Background:

Traders often discuss how ‘month end’ flows may impact a currency or a currency pair during the last few day(s) of the month. These flows are caused by global portfolio managers rebalancing their existing currency hedges. If the value of one country’s equity and bond markets increases, these fund managers typically look to sell or hedge their elevated risk in that country’s currency and rebalance their exposure back to an underperforming country’s currency. The more severe the change in a country’s asset valuations, the more likely portfolio managers are either under- or over-exposed to certain currencies.

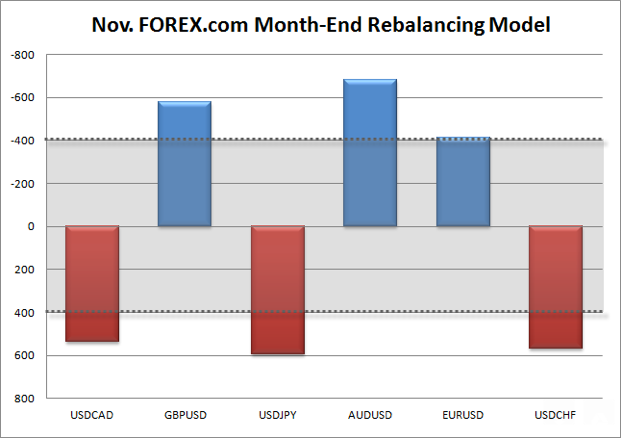

In order to predict these flows and how they impact FX traders, we’ve developed a model that compares monthly changes in total asset market capitalization in various countries. In our model, a relative shift of $400B between countries over the course of a month is seen as the threshold for a meaningful move, whereas monthly changes of less than $400B can be easily overwhelmed by other fundamental or technical factors. As a final note, the largest impact from month-end flows is typically seen heading into the 11am ET fix (often in the hour from 10 & 11am ET) as hedge and/or mutual fund portfolio managers scramble to hedge their overall portfolio ahead of the European market close.

It’s been an interesting month for traders, who have been forced to navigate a series of surprise developments from global central banks including the ECB seemingly coming around to sovereign QE early next year, the PBOC’s surprise decision to cut interest rates, and the RBA upping its dovish rhetoric. With a tail risk from tomorrow’s conclusion of the highly-anticipated OPEC meeting and the Swiss gold referendum still on tap, more volatility could still emerge by the end of the month.

Overall, US markets saw the biggest inflows this month, creating a strong bearish signal on the US Dollar heading into the final trading day of the month on Friday. That said, the timing of the Thanksgiving holiday may prompt some US fund managers to rebalance a bit earlier on Wednesday. All of the six major currency pairs we track exceed the +/- $400B threshold for a meaningful move, but the strongest signal is on AUD/USD, which just dropped to a 4-year low earlier this week. On the other hand, EUR/USD’s signal barely cleared $400B threshold, so traders looking to take advantage of month-end flows may want to broaden their horizons beyond just the world’s most-traded currency pair.

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom).