You didn’t really expect things to go as planned, did you?

The Regional Fed Presidents as well as Janet Yellen have been doing their best to keep market expectations on track and price action smooth heading into a hike that has been relying on the one consistently good piece of economic data coming out of the spluttering US economy: Employment Data.

With the positive buzz surrounding employment, the Fed has been happy to continue on their current trajectory toward further rate hikes. But Friday’s NFP release may have just given markets that unexpected twist that traders have been hanging out for.

“USD Non-Farm Employment Change (38K v 159K with last month’s 160K revised down to 123K)”

“USD Average Hourly Earnings m/m (0.2% v 0.2% expected)”

“USD Unemployment Rate (4.7% v 4.9% expected)”

This print was actually the weakest NFP number in six years… Ouch.

Whether the data actually says that the Fed’s plan isn’t working is still debatable, and it will be very interesting to hear how Janet Yellen spins the latest number when she speaks tonight at the World Affairs Council of Philadelphia’s luncheon.

Is this environment of sluggish economic growth and activity the type you want to be raising rates in? Heck, even talking about raising rates in? It’s going to be a tough one for the Fed to answer from here, but as Forex traders, the opportunities that are presenting themselves are HOT.

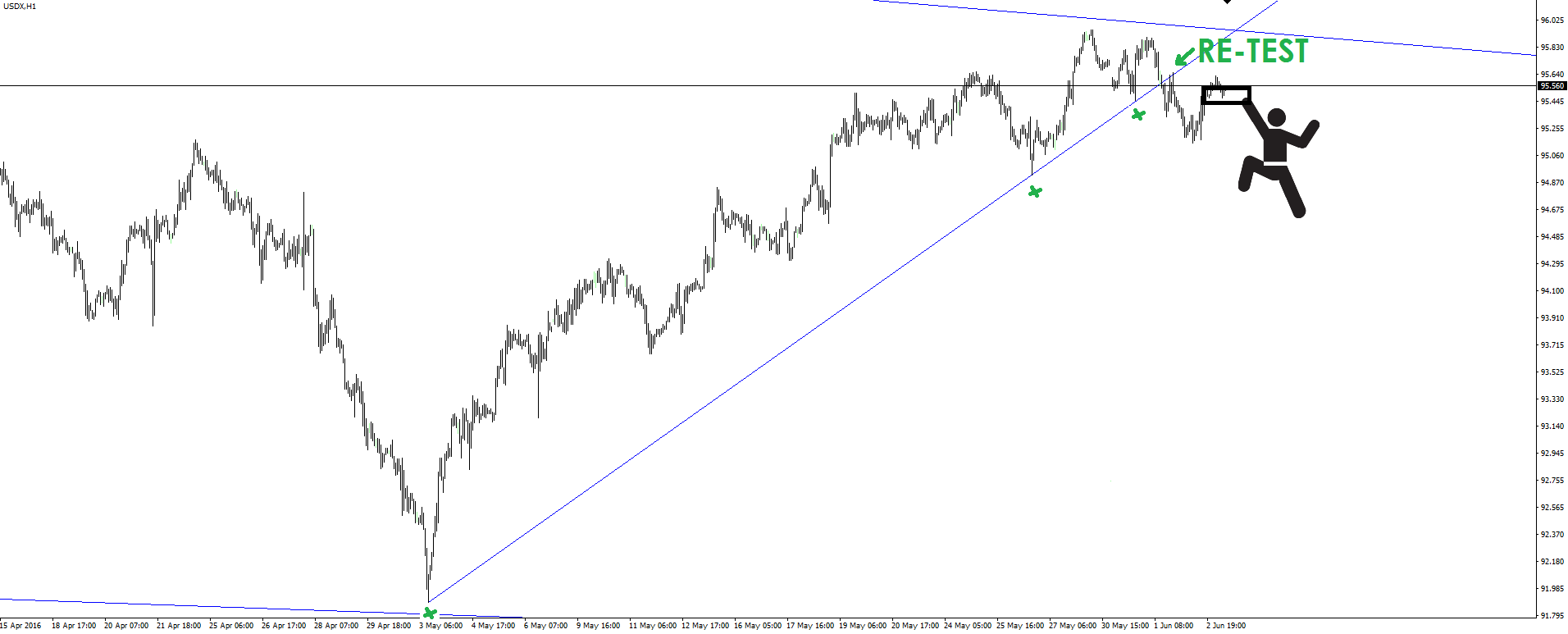

Within Friday’s NFP Preview, we focused on looking at the US Dollar Index charts with this quoted text being the main takeaway heading into the release:

“That’s price hanging on for dear life. Just look at him!”

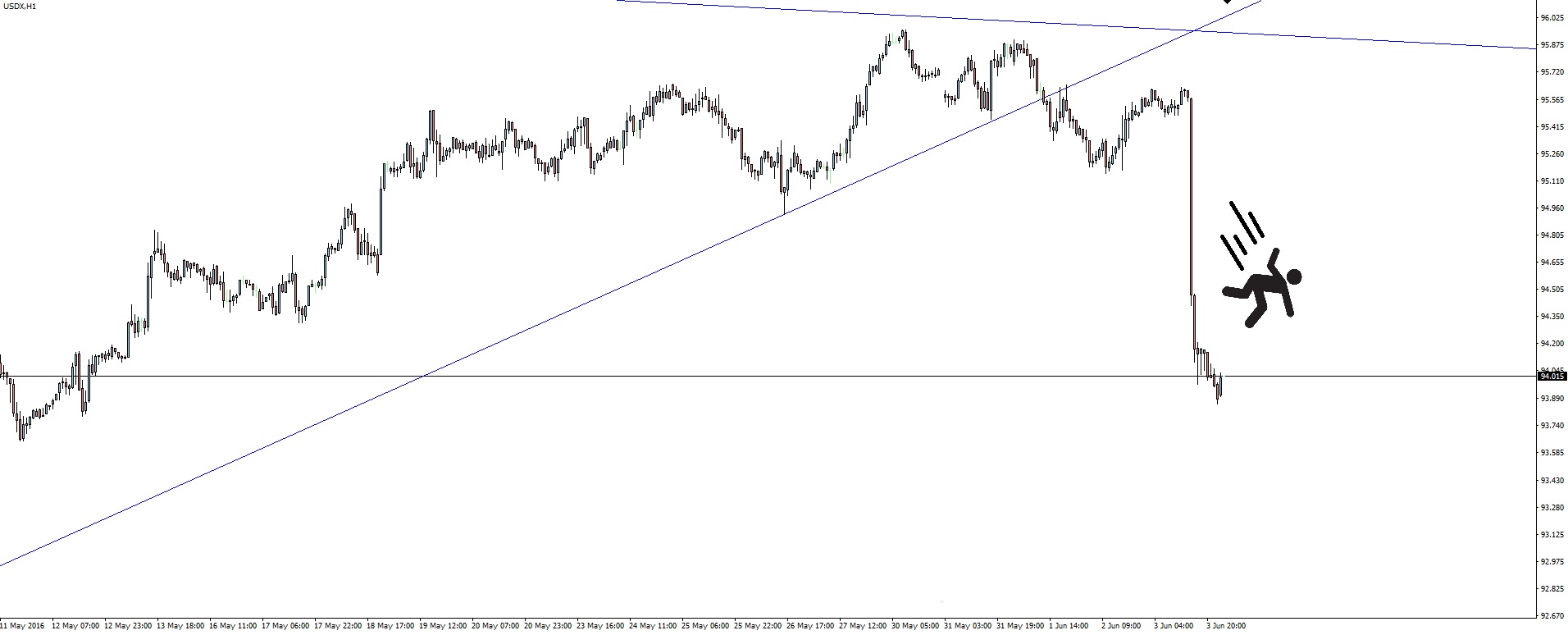

We identified the greatest risk, and therefore greatest potential for a game changing, major re-pricing type of move coming from a an NFP miss to the downside and therefore dropping the USD.

