The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Monday higher, low confidence.

- ES pivot 1950.92. Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

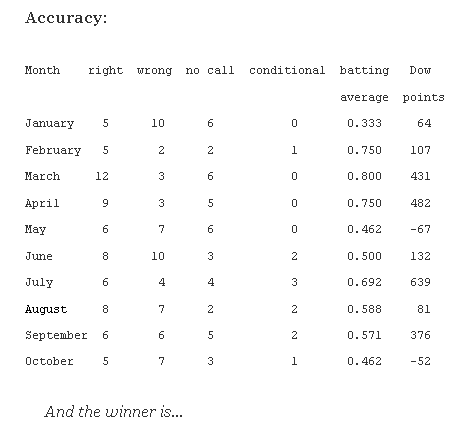

Last Thursday's break back up over the 200 day MA was all the Dow needed to post a 128 point advance on Friday, despite what looked like a fair number of bearish signs to me. As the spooky month of October enters its final week, we'll try to redeem ourselves by getting Monday right.

The technicals

The Dow: The Dow last Friday was completely uninterested in the overbought indicators or the incipient bearish stochastic crossover as it simply kept going higher. We remain in a rising RTC and the upper BB is still along way off. So now I'm going to ignore the overbought indicators as hazard a guess that there's still more upside available here, especially in the absence of a reversal candle..

The VIX: On Friday the VIX fell another 2.54% on an inverted hammer but support around .16.15 held. With indicators remaining quit oversold and the stochastic flat on the floor with nowhere to go but up, it still seems to me like the next move here is likely higher than lower.

Market index futures: Tonight all three futures are higher at 12:28 AM EDT with ES up 0.08%. On Friday ES just continued higher, remaining inside a rising RTC with the indicators all broken now at extreme overbought levels. We stopped right at resistance at 1961 so the $64K question is can we push on through. The overnight seems to suggest that might be possible - at least as it looks late Sunday night.

ES daily pivot: Tonight the ES daily pivot rises from 1941.50 to 1950.92. We're now above the new pivot so this indicator turns bullish.

Dollar index: On Friday the dollar gave up 0.15% on a tall doji star which coming in below Thrusday' candle has the look of a reversal lower. However, the indicators are still not overbought so I will defer on this one.

Euro: After a star on Thursday the euro confirmed it Friday with an inverted hammer from oversold levels. It's gapping up in the new overnight and trading outside the descending RTC for a bullish setup so this one looks higher on Monday.

Transportation: The Trans have now completely refilled (and then some) the V left by the collapse of the first half of this month.Friday's 0.97% gain outperformed the Dow and cleared resistance at 8489. We remain in a strong rising RTC and the indicators are all broken at overbought so there's no reason not to call this one higher again on Monday.

Most of the charts look reasonably bullish tonight. The only one that concerns me is the VIX, which looks ready to move higher, though given its inverted hammer, perhaps I'm worrying too much. OK then, I'm just going to go with the flow and call Monday higher.

ES Fantasy Trader

Portfolio stats: the account remains at $121,625 after nine trades in 2014, starting with $100,000. We are now 7 for 9 total, 5 for 5 long, 2 for 3 short, and one push. Tonight we stand aside.