Forex News and Events

FX markets will be focused on Fed Chair Yellen’s semiannual testimony before the Congressional Committees. The comments are expected to carry significantly more weight than the FOMC meeting minutes. We continue to expect the first rate hike at the June meeting which should be signaled by the removal of the word “patient” from its policy directives. In recent weeks Fed statements have become highly ambiguous with no real sense of when the timing of the first hike is likely to come. Yellen might want to keep her policy options open and not pre-empt the official notification. Yet strong economic data suggest this announcement is coming. The latest Job Openings survey also showed the highest number of job vacancies in this expansion cycle, indicating that robust job growth will continue. It’s only a matter of time when the tightening of the labor markets will put pressure on labor cost and prices. This should reverse current decline in inflation cause primarily by the rapid fall in oil prices, as wages play a much larger part in applying pressure. We see the biggest barrier to higher interest rates to be the stronger USD.

Don’t get excited over Commodity Currency Rally

Rebound in commodity price has many pricing in a strong recovery in AUD, NZD, CADand NOK (commodity currencies). However, its unlikely commodity prices have more upside. With inventories rising sharply, pace of demand will have to increase significantly to clear the supply overhang before prices can resume their bullish trend. BoC members have sounded increasingly bearish given the downward trend of inflation, sending CAD lower. With CPI expected to ease further and members becoming more dovish we are bearish on CAD. Today BoC Governor Poloz will speak on “Lessons New and Old: Reinventing Central Banking.” We are bullish USD/CAD and expect break of range high at 1.2698 to confirm bullish extension to 1.3065. The recent weakness is seen as a medium-term corrective phase. Key supports stand at 1.2314 (22/01/2015 low) and 1.2047 (intraday low).

Time to sell deficit running EM nations

With US longer term yields on the rise, we again need to focus on current account deficit EM nations which are sensitive to changes. Despite the soft incoming US data and slightly dovish FOMC minutes we still expected rate hike to begin in June. US yields will continue to steepen but at a slow pace especially as the ECB begins its bond buying program. None-the-less increase in USD funding cost will occur. In the last few years developing nations borrow in USD has increased significantly making then extremely susceptible to sudden adjustments. Prime culprits include MXN, BRL Turkey, and Russia.

| Today's Key Issues | Country / GMT |

|---|---|

| 4Q Private Consumption QoQ, last 0.70% | EUR / 07:00 |

| 4Q Government Spending QoQ, last 0.60% | EUR / 07:00 |

| 4Q Capital Investment QoQ, last -0.90% | EUR / 07:00 |

| 4Q Construction Investment QoQ, last -0.30% | EUR / 07:00 |

| 4Q Domestic Demand QoQ, last -0.20% | EUR / 07:00 |

| 4Q Exports QoQ, last 1.90% | EUR / 07:00 |

| 4Q Imports QoQ, last 1.70% | EUR / 07:00 |

| 4Q F GDP SA QoQ | EUR / 07:00 |

| 4Q F GDP WDA YoY | EUR / 07:00 |

| 4Q F GDP NSA YoY | EUR / 07:00 |

| Feb Business Confidence, last 94 | EUR / 07:45 |

| Feb Manufacturing Confidence, last 99 | EUR / 07:45 |

| Feb Production Outlook Indicator, last -11 | EUR / 07:45 |

| Feb Own-Company Production Outlook, last 13 | EUR / 07:45 |

| Jan CPI MoM, last -0.10% | EUR / 10:00 |

| Jan F CPI YoY, last -0.60% | EUR / 10:00 |

| Jan F CPI Core YoY, last 0.60% | EUR / 10:00 |

| Dec S&P/CS 20 City MoM SA, last 0.74% | USD / 14:00 |

| Dec S&P/CS Composite-20 YoY, last 4.31% | USD / 14:00 |

| Dec S&P/CaseShiller 20-City Index NSA, last 172.94 | USD / 14:00 |

| Dec S&P/Case-Shiller US HPI MoM, last 0.76% | USD / 14:00 |

| Dec S&P/Case-Shiller US HPI YoY, last 4.69% | USD / 14:00 |

| Dec S&P/Case-Shiller US HPI NSA, last 167 | USD / 14:00 |

| Feb P Markit US Composite PMI, last 54.4 | USD / 14:45 |

| Feb P Markit US Services PMI, last 54.2 | USD / 14:45 |

| Feb Consumer Confidence Index, last 102.9 | USD / 15:00 |

| Feb Richmond Fed Manufact. Index, last 6 | USD / 15:00 |

The Risk Today

Peter Rosenstreich

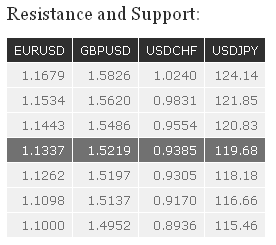

EUR/USD EUR/USD has bounced near the support at 1.1262. However, the recent break of the hourly support at 1.1320 (16/02/2015 low) and the current lower highs below the hourly resistance at 1.1450 suggest a weakening momentum. Another support stands at 1.1098, while another resistance can be found at 1.1534. In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, any strength is likely to be temporary in nature. Key resistances stand at 1.1679 (21/01/2015 high) and 1.1871 (12/01/2015 high). Key supports can be found at 1.1000 (psychological support) and 1.0765 (03/09/2003 low).

GBP/USD GBP/USD is challenging the resistance at 1.5486. The short-term technical structure remains positive as long as the hourly support at 1.5317 holds. Another hourly support can be found at 1.5197. A key resistance stands at 1.5620. In the longer term, the break of the key resistance at 1.5274 (06/01/2015 high) suggests renewed buying interest. Upside potentials are likely given by the resistances at 1.5620 (31/12/2014 high) and 1.5826 (27/11/2014 high). A strong support stands at 1.4814.

USD/JPY USD/JPY is improving after its successful test of the support at 118.18. A break of the hourly resistance area between 119.42 (17/02/2015 high) and 119.60 (61.8% retracement) would open the way for a new move towards the key resistance at 120.83. An hourly support can be found at 118.74 (23/02/2015 low). A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Even if a medium-term consolidation is likely underway, there is no sign to suggest the end of the long-term bullish trend. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured. A key support can be found at 115.57 (16/12/2014 low).

USD/CHF USD/CHF is challenging the resistance at 0.9554. An hourly support lies at 0.9374 (20/02/2015 low, see also the short-term rising trendline). Another hourly support can be found at 0.9284 (16/02/2015 low). Following the removal of the EUR/CHF floor, a major top has been formed at 1.0240. The break of the resistance implied by the 61.8% retracement of the sell-off suggests a strong buying interest. Other key resistances stand at 0.9554 (16/12/2014 low) and 0.9831 (25/12/2014 low). A key support can be found at 0.9170 (30/01/2015 low).