The NZD/USD has been ranging strongly over the previous month, between the 79 cent and 76 cent range as the market has lacked direction and today's CPI result will confuse the market slightly but there is every reason to still believe in the NZD/USD.

CPI data came in at -0.2% q/q for the NZ economy and 0.8% y/y, now this seems like a horrible result for a central bank that is trying to maintain inflation at around 2%. But, it was pushed lower by recent oil prices, which have had a massive deflationary impact on the NZ economy as a whole. Going forward, we are now likely to see further pressure on inflation in the long run, as oil is likely to remain low for some time as OPEC looks to keep prices low. This impact is being seen globally, however, with global growth slacking, it’s likely to remain low for some time.

So with low inflation the Reserve Bank of New Zealand has little choice but to hold off interest rates in the long run until it see’s a pick up. Many forecasts are now being revised, and we see no interest rate rises until 2015. This is not a bad thing, the NZ OCR is currently at 3.5%, however, further deflationary pressure on the economy could in fact lead to the RBNZ cutting interest rates. But we will have to wait to see if that is possible.

The Reserve Bank of Australia is looking to cut rates, according to the market and the two intertwine in the market place. With the RBA looking to cut rates this could be a large boon for the NZ economy, as traders with a hunger for fixed interest will look towards NZ in an effort to find stable economies with strong interest rates.

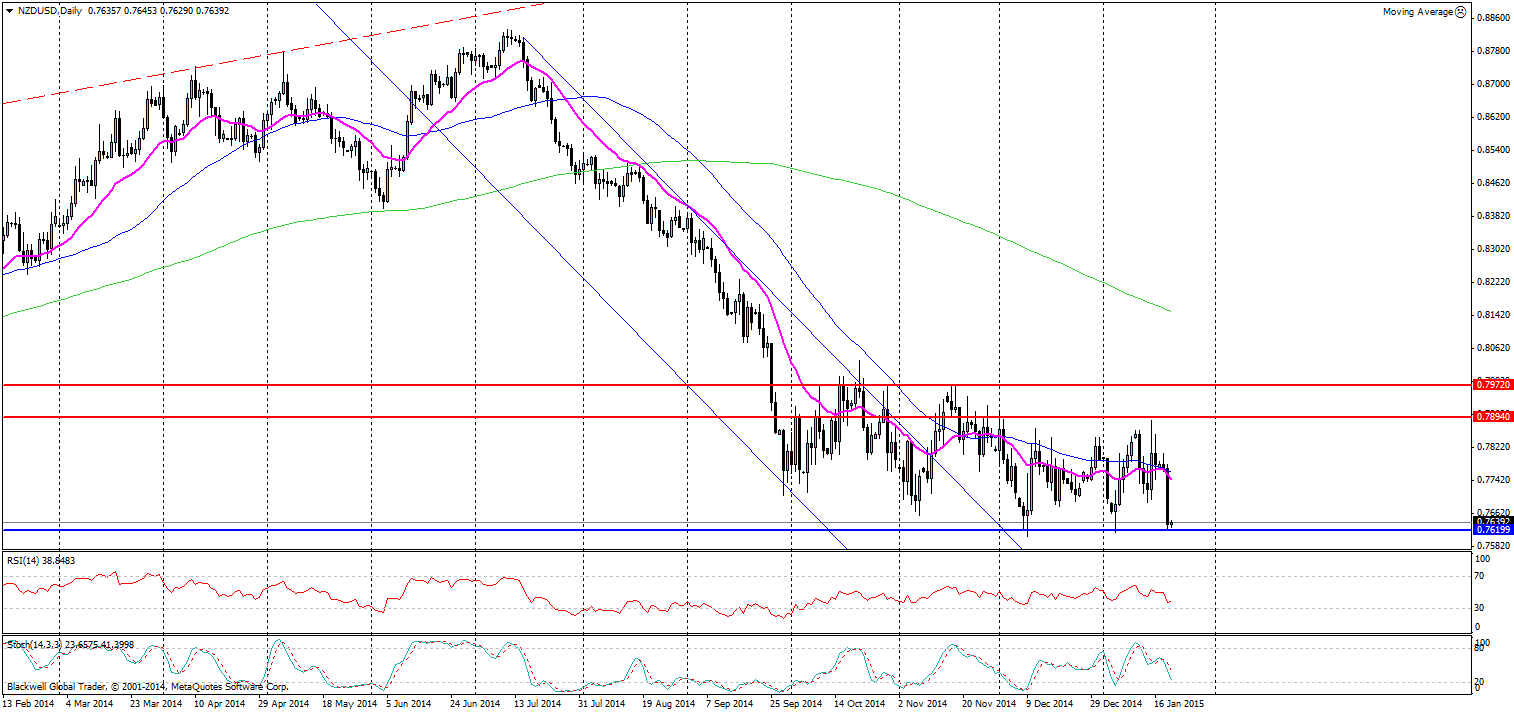

Source: Blackwell Trader (NZD/USD, D1)

With support at 0.7619 the market has continually looked to bounce off this level, and we believe it presents a good long opportunity. Which is a plus for the NZD/USD as swaps can be quite expensive if holding for a few days. Targets higher could look for the 0.78 level however this looks quite high and we need to see strong risk appetite in the short term. We might not find it tonight, given the expected QE from the Euro-zone.

Overall, the NZD/USD is a good position for a tight stop loss and a good long term vision. Many people are likely to jump at this trade and it’s certainly one to pay attention to.