Forex News and Events

With FX markets subdued and talks over the Greek reform plan failing to produce new headlines, traders have turned their focus back to oil. Today is the deadline for the US-Iran talks (less than 24hrs left). There is marginal optimism that an agreement can be reached (although talks have been difficult) on Iran’s nuclear program. An agreement that will lessen Western sanctions and open up oil to the worlds markets. However, in a bit of political intrigue comments by the republican run US congress indicates that any deal will most likely be challenged. Estimations that should sanctions get lifted, we could see oil exports rising by 0.7 to 1mln bpd by years-end. Not a huge increase, but more than enough to cover current production decrease and keep upside in price capped. In the FX markets, commodity producing nations will continue to underperform. A decline only accelerated by any US-Iran agreement. In Canada BoC Poloz, highlighted the damage caused by oils “atrocious” fall in exports revenues and halting energy investments. He suggested that further economic weakness should be expected as the headlines losses spilldown into the broader economy. On the docket today, Canada will release its January GDP which is expected to drop to 2.4% y/y from 2.8% y/y (-0.2 m/m exp vs. 0.3m/m prior read) . Any further surprise to the downside would trigger expectations of a 25bp rate cut to 0.50% at the next meeting (April 15th). With our expectations that commodity prices will remain low and further monetary policy divergence between US and Canada, we continue to be constructive on USD/CAD. Confirmation of USD/CAD reversal pattern at 1.2410, and subsequent break of 55d MA at 1.2498 indicates and extension of bullish momentum to 1.2846 range highs.

The SNB released its balance sheet items ending of February 2015 and IMF Special Data dissemination standard ending 31st March 2015 today. There was not too much at could be deduced from the data that the market did not already know. According to the report, the SNBs balance sheet foreign currency investment expanded to chf519.33 from chf507.85 in February. In the days after the SNB abandoned the EUR/CHF minimum exchange rate were busy with SNB clearly using physical interventions to stabilized the CHF market. Interestingly, while Swiss corporates names were crying the end of days, yesterday’s Swiss Kof leading indicators is telling a different story. The index is designed to predict the direction of the Swiss economy over the next 6-months. The indicator unexpectedly rose slightly to 90.8 verse a broadly expected decline to 88.0 as solid domestic spending (consumption) offset fall in exports due to the strong CHF. While the Swiss economy is clearly feeling the effect of the SNB decisions to end the cap as sentiment in construction and financial sector deteriorated further potentially the downside is not as large as originally prophesized. In fact according to the Kof institute Switzerland is now expected to see growth in 2015. USD/CHF continues to bounce above 0.9695 hourly resistance indicating improvement in short term buying interest. Traders will be focused on the next resistance area located at 0.9984.

Swissquote SQORE Trade Idea:

Stat Arb FX Model - Buy USD/RUB @ 57.82 Sell @ USD/CHF @ 0.9698

| Today's Key Issues | Country / GMT |

|---|---|

| Feb HIA New Home Sales MoM, last 1.80% | AUD / 00:00 |

| Mar ANZ Activity Outlook, last 40.9 | NZD / 00:00 |

| Mar ANZ Business Confidence, last 34.4 | NZD / 00:00 |

| Feb Private Sector Credit MoM, exp 0.50%, last 0.60% | AUD / 00:30 |

| Feb Private Sector Credit YoY, exp 6.30%, last 6.20%, rev 6.10% | AUD / 00:30 |

