The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Monday lower, low confidence.

- ES pivot 1987.83. Holding below is bearish.

- Next week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

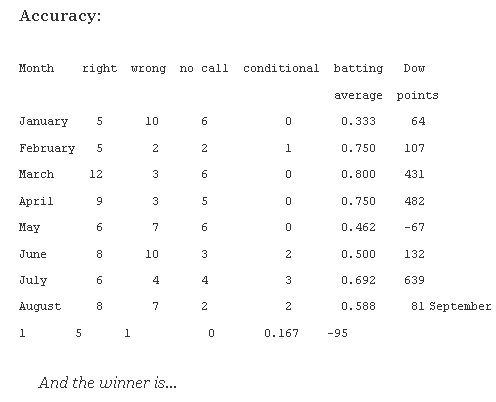

Whoa - looks like I picked a bad day to be wrong, since the Dow did not rise on Friday - it went down 61 points. That leaves me 0 for 3 in the forecasting department. For whatever reason (geopolitics probably had something to do with it) the technicals are not on our side lately. But that's all part of the game. As I always say, you don't have to be right all the time to win in the long run - and we are in it for the long run. In the meantime, let' see if we can't get one right on Monday for a change.

The technicals

The Dow: On Friday the Dow tried in vain to rally off an early loss but by 11 AM it was all over as the selling just kept on going into the close. A weak rally in the final hour didn' help much leaving us down 0.36%. And with a down Friday comes the danger of a down Monday quite a bearish sign. And I see nothing bullish on the daily charts here..

The VIX: Huh - so much for the big bearish engulfing pattern last Thursday. The VIX gained 4% on Friday anyway. But that came with yet another failed retest of the 200 day MA, the fourth one in four days. Being so wrong lately though, the most I'll commit to now is that the VIX isn't going above that number (13.56) on Monday.

Market index futures: Tonight all three futures are lower at 12:21 AM EDT with ES down a significant 0.37%. And so much for last Thursday's bullish RTC exit. On Friday ES tanked, canceling all the previous bullish signs to fall right back into its descending RTC, And we're still not oversold yet. And with the overnight lower by a non-trivial amount, this chart continues to look bleak for Monday.

ES daily pivot: Tonight the ES daily pivot drops from 1993.83 to 1987.83. That leaves ES below the new pivot so this indicator is back to bearish.

Dollar index: The dollar's been in the news a lot lately because of its year-long strength. But in the past week it's gone nowhere, putting in four indecisive dojis in a row while remaining highly overbought. I"m not touching this chart with a ten dollar bill.

Euro: And the euro finally seems to have found some support around 1.2900 as it posted a rare gain on Friday that sent all the indicators rising off oversold. The overnight is trading just outside a long-running descending RTC for a bullish setup and above its daily pivot for a change. This looks at least a bit positive to me for the euro on Monday.

Transportation: The Trans on Friday put in a perfect little star sitting on top of Thursday's big gain. That bent the stochastic around into position for a bullish crossover. But with a reversal candle hanging there, we just have to take a pass on this chart.

For what it's worth (and lately it seems like it hasn't been much), the technicals are looking bearish tonight. That probably means the market will be higher just on a contrarian basis but the system demands that I call Monday lower - so bet it.

ES Fantasy Trader

Portfolio stats: the account remains $114,250 after eight trades in 2014, starting with $100,000. We are now 6 for 8 total, 4 for 4 long, 2 for 3 short, and one push. Tonight we stand aside.