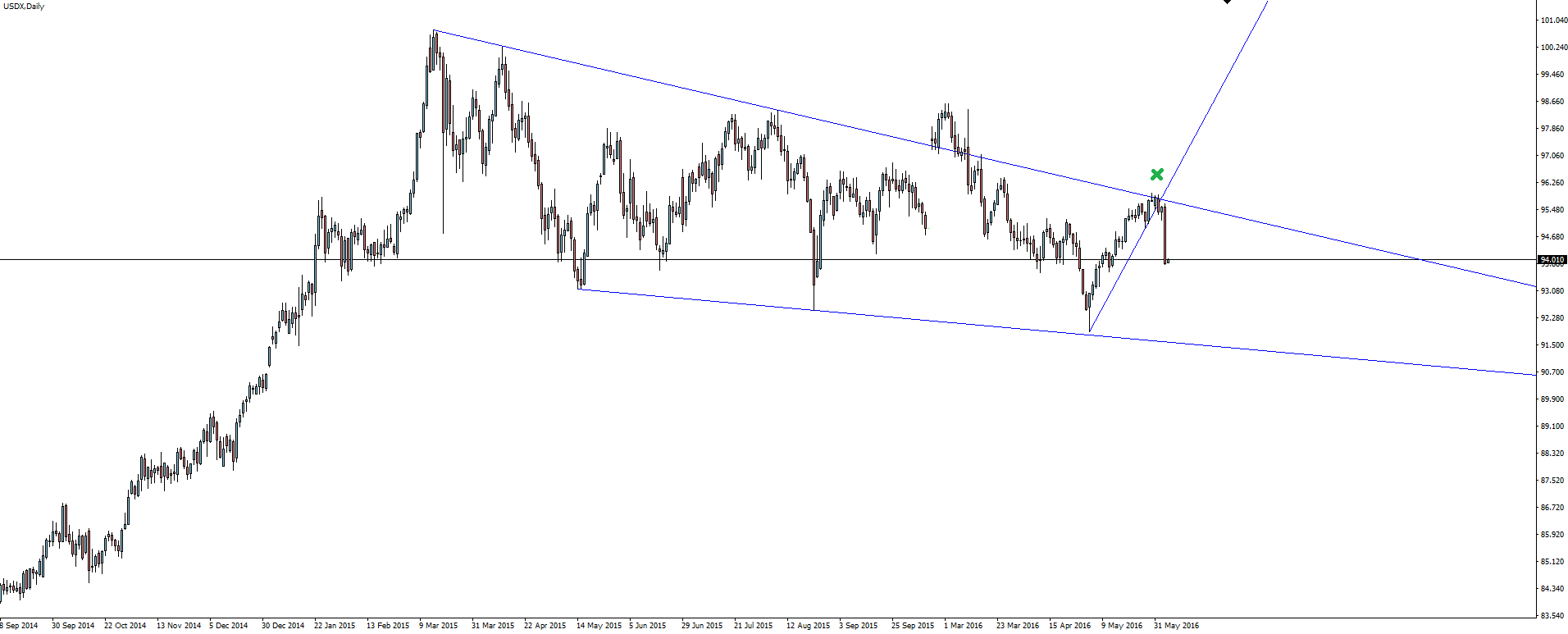

USDX Daily:

USDX Hourly:

…and well yeah. You can see pretty clearly what happens when technicals are sitting at a major level and the fundamentals don’t allow it to go any further. Goodbye little man!

Open up your charts and check out some of the very tradable moves across the Forex majors.

