It’s been quite a month.

In late October Japan, despite a year of fairly aggressive quantitative easing, dropped back into recession and concluded that even easier money was the cure for its ills. It announced a debt monetization plan of almost science-fictional proportions in which the amount of new yen to be created, as a percentage of GDP, will be equivalent to $3 trillion a year in the US. See Reactions to BoJ’s Kuroda’s Stunning, Doubled-Down QE ‘Experiment’

Then the European Central Bank, after years of operating in Germanic tight-money mode, finally accepted that a shrinking money supply was pushing the weaker eurozone countries into depression. On November 21 it threw caution to the wind and began buying up (by the sound of it) pretty much every stray piece of paper that’s blowing in the Continental wind.

Most recently China, whose massive purchases of raw materials became the engine of the post-2008 recovery, discovered that much of the debt incurred to build those entire new cities is about as likely to be paid back as a typical subprime mortgage circa 2007. So it announced a surprise interest rate cut and a promise to do much more if necessary.

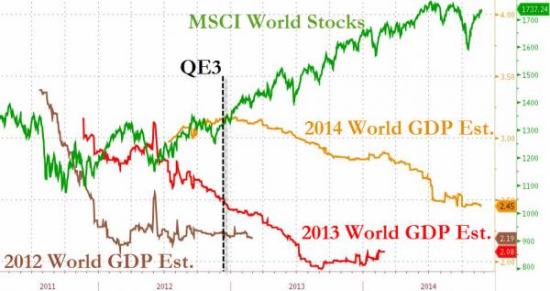

These are not the actions of economies in sustainable recovery but of countries falling into an abyss. Such open-ended offerings to the market gods are explicitly designed to get the juices of stock traders flowing. But so far that’s all they’ve done. Here’s a chart from Zero Hedge showing how each year’s initial GDP optimism has faded even while equity prices have continued to rise.

So, two questions:

1) Will stepped-up debt monetization and interest rate reductions succeed where the past batch failed? Not likely, for both practical and theoretical reasons. There’s just too much debt outstanding to allow normal market mechanisms to produce sustainable growth. There’s simply nothing that Italy or Japan can build with borrowed money that will generate a positive return, given how much they already owe. So those descending GDP estimate lines will soon be joined by a new one with the same arc for 2015.

2) Can the US remain aloof from the carnage taking place all around it? Also not likely, since the actions being taking by our trading partners all coalesce around a single data point, which is a more expensive dollar. The US has had a relatively smooth few years because Fed policy was relatively easy and the dollar, as a result, was relatively weak versus the yen and euro. Now both of those trends have reversed in a big way. Here’s the dollar versus the world’s other main currencies over the past year:

Where the previously-strong euro and yen pushed Europe and Japan into recession, a strong dollar will impose the same headwind on the US in 2015. So there’s a decent chance that a year from now we’ll be faced with a world in which debt monetization has failed in three of the four major economies and a strong currency has sucker-punched the last one standing. And the only politically-acceptable response will be more of the same. Why isn’t gold soaring?