| Feb Money Supply M3 YoY, last 6.20% | NZD / 02:00 |

| Feb Vehicle Production YoY, last -9.70% | JPY / 04:00 |

| Feb Housing Starts YoY, exp -6.80%, last -13.00% | JPY / 05:00 |

| Feb Annualized Housing Starts, exp 0.877M, last 0.864M | JPY / 05:00 |

| Feb Construction Orders YoY, last 27.50% | JPY / 05:00 |

| 4Q F GDP QoQ, exp 0.40%, last 0.40% | DKK / 07:00 |

| 4Q F GDP YoY, exp 1.30%, last 1.30% | DKK / 07:00 |

| Feb Unemployment Rate Gross Rate, exp 4.90%, last 4.90% | DKK / 07:00 |

| Apr Norges Bank Daily FX Purchases, last -700M | NOK / 08:00 |

| 4Q Current Account Balance, exp -22.0B, last -27.0B | GBP / 08:30 |

| 4Q F GDP QoQ, exp 0.50%, last 0.50% | GBP / 08:30 |

| 4Q F GDP YoY, exp 2.70%, last 2.70% | GBP / 08:30 |

| 4Q F Total Business Investment QoQ, last -1.40% | GBP / 08:30 |

| 4Q F Total Business Investment YoY, last 2.10% | GBP / 08:30 |

| Jan Index of Services MoM, exp 0.30%, last 0.60% | GBP / 08:30 |

| Jan Index of Services 3M/3M, exp 0.80%, last 0.80% | GBP / 08:30 |

| Mar Lloyds (LONDON:LLOY) Business Barometer, last 45 | GBP / 08:30 |

| Feb Unemployment Rate, exp 11.20%, last 11.20% | EUR / 09:00 |

| Mar CPI Estimate YoY, exp -0.10%, last -0.30% | EUR / 09:00 |

| Mar A CPI Core YoY, exp 0.70%, last 0.70% | EUR / 09:00 |

| Jan GDP MoM, exp -0.20%, last 0.30% | CAD / 12:30 |

| Jan GDP YoY, exp 2.40%, last 2.80% | CAD / 12:30 |

| Mar ISM Milwaukee, exp 51.5, last 50.32 | USD / 13:00 |

| Jan S&P/CS 20 City MoM SA, exp 0.60%, last 0.87% | USD / 13:00 |

| Jan S&P/CS Composite-20 YoY, exp 4.60%, last 4.46% | USD / 13:00 |

| Jan S&P/CaseShiller 20-City Index NSA, exp 172.9, last 173.02 | USD / 13:00 |

| Jan S&P/Case-Shiller US HPI MoM, exp 0.80%, last 0.73% | USD / 13:00 |

| Jan S&P/Case-Shiller US HPI YoY, last 4.62% | USD / 13:00 |

| Jan S&P/Case-Shiller US HPI NSA, last 166.82 | USD / 13:00 |

| Mar Chicago Purchasing Manager, exp 51.7, last 45.8 | USD / 13:45 |

| Mar Consumer Confidence Index, exp 96.4, last 96.4 | USD / 14:00 |

| 29.mars ANZ Roy Morgan Weekly Consumer Confidence Index, last 111.4 | AUD / 22:30 |

| Mar GfK Consumer Confidence, exp 2, last 1 | GBP / 23:05 |

| Feb Loans & Discounts Corp YoY, last 2.91% | JPY / 23:50 |

The Risk Today

Peter Rosenstreich

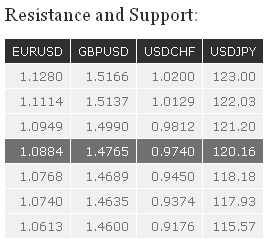

EUR/USD Bullish momentum is fading. EUR/USD is weakening after the successful test of its key resistance area between 1.1043 and 1.1114 (see also the declining trendline). The hourly support at 1.0768 (see also the 50% retracement) is challenged. Another hourly support lies at 1.0613. An hourly resistance can be found at 1.0949. In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, any strength is likely to be temporary in nature. Strong resistances stand at 1.1114 (05/03/2015 low) and 1.1534 (03/02/2015 high). Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support).

GBP/USD Drifting lower. GBP/USD is weakening after the successful test of the resistance at 1.4990. A further short-term decline towards the support at 1.4635 is favoured. An hourly support lies at 1.4689 (19/03/2015 low), whereas an hourly resistance stands at 1.4922. In the longer-term, the break of the strong support at 1.4814 opens the way for further medium-term weakness towards the strong support at 1.4231 (20/05/2010 low). Another strong support stands at 1.3503 (23/01/2009 low). A key resistance can be found at 1.5552 (26/02/2015 high).

USD/JPY Approaching the resistance implied by its declining trendline. USD/JPY continues to improve as can be seen by the break of the hourly resistance at 119.98. However, monitor the resistance implied by the declining trendline (around 120.48), as the bounce seems short-term overextended. Hourly supports lie at 119.49 (27/03/2015 high) and 118.93 (27/03/2015 low). Another resistance can be found at 121.20. A long-term bullish bias is favoured as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured. A key support can be found at 118.18 (16/02/2015 low), whereas a key resistance stands at 121.85 (see also the long-term declining channel).

USD/CHF Rising towards the resistance at 0.9812. USD/CHF continues to bounce as can be seen by the break of the hourly resistance at 0.9695. However, a break of the resistance at 0.9812 (see also the 50% retracement) is needed to signal a significant improvement in the short-term buying interest. An hourly support lies at 0.9558 (27/03/2015 low), while a key support stands at 0.9450 (see also the 38.2% retracement). Another resistance can be found at 0.9984. In the longer-term, the bullish momentum in USD/CHF has resumed after the decline linked to the removal of the EUR/CHF floor. A test of the strong resistance at 1.0240 is likely. A key support can be found at 0.9374 (20/02/2015 low, see also the 200-day moving average).