Our base case remains negative EPS growth and a higher unemployment rate from May/June 2023.

In other words: a recession.

But what if we are wrong?

Labor Hoarding

During the pandemic, companies experienced serious staff shortages and faced major challenges when trying to hire newly qualified staff.

These memories might still be very fresh – look at this chart, for instance.

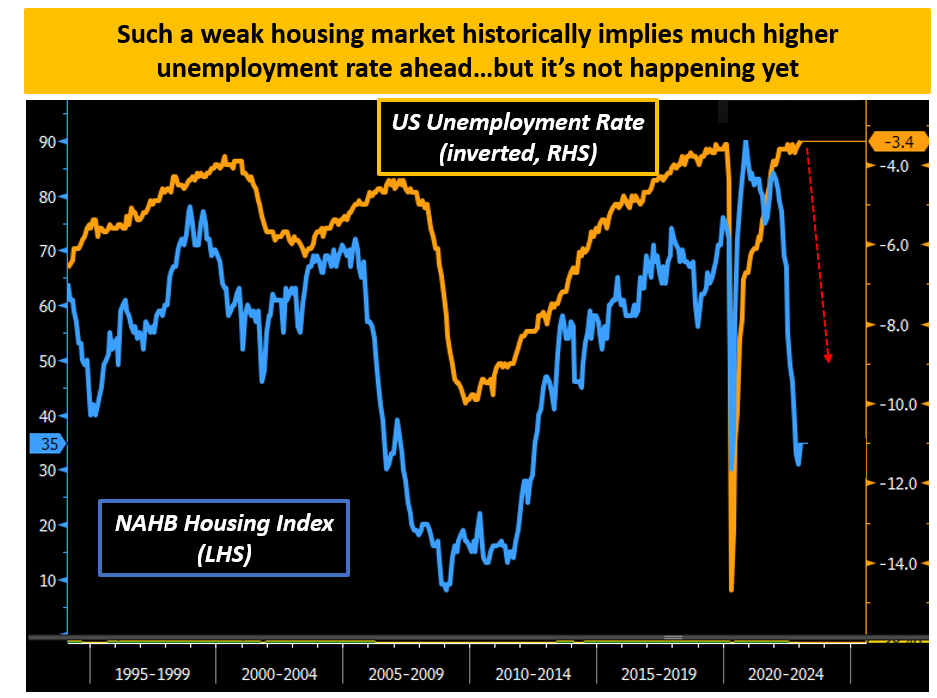

The rapid deterioration in the U.S. housing market (blue) would historically suggest big layoffs in the construction sector which would significantly move the needle for the unemployment rate (orange).

Some back-of-the-envelope calculations suggest such a frozen housing market should involve roughly 1.5 million job losses in all sectors related to real estate (construction, financials, brokers, and ancillary activities). These job cuts alone would put the U.S. in recessionary territory.

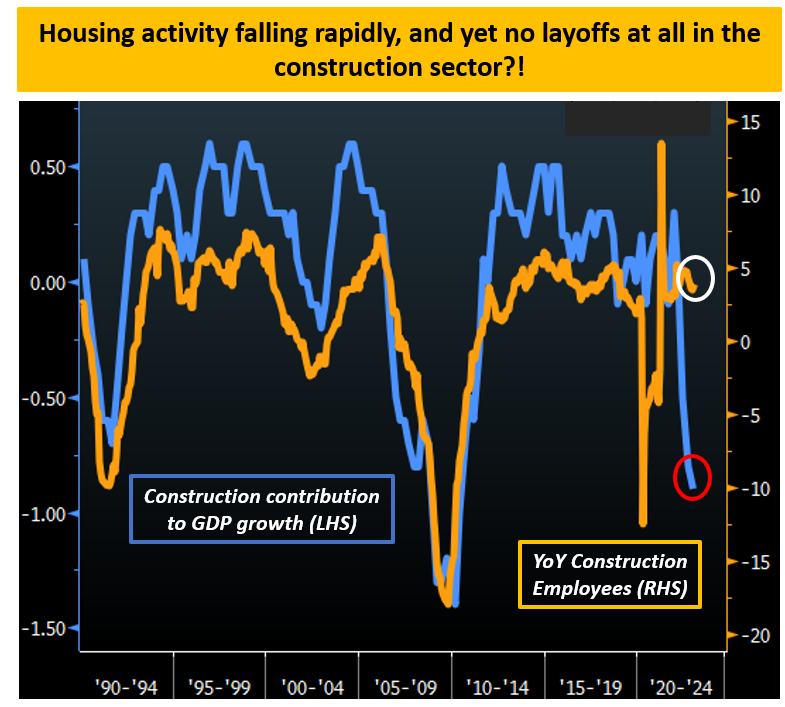

And instead, the construction sector has been net hiring (?!) over the last 12 months.

The only reasonable explanation here is labor hoarding.

As companies experienced serious difficulties in hiring qualified staff during the pandemic and perhaps expect this housing market freeze to be short-lived, they are not actively laying off people as they fear it might be hard to get them back.

Two confirming factors: wage growth isn’t accelerating and the average workweek hours keep declining. If companies want to hoard labor even if activity slows down, to save costs they will decrease their employees’ working hours and be more mindful about bumping up wages.

Labor hoarding seems real, and it might well delay the start of a recession.

Ultimately though, it’s a kick-the-can-down-the-road exercise.

***

Disclaimer: This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.