Charts of the Day:

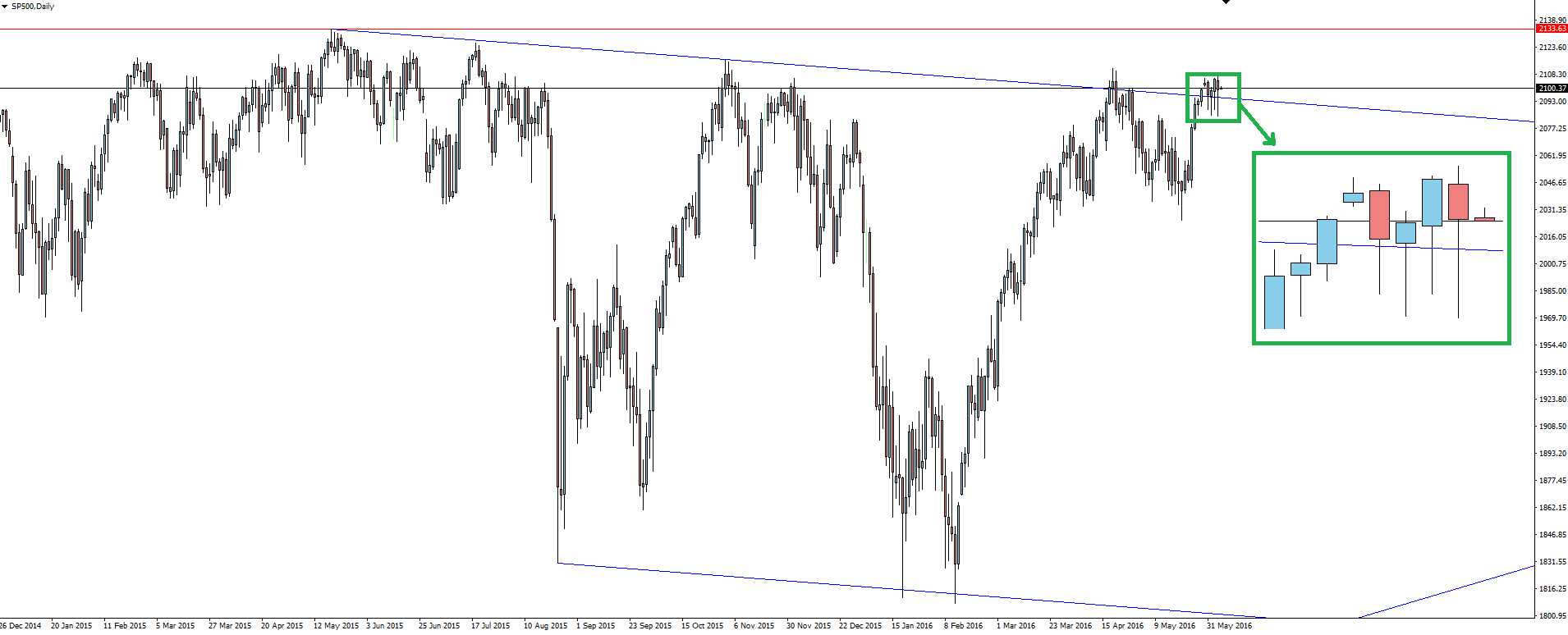

The other major ‘overview’ type market that is worth a look after these major releases is the S&P 500.

S&P 500 Daily:

Price has been sitting at major daily resistance, but trapped in a little trading range at the level.

The level price is struggling at definitely is having an effect. The prospect of potentially more cheap money could easily have sent stocks flying higher, but the uncertainty in the highlighted price action shows that the resistance ceiling is certainly coming into play here.

As we’re at a major higher time frame level, once again I would rather treat this line as a zone rather than a hard resistance level and that theory is reflected in the price.

Stay safe out there!

On the Calendar Monday:

NZD Bank Holiday

USD Fed Chair Yellen Speaks

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX does not contain a record of our prices, low spreads or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and market commentary – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, Australian Forex Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.