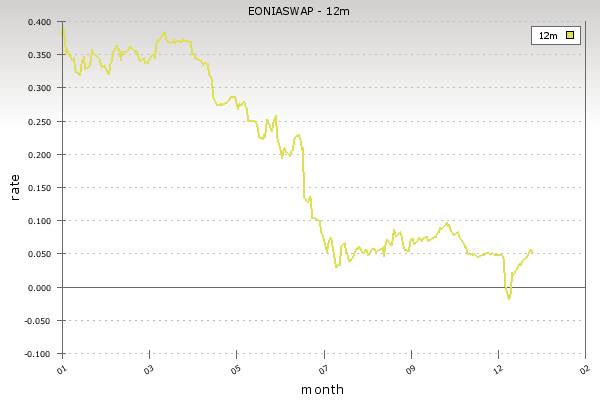

There is concern among some eurozone banks that the ECB may push the deposit rates on excess reserves into negative territory next year. In fact the 12-month EUR OIS rate (the so-called EONIA swap rate), which is the market expectation of where the overnight rates will be next year, briefly dipped below zero recently.

If that were to happen, banks would in effect be penalized for holding excess reserves at the ECB. Such action would force those who are able (more likely the core banks) to pay down their borrowings from the ECB (otherwise they are paying 1% for the LTRO funding and then paying again for depositing the cash at the ECB).

JPMorgan: There has been renewed speculation that the ECB will set a negative rate on its deposit facility. Indeed, the EONIA curve, which tracks the deposit facility, dipped into negative territory for the first time last week. Negative interest rates on deposits are like safe deposit charges – the idea is that they should incentivize banks to lend out money rather than suffer an erosion of capital.

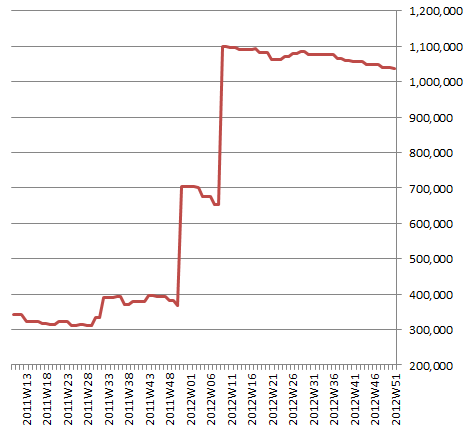

Core banks are more susceptible to negative deposit rates. The first response by core banks would be to repay back most of the extra funds they borrowed via the 3y LTROs, which they can do from January 30th. We previously argued that core banks could repay €100bn of 3y LTRO funds as yield compression makes carry trades less attractive. But an ECB deposit rate cut to -25bp could induce them to pay back perhaps all of the €140bn they borrowed on net via the 3y LTROs.

In preparation for this potential event, banks have been paying down the shorter term LTRO balances (not all LTRO is 3 years). In fact the ECB is showing a gradual but consistent decline in LTRO funding provided to the euro area banks.

According to JPMorgan, the effect of a negative deposit rate on excess balances would help the eurozone periphery by pushing capital out of the core.

JPMorgan: ... an ECB rate cut to -25bp could accelerate that process [of paying down LTRO]. In trying to avoid negative carry, the resulting search for yield and increase in the velocity of reserves, i.e. passing on the “hot potato,” within the euro area banking system is likely to improve capital flows back to peripheral banks and reduce TARGET2 imbalances, especially now that the ECB has back-stopped the system with OMT. From this perspective, negative deposit rates could be a useful policy tool to induce financial re-integration in the eurozone and ultimately allow the periphery to reduce its reliance on the ECB.

Of course one of the reasons the Fed hasn't followed this path is a potential disruption to the money markets. Even the recent drop to zero rate on deposits by the ECB has caused havoc for euro denominated money market funds (see discussion). A negative rate would force money market firms to simply kick the existing depositors out, forcing them into periphery government paper or periphery banks - which of course is the idea behind negative rates.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Negative Deposit Rates To Force Eurozone Core Banks To Repay LTRO Funds

Published 12/30/2012, 02:36 AM

Updated 07/09/2023, 06:31 AM

Negative Deposit Rates To Force Eurozone Core Banks To Repay LTRO Funds

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.