Forex News and Events

Brexit will provide the ECB with some room

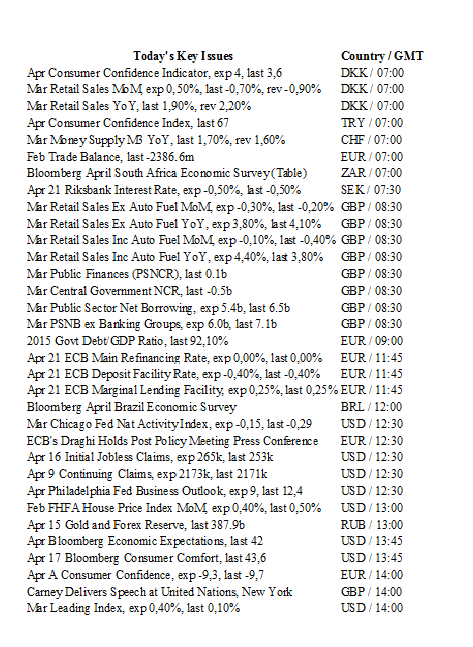

Nothing major is expected from today’s ECB meeting, with rates very likely to remain unchanged (main refinancing at 0%, Depo rate at -0.4% and Marginal lending at 0.25%). We also do not expect the pace of the current QE to be increased. Since the beginning of the year, the EUR has strengthened gaining a few figures over the end of the monetary policy divergence with the US.

However, we think that Mario Draghi still has some room to devalue the single currency and he may mention this during today's press conference. We also expect Draghi to highlight his concerns over a potential Brexit and Europe’s delicate growth environment. We feel that Draghi’s intervention will focus on adding downside pressures to the EUR. Currency wars continue.

Ironically, European uncertainties are buying the ECB more time and despite the fact the institution is already all-in, we should not see any helicopter money or FX intervention in the short-term. Yet, we also remain concerned about further potential upside pressures on the EUR/USD as we firmly believe that financial markets are becoming increasingly disappointed with US monetary policy. Next week the April FOMC meeting will take place.

Swiss Watch Exports Collapse

Providing further evidence of the lack of Swiss franc competitiveness and general growth economic sluggishness, Switzerland watch exports have collapsed to their lowest levels since 2011. Data from the Federation of the Swiss Watch Industry stated that watch exports deteriorated -16.1% y/y to chf1.5bn. The sharp fall, prompted the industry watchdog to indicate that the size the downturn was “unusual”. Hong Kong, the largest Swiss watch export destination declined a massive -37.7%, followed by steep drops in the USA and China. Today’s watch export data follows a disturbing downward trend since 2007 shadowing the aggressive appreciation of the CHF. While there is some idiosyncratic market behavior, such as Beijing's anti-corruption clampdown on “gift giving”, which justifies today’s worrying read. Yet the long term extent and correlation of CHF indicates that CHF strength is playing a substantial part in the sector’s unswerving erosion. With current overvaluation remaining a drag on the Swiss economy and risk to further CHF appreciation on the horizon and evidence that the SNB is potentially confronted with some difficult choices. We have consistently highlighted the risk of Brexit on CHF and probability for the SNB to proactively react to excess CHF strength. We suspect that the SNB threshold for pain is around EUR/CHF 103-105. At these levels we should see SNB policy action including but not limited to significant direct fx intervention, tightening of negative rate exemptions and deeper negative rates.

Crude Oil - Surging.

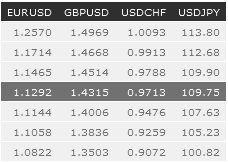

The Risk Today

EUR/USD has failed to break 1.1400 and is now bouncing back. The pair is moving within an uptrend channel. Hourly support can be found at 1.1144 (24/03/2016 low) and resistance at 1.1465 (12/04/2016 high). Stronger support is located a 1.1058 (16/03/2016 low). Expected to show further increase. In the longer term, the technical structure favours a bearish bias as long as resistance at 1.1746 ( holds. Key resistance is located at 1.1640 (11/11/2005 low). The current technical appreciation implies a gradual increase.

GBP/USD is trading around the strong resistance area implied by the upper bound of the downtrend channel near hourly resistance at 1.4514 (18/03/2016 low). Hourly support is given at 1.4320 (04/04/2016 high). Expected to show further bounce back. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is trading between hourly support at 107.68 (07/04/2016 low) and hourly resistance at 109.90 (07/04/2016 high). Despite medium-term momentum is clearly bearish. Selling pressures are fading. Expected to show further increase. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF has exited the downtrend channel. Hourly support can be found at 0.9499 (12/04/2016 low). Hourly resistance is located at 0.9788 (25/03/2016 high). Expected to show further consolidation as short-term buying pressures do not seem strong. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

Resistance and Support: