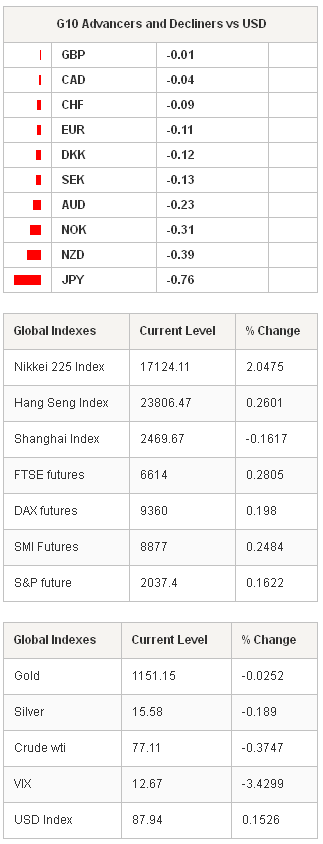

Japanese current account surplus increased to 963.0 billion yen in September, significantly more than 537.7 billion expected (287.1bn last); trade deficit narrowed from 831.8 to 714.5 billion yen. The sizeable depreciation in Yen and lower oil prices are most probably the leading explanatory factors in outstanding BoP print. USD/JPY and JPY crosses rallied in Tokyo, Nikkei 225 stocks gained 2.05%. USD/JPY hit 115.45, stone’s throw below 7-year high 115.59. The pair is deeply overbought, yet pressures remain on the upside. Stops are eyed above 115.60/116.00. EUR/JPY consolidates gains at 142.59/143.36. The key resistance stands at 145.69 (Dec 27th high).

EUR/CHF legged down to 1.20218 yesterday. Downside pressures remain high as tensions on “Gold referendum” mount. The option markets are shifting toward “yes” pricing. We stand ready for SNB intervention should the pressures on 1.20 floor do not ease. In the gold markets, trend and momentum indicators remain on the downside. We see formation of bearish belt hold line suggesting the exhaustion of uptrend. Offers remain solid at $1,200.

Today, SEK-traders watch Riksbank October meeting minutes and October inflation data. The inflation expectations remain soft, the consensus is -0.1% deceleration in month to October (-0.2% y/y vs. -0.4% y/y in Sep). It is clearly too early to see the impact of October 28th aggressive 25 basis point rate cut on the macroeconomic data. USD/SEK extends gains in the continuation of ascending channel building since March. Trend and momentum indicators are comfortably positive, 7.45/7.50 levels are at the radar. On the downside, support is seen at 7.3119 (21-dma), then 7.2228 (50-dma & Apr-Nov uptrend base). EUR/SEK remains well bid above 9.18/23 (including 21/50 and 100-dma & July-Oct downtrend top), key support is seen at 200-dma (currently at 9.0882). The pair did not trade below its rolling 200-dma in more than a year.

The Russian Central Bank moved closer to a free-float mechanism by removing its predictable intervention policy framework and RUB basket band yesterday, therefore giving itself freedom to intervene unannounced when market moves in RUB threatens country’s financial stability. Unhappy to see the RUB liquidity played against the good of Russia, the CBR will fight speculative unwinds by adjusting supply. The shift toward free-float RUB triggered RUB rally at the week start (+2.43% vs. USD on Monday), yet the overall bias remains comfortably RUB-negative, now that the RUB will be increasingly subject to macro factors as inflation, current account balance, oil prices, and geopolitical tensions – all seeming to go against RUB. We expect a bounce back toward 48/50 offers. Russian trade data and official reserve assets are due today.

G10 economic calendar is light, little data flow out of the US due to Veterans Day holiday. Traders watch Swedish October Unemployment Rate, CPI m/m & y/y, Spanish September House Transactions y/y, US October NFIB Small Business Optimism.

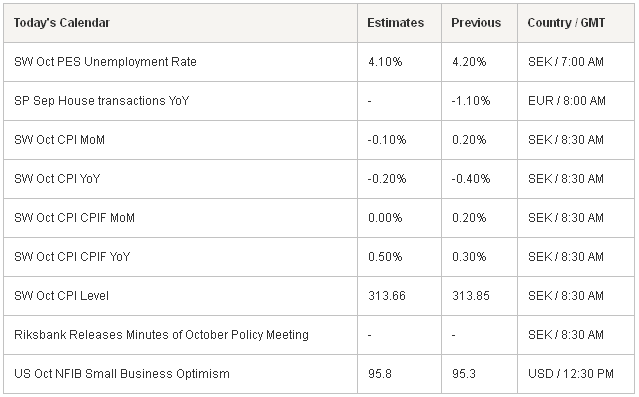

Currency Tech

EURUSD

R 2: 1.2577

R 1: 1.2509

CURRENT: 1.2411

S 1: 1.2358

S 2: 1.2288

GBPUSD

R 2: 1.6050

R 1: 1.5917

CURRENT: 1.5848

S 1: 1.5791

S 2: 1.5738

USDJPY

R 2: 116.50

R 1: 116.00

CURRENT: 115.77

S 1: 113.86

S 2: 112.50

USDCHF

R 2: 0.9839

R 1: 0.9751

CURRENT: 0.9691

S 1: 0.9617

S 2: 0